Key takeaways:

|

What’s pay by financial institution?

Pay by financial institution is a safe cost methodology that permits direct financial institution transfers between people and/or companies. It’s also known as digital financial institution transfers or EFT as a result of the alternate of funds is finished electronically between the sender’s and recipient’s banks.

Within the early days, pay by financial institution was generally generally known as bank-to-bank, account-to-account (A2A), or direct financial institution switch, as this cost methodology was used primarily for cash transfers between two people. Finally, pay by financial institution turned a staple for B2Bs as a result of it permits for clear paper trails. Shoppers have additionally begun utilizing digital checks as a substitute of the paper model to pay their payments.

At the moment, the pay by financial institution methodology features a trendy C2B strategy the place clients pay retailers instantly by means of on-line banking and cellular banking apps.

Sorts of pay-by-bank strategies

Pay by financial institution contains the whole lot from conventional ACH transactions to digital banking apps. Every choice differs in processing pace and costs.

- Wire transfers: Easy bank-to-bank processes used for large-value transfers; greatest for one-time transactions.

- ATM funds: Financial institution transfers initiated from an ATM machine; greatest for one-time transactions

- IVR funds: Financial institution transfers carried out through a computerized transaction from a pay-by-phone or Interactive Voice Response (IVR) system; greatest for giant, one-time transactions

- Debit card funds: Transactions accomplished by paying with a debit card to entry the supply of funds; greatest for small, frequent funds

- Digital pockets funds: Funds made by selecting a checking account that’s linked to the digital pockets to be able to full transactions; greatest for small, frequent funds

- Native bank-to-bank or International ACH: Financial institution transfers involving accounts which might be positioned in the identical nation or area. International ACH is feasible when you’ve got an account with a international financial institution that has a presence in your area or nation. Finest for small, occasional funds.

- ACH funds: Transfers that undergo the ACH cost community. Unique to US banks.

- Direct deposit: Sender completes the transaction; used for worker paychecks, taxes, and echecks

- Direct cost: Each sender and receiver provoke and full transactions

- ACH debit: For subscriptions/recurring funds

- ACH credit score: Comparable to Zelle and Venmo

|

Within the US, the Automated Clearing Home (ACH) community consists of monetary group representatives that assume the position of processing, clearing, and settling all ACH and echeck funds.

|

See: Finest ACH Cost Processing for Companies

How do financial institution funds work?

The private pay-by-bank (particular person financial institution transfers) course of differs from industrial pay by financial institution (C2B, B2B) when it comes to how transactions are initiated. Nevertheless, the processing and clearing phases are principally the identical.

Usually, the receiver in particular person bank-to-bank transfers doesn’t request (or provoke) the cost. In the meantime, industrial pay by financial institution transactions are sometimes characterised by cost requests, reminiscent of an bill.

Step 1: Cost is initiated.

For private pay by banks: The client chooses a pay-by-bank methodology and prepares a fund switch request.

For industrial pay by financial institution: The client receives an bill from the service provider, chooses a pay-by-bank methodology, and prepares the fund switch request.

Step 2: Sender transmits cost request to their financial institution.

The sender chooses from one of many pay-by-bank varieties.

For IVR and ATM cost kind: The sender interacts with the IVR system or ATM machine by going by means of the prompts to course of their cost request.

For debit card cost kind: The sender verifies the required quantity on the cost terminal and enters their PIN code on the PIN pad.

For digital pockets cost kind: The sender logs into the app and follows the immediate for sending funds.

For all different pay-by-bank varieties: The sender fills out a kind that specifies the transaction particulars in addition to offers a discover of official authorization to finish the transaction.

Step 3: Sender’s financial institution receives and processes the request.

For all pay-by-bank cost varieties: The sender’s financial institution receives the cost and authorization request. The financial institution first verifies the identification of the account holder after which validates that the sender’s account has adequate funds.

For ACH and echecks: As soon as the financial institution verifies and validates the monetary data, the funds and the transaction particulars are routed electronically to Nacha’s ACH community for clearing and forwarding to the recipient’s account.

Step 4: If the request is authorised, the financial institution initiates the fund switch course of.

The sender’s financial institution debits the transaction quantity for authorised (and cleared for ACH and echecks) cost requests. The financial institution adjusts the sender’s fund steadiness and in addition notifies the sender that the request is profitable within the type of a receipt.

If the request is rejected, the sender can be notified and should select a special cost methodology.

For digital pockets, IVR, debit card, and ATM cost varieties: The approval or rejection discover can be displayed on the terminal display along with a printed or emailed receipt.

Step 5: Funds are credited to the recipient’s financial institution and the recipient is notified of the profitable transaction.

The recipient of the funds will get a notification by e-mail from their financial institution as soon as the switch is profitable.

For debit card funds on the level of sale: Transaction information are saved and up to date throughout the POS software program.

Observe that fund switch pace varies relying on the pay-by-bank kind. Digital pockets, IVR, debit card, and ATM transactions are practically instantaneous. With wire transfers, the primary ship takes a median of three to 5 enterprise days. Succeeding funds to the identical recipient inside 24 hours. Funds that undergo the ACH community takes anyplace from two to a few enterprise days.

See: 10 Finest Free Enterprise Checking Accounts

2 methods of accepting trendy pay-by-bank transactions

The fashionable pay-by-bank methodology is all about the usage of know-how in sending and receiving funds. Every pay-by-bank methodology, aside from IVR and ATM transactions, may be finished on-line or from a banking app.

Pay by financial institution on-line

Financial institution web sites present particular person and enterprise account holders with the power to provoke transactions on-line. Customers can log in to entry their funds and quite a lot of options. Enterprise checking account holders have the power to create and ship digital invoices to their clients. Those that have an e-commerce web site can hyperlink their financial institution to their service provider account and cost processor so clients can have the choice to pay through financial institution for his or her on-line buy with an ACH or financial institution switch.

Additionally learn:

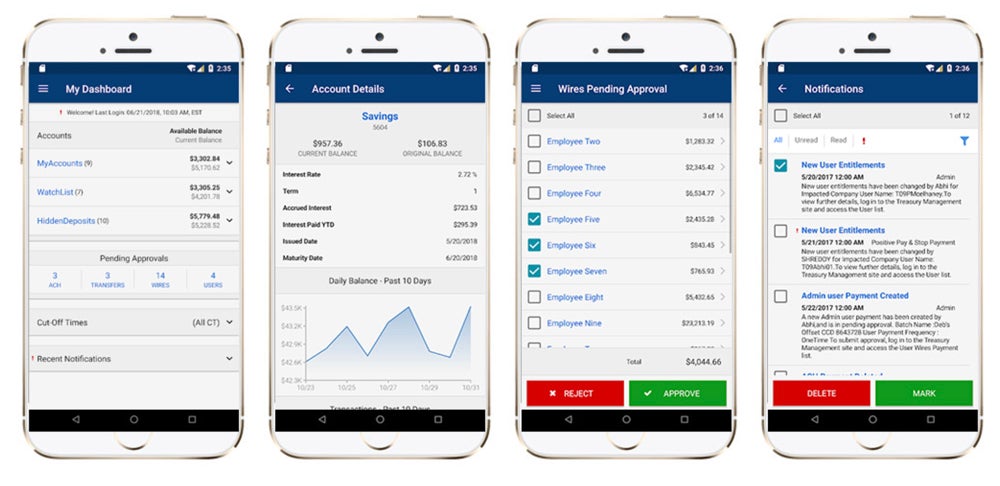

Pay by financial institution app

A banking app is a cellular pockets put in on the person’s smartphone, pill, or iPad. It may be linked to a number of financial institution accounts and the out there options for accepting funds will depend upon the kind. In each variations, the app can generate QR codes and cost hyperlinks. Enterprise financial institution accounts can generate invoices; particular person financial institution accounts may even ship cost requests.

5 advantages of pay by financial institution

Decrease-risk cost methodology. In comparison with bank card funds, pay-by-bank transactions are much less dangerous to monetary establishments since they cope with out there funds as a substitute of a credit score line (reminiscent of in bank cards), leading to decrease transaction processing charges.

Accessibility. A number of pay-by-bank varieties, notably cellular banking apps, present clients with 24/7 entry to their financial institution accounts and quicker technique of cost for his or her purchases. This implies companies that settle for pay by financial institution obtain funds any time of the day.

Decrease charges. Charges for accepting pay-by-bank funds are typically decrease in comparison with bank card transaction charges which helps enhance the underside line for companies.

Much less vulnerable to disputes. There aren’t any chargeback claims in pay-by-bank transactions, which suggests a decrease threat of incurring chargeback charges for companies. Financial institution-to-bank transactions are additionally nicely documented, so senders have real-time entry to information of their transactions.

Seamless cross-border transactions. Fashionable pay-by-bank transactions, notably cellular banking, present customers with entry to worldwide fund transfers. Sooner or later, pay by financial institution improvements will make same-day — even instantaneous — transfers potential.

Frequent issues when paying by financial institution

Sluggish processing time. In the meanwhile, pay-by-bank strategies, reminiscent of ACH and wire transfers, take no less than a day to course of.

Transaction limits. Most pay-by-bank strategies restrict the transaction worth allowed inside a day and inside a month, making it tough to make use of for large-volume companies.

Restricted integrations. Pay-by-bank strategies have very restricted integration capabilities. Clients should provoke requests instantly from a banking platform whereas service provider cost processors solely help ACH and pay-by-bank app integrations.

See: 8 Finest Banks for Ecommerce

Pay by financial institution future traits

Current developments within the monetary know-how panorama focus largely on making funds quicker and extra handy. A lot focus is given to upgrading the present pay-by-bank infrastructure with digital railways and improved banking insurance policies.

- Personalised cellular banking apps with AI.

2025 is the 12 months of AI as extra companies, together with banks and different monetary establishments, race to combine generative AI and machine studying to enhance the banking expertise with personalization. With AI, cost processing in banking apps shall be extra intuitive and account administration shall be extra streamlined.

- New pay-by-bank methodology integrations inside banking apps.

New cost choices shall be built-in as cellular banking apps evolve. This contains purchase now, pay later (BNPL), cryptocurrency, and even QR code funds. The addition of those cost choices will permit companies, particularly, to make cryptocurrency checkout extra mainstream with Central Financial institution Digital Currencies (CBDC)and develop BNPL adoption past retail. QR codes, now common within the Asia Pacific area, are a well-liked methodology for quick cross-border transactions.

- Enhanced person expertise will drive wider acceptance.

The event of cellular banking apps offers customers with extra comfort. Except for 24/7 entry to their financial institution accounts, superior cellular apps will permit for a extra seamless banking expertise resulting in elevated adoption. In Uncover’s 2024 Funds State of the Union research, 67% of shoppers say they’re open to utilizing their digital identification in alternate for a extra seamless cost course of.

- New banking frameworks for seamless cross-border transactions.

Because the UK leads the worldwide group in utilizing pay-by-bank for cross-border transactions, trendy frameworks reminiscent of open banking will permit banks and cost processors to share monetary knowledge. Moreover, the November 2025 deadline for adopting the ISO 20022 requirements for cost messaging means we’re a lot nearer to creating world real-time cross-border funds a actuality.

- Improved safety measures and compliance.

Safety will stay a prime precedence in the way forward for pay by financial institution. Count on to see continued developments in safety measures in addition to improved compliance to guard bank-to-bank transactions, notably cross-border exchanges. Examples embody biometric authentication and Europe’s revised PSD2, which outlines a suggestion for sturdy buyer authentication.