Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

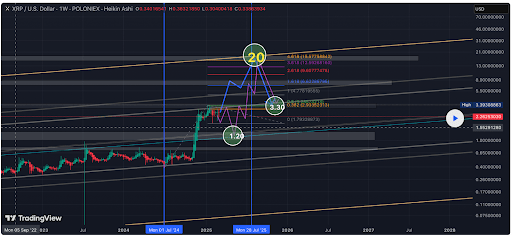

Crypto analyst ElmoX has asserted that the XRP worth remains to be bullish regardless of the latest crypto market crash. His evaluation revealed that XRP is about to face main resistance at $2.9, though he’s assured that the crypto will ultimately break this resistance and rally to as excessive as $20.

XRP Worth Faces Resistance At $2.9 However Might Nonetheless Rally To $20

In a TradingView put up, ElmoX outlined two situations for the XRP worth because it eyes a rally to $20, though he famous that the crypto will retest the most important resistance at round $2.92 both method, on its strategy to a brand new all-time excessive (ATH). For the primary state of affairs, the analyst said that XRP would break this resistance after which skyrocket to $20.

Associated Studying

In the meantime, within the second state of affairs, ElmoX said that the XRP worth may face one other rejection, sending it under the $1.5 stage earlier than it witnesses a bullish reversal and rallies to a brand new ATH. The analyst revealed that he’s betting on this second state of affairs since there’s normally a swift crash earlier than an impulsive transfer to the upside.

ElmoX remarked that the XRP worth has barely corrected, which can also be why he believes there may nonetheless be a large crash earlier than a rally to a brand new ATH. In the meantime, the analyst didn’t present a precise timing for the potential worth correction and subsequent rally to a brand new ATH and the $20 worth goal.

As an alternative, he merely instructed market individuals to be affected person. He additional warned that the XRP worth would possibly sit in worth discovery till no less than mid-July. His accompanying chart confirmed that XRP will first drop to as little as $1.20 earlier than it witnesses an impulsive transfer to as excessive as $20.

The Altcoin Data A Bullish Shut

In an X put up, crypto analyst CasiTrades famous that though the XRP worth briefly broke under the $2 trendline, the candle closed again above this trendline, reclaiming the consolidation vary. She remarked that that is precisely what bulls wanted to see. Nevertheless, the analyst added {that a} affirmation is required with XRP holding the vary between $2 and $2.03 as help.

Associated Studying

CasiTrades said {that a} breakdown from consolidation normally results in additional downsides, however the XRP worth managed to get well the extent shortly, exhibiting that patrons are stepping in. She additionally famous that the bullish divergence remains to be holding as much as the 1-hour RSI even after the dip with promoting strain weakening, which suggests a shift in momentum is feasible.

If the XRP worth holds the help between $2 and $2.03, CasiTrades predicts that the crypto may bounce and rally towards $2.25 and $2.70. Alternatively, if XRP loses this stage, she said that the following main help sits at $1.90 which is the 0.5 Fibonacci retracement stage. In the meantime, there’s additionally the likelihood that XRP may drop to the 0.618 Fib retracement stage at $1.54.

On the time of writing, the XRP worth is buying and selling at round $2.10, down over 4% within the final 24 hours, in line with knowledge from CoinMarketCap.

Featured picture from Adobe Inventory, chart from Tradingview.com