Investing throughout election years usually brings market uncertainty because of the potential for coverage shifts. This uncertainty can immediate some buyers to carry money, fearing volatility, whereas others keep absolutely invested. Primarily based on historic tendencies, market conduct, and funding rules, right here’s a comparability of the potential advantages of absolutely investing throughout election years versus holding money.

1. Lengthy-Time period Progress Potential:

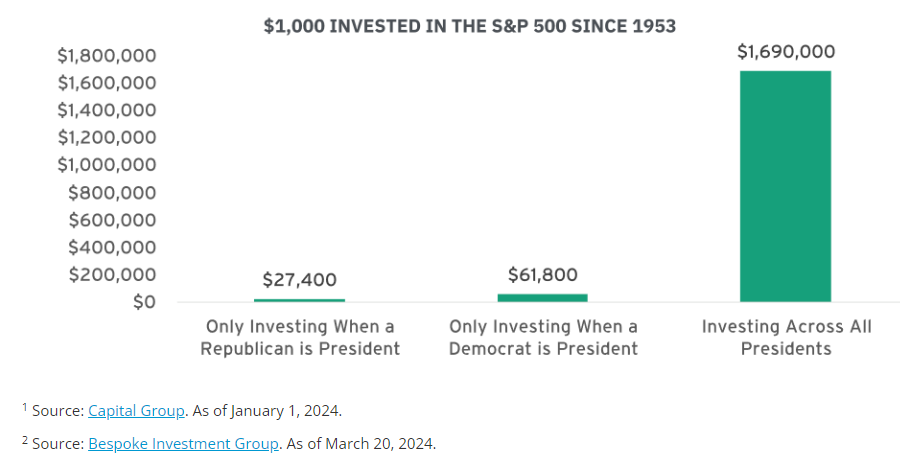

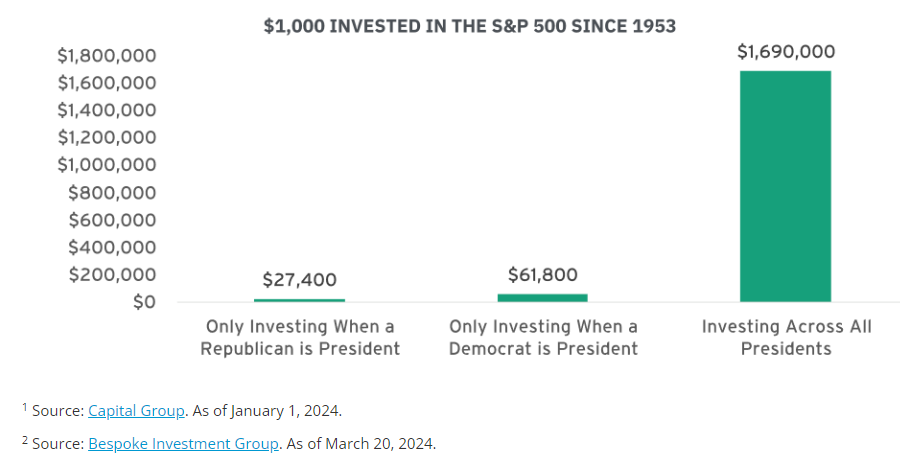

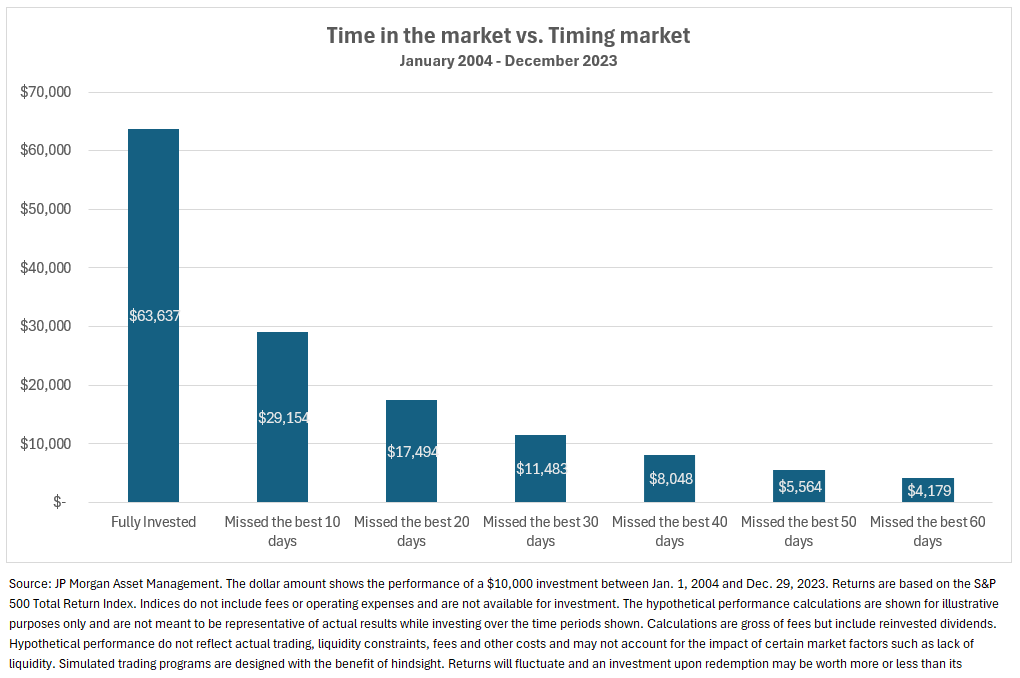

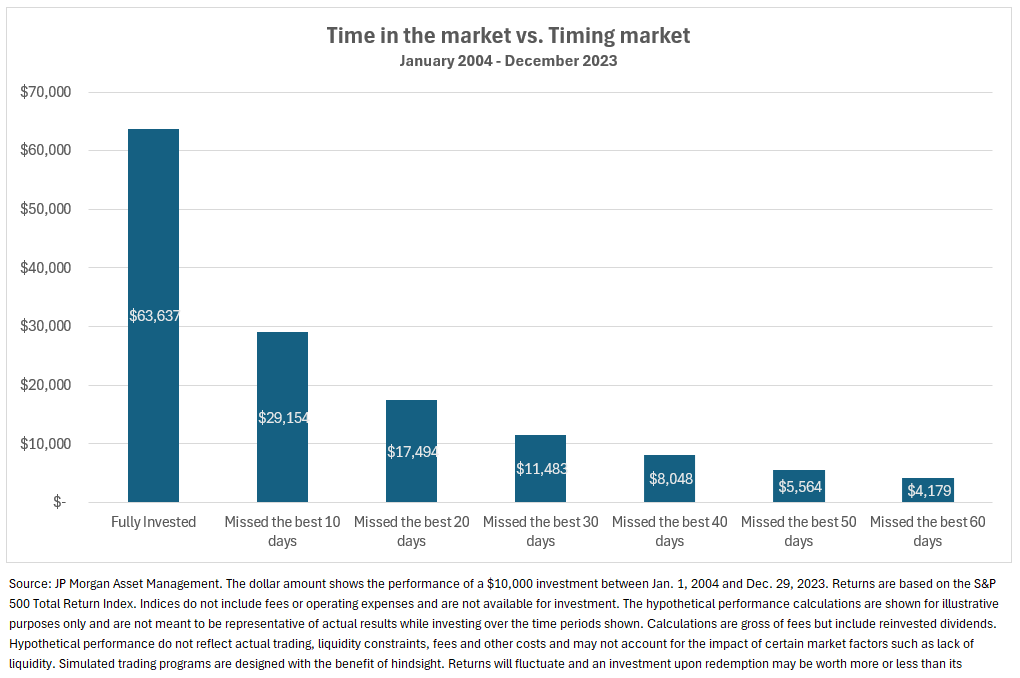

Historic knowledge reveals that staying invested by way of election years yields higher long-term outcomes than holding money. The inventory market has typically trended upward over time regardless of short-term volatility. Among the greatest days within the inventory market occur throughout instances of uncertainty. Lacking out on even a couple of of the perfect days available in the market can considerably cut back long-term returns. You usually tend to profit from market rebounds and potential beneficial properties by remaining absolutely invested.

Holding money throughout election years may shield your portfolio from short-term market volatility. But it surely additionally removes the chance to learn from long-term development. Money is taken into account a low-risk, low-reward technique. Whereas it may possibly present security throughout market downturns, money returns are minimal, particularly when factoring in inflation, which erodes buying energy over time. Traditionally, money has underperformed shares by a large margin in the long term. In durations of excessive inflation or low-interest-rate environments, the true return on money could be destructive. Whereas your cash feels safer, its worth diminishes over time because of the rising value of products and companies.

2. Election Years and Market Efficiency:

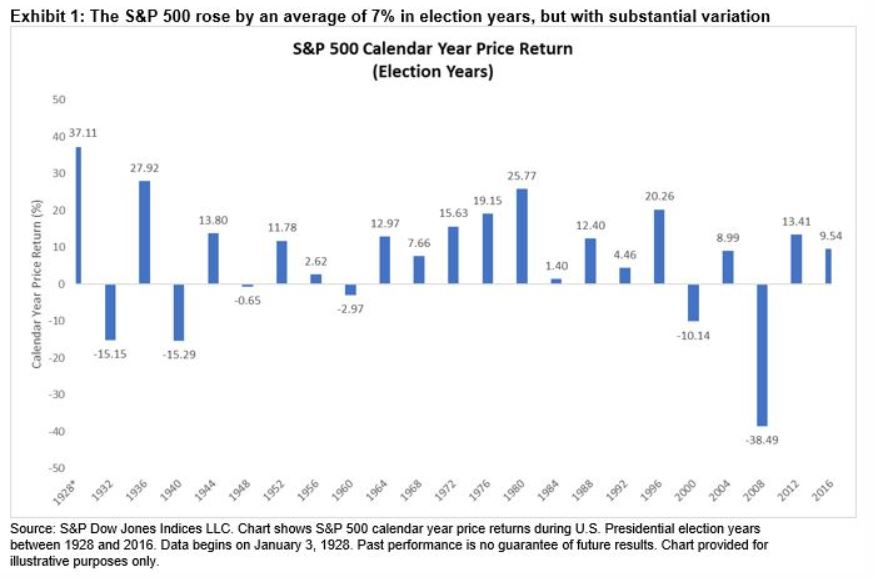

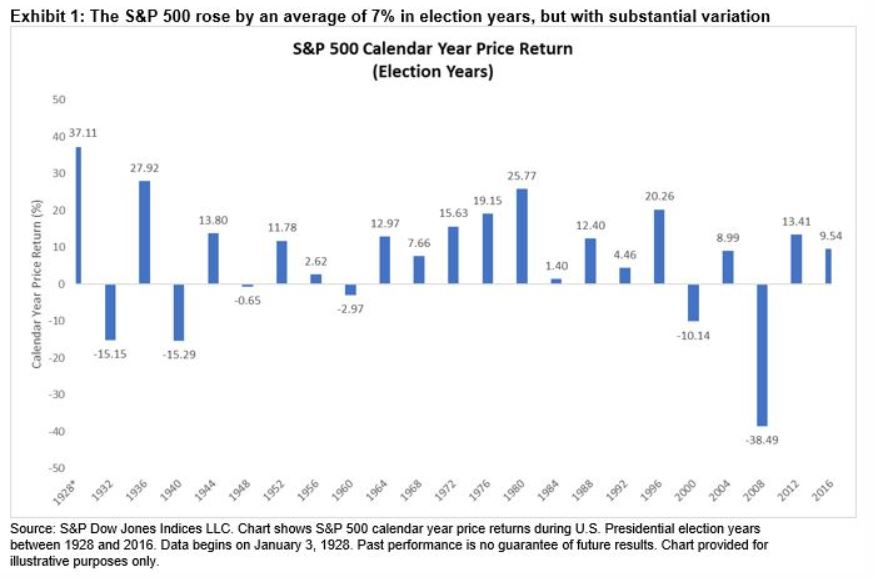

Historic knowledge reveals that, regardless of pre-election volatility, the inventory market tends to carry out positively throughout election years, no matter which get together wins. Since 1928, the S&P 500 has had constructive returns in 19 of 24 election years (by way of 2020). Traders who stay absolutely invested profit from these long-term upward tendencies, even when there are short-term dips as a consequence of market uncertainty main as much as the election.

Holding money to keep away from the short-term volatility related to election-year uncertainty means lacking out on the potential upside. Market volatility tends to spike throughout the months main as much as an election, however markets have usually stabilized and continued their upward trajectory after election outcomes develop into extra evident. You might keep away from short-term losses by holding money, however you additionally threat lacking the post-election rally.

In 2016, many buyers have been unsure concerning the end result of the Trump-Clinton election. The S&P 500 dropped 5% within the futures market the evening Trump received, nevertheless it shortly recovered, gaining round 11% by the top of the yr. Traders who held money missed out on these beneficial properties.

3. Impression of Coverage on Completely different Sectors:

Elections deliver uncertainty over potential coverage adjustments affecting particular sectors (e.g., healthcare, vitality, protection). Whereas some industries might expertise volatility based mostly on candidate insurance policies, diversified portfolios are likely to mitigate the dangers of sector-specific downturns. Being absolutely invested throughout a broad vary of sectors helps seize development in those who profit from new insurance policies whereas minimizing publicity to underperforming sectors.

Within the 2020 election, sectors like renewable vitality and know-how benefited from the expectation of coverage adjustments below a Biden administration, whereas conventional vitality shares confronted strain. A diversified portfolio might seize beneficial properties within the rising sectors whereas buffering towards losses in others.

Money is commonly seen as a protected haven when buyers are unsure about how completely different insurance policies will have an effect on markets. Nonetheless, staying in money avoids potential beneficial properties in sectors which may profit from election outcomes. Traditionally, markets have tailored to new administrations, whether or not Democratic or Republican. Holding money prevents buyers from benefiting from policy-driven sector booms.

4. Inflation and Money Returns:

Over time, shares are likely to outpace inflation, offering an actual return on funding. Election-year volatility is commonly short-lived whereas inflation continues to erode buying energy. Remaining absolutely invested permits your portfolio to develop and offset the long-term results of inflation.

Instance: Over the past century, U.S. equities have delivered a mean return of round 7–10% yearly, far outpacing inflation, averaging 2–3%. Staying invested, even throughout unstable durations, is important to sustaining and rising wealth.

Holding money in an election yr can really feel protected. Nonetheless, inflation usually outpaces money returns, particularly in durations of low rates of interest. Even with rising charges, the true return on money might not sustain with inflation. The buying energy of money declines after factoring in taxes. In unsure instances, inflation-proofing your portfolio by way of asset development is vital.

5. Emotional Investing and Market Timing:

Staying absolutely invested throughout election years helps keep away from emotional investing and the pitfalls of market timing. Many buyers trying to time the market, promoting earlier than an anticipated downturn and shopping for again after stability returns, usually miss out on vital beneficial properties. Historic knowledge reveals that lacking even a couple of of the perfect buying and selling days can devastate portfolio returns. Remaining invested by way of the volatility of elections helps buyers keep away from pricey timing errors.

Traders holding money throughout election years may really feel they’re avoiding threat, however market timing is notoriously troublesome. Making an attempt to foretell when to re-enter the market can result in missed alternatives, particularly as markets are likely to recuperate shortly after short-term dips. Holding money might also improve the temptation to “anticipate the proper second,” which hardly ever occurs, resulting in misplaced development potential.

Investing throughout election vs. holding money:

Whereas holding money throughout an election yr can present short-term safety from volatility, the long-term advantages of absolutely investing throughout election outweigh the perceived security of money

Historic tendencies point out that election-year volatility is normally short-lived. Markets are likely to recuperate and even thrive, no matter political outcomes. Staying absolutely invested permits buyers to seize long-term market development, benefit from policy-driven sector beneficial properties, and keep away from the detrimental results of market timing.

However, holding money can shield towards short-term losses. Sadly, money usually underperforms as a consequence of inflation, taxes, and the chance value of lacking market rebounds. Whereas money may really feel safer throughout unsure instances, Totally investing throughout elections has constantly confirmed to be a simpler technique for rising wealth over the long run, particularly within the context of the inventory market’s resilience and historic upward development.

In essence, staying absolutely invested by way of election cycles permits buyers to learn from the market’s potential to adapt, whereas holding money can imply lacking out on the beneficial properties that drive long-term monetary success.