Key takeaways:

- Sq. is a pioneer in cellular fee know-how. It got here out with the primary cellular card reader and has developed into an ecosystem of enterprise operations instruments designed to serve companies of all sizes.

- Sq.’s free pricing and flat-fee fee processing construction are its largest benefits, offering an all-in-one resolution for retailers, particularly small companies seeking to discover methods to maintain operational prices low.

- Sq. Funds lets retailers settle for quite a lot of fee strategies, comparable to in-person, on-line, cellular, guide/keyed-in, invoiced, and recurring billing.

Sq. is a extensively fashionable and extremely beneficial point-of-sale (POS) resolution by specialists and real-world customers alike. It has featured in a number of our POS purchaser’s guides, primarily owing to its value level, suite of sturdy options, and low-cost charges and {hardware} choices.

Learn on to study extra about Sq. as I sort out the way it works, what it does, and the way a lot it prices.

What’s Sq.?

Sq. is a trailblazer in cellular card and fee know-how, having invented the primary cellular card reader in 2009. Sq. didn’t require long-term contracts nor prolonged software or approval processes, and most of all, got here with no fastened month-to-month prices and provided a free POS system. This innovation helped companies take funds wherever and utterly modified the fee panorama within the retail trade.

As we speak, Sq. is greater than a fee processor — it has developed right into a enterprise know-how platform serving all types of companies. The Sq. ecosystem permits companies to promote wherever, handle stock, talk with clients, guide appointments, order on-line, and a lot extra. The Sq. ecosystem has greater than 36 merchandise, offering assist and numerous alternatives for any operation, from international chains to mom-and-pop outlets.

Given the unimaginable worth Sq. offers and the quite a few different instruments in addition to fee processing it provides free of charge or at minimal prices, Sq. is the right fee resolution for small companies processing lower than $120,000 per 30 days.

How does Sq. work?

Sq. primarily lets small companies course of funds via bank cards, contactless funds, and ACH transfers. From this service, it then provides varied instruments inside its ecosystem that seamlessly work collectively and supply a whole enterprise resolution.

Primarily, Sq. can offer you all of the instruments you might want to run your corporation. Listed here are Sq. merchandise accessible inside its ecosystem:

- Funds: Cell and in-store funds, {hardware}, vertical terminal, invoicing, chargeback and dispute administration.

- Level-of-Sale (POS): Cell and iPad apps, stock monitoring, reporting and analytics, buyer and staff administration.

- Business-specific POS: Retail (Sq. for Retail), meals and beverage (Sq. for Eating places), providers (Sq. Appointments).

- On-line ordering: E-commerce (Sq. On-line).

- Enterprise administration: Payroll, electronic mail advertising and marketing, buyer messaging (assist), loyalty program.

- Banking: Checking account, financial savings account, debit card, small enterprise loans.

What you get with Sq.

Listed here are all of the options you get with a free Sq. account:

POS

Sq. POS software program enables you to course of quite a lot of fee strategies, hyperlinks to all of your merchandise, syncs your stock, tracks your buyer information, staff members, and extra via a central Sq. dashboard.

It allows you to settle for the next fee strategies: money, verify, vouchers; credit score and debit playing cards; digital wallets, ACH transfers, present playing cards, purchase now, pay later (BNPL) via Afterpay; and peer-to-peer funds via CashApp.

Sq. additionally helps the next fee providers: cellular funds, in-store POS, on-line fee gateway, invoicing, recurring funds, digital terminal, and the CBD program.

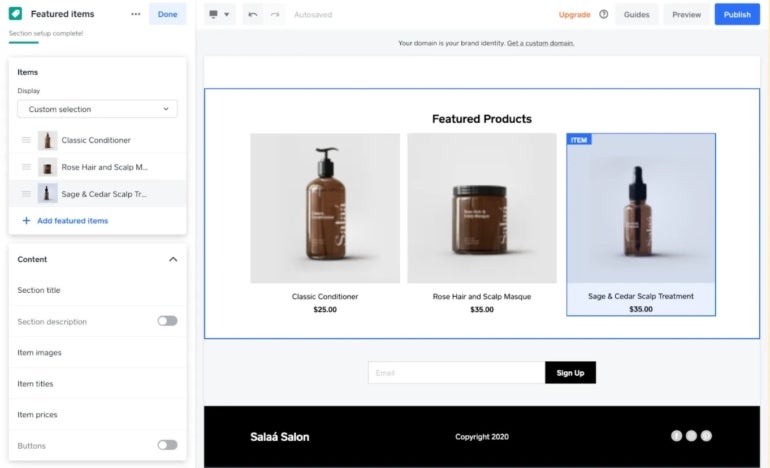

On-line Retailer

While you enroll with Sq., you additionally get a free on-line retailer. Referred to as Sq. On-line, it comes with an easy-to-use web site builder and e-commerce platform that lets you take orders on-line. What’s nice about Sq. On-line is that stock mechanically syncs with Sq. POS, permitting you to have real-time stock monitoring.

Sq. pricing

Check out the related charges with Sq.’s point-of-sale (POS, fee processing, and POS {hardware}.

Sq. POS pricing

Sq. POS software program’s fundamental subscription is free, and any upgrades are billed month-to-month. The software program works on Sq. {hardware} and cellular gadgets—iPad, iPhone, and Android gadgets.

Associated:

Sq. fee processing charges

Sq.’s largest benefit over its opponents is its easy, flat-rate fee processing, with no month-to-month charges. Which means Sq. deducts a set proportion price on profitable fee transactions.

- Money, cheque, vouchers, and different tenders: $0

- In-person, cellular, and present card funds: 2.6% + 10 cents per transaction

- On-line funds: 2.9% + 30 cents per transaction

- Recurring billing and card-on-file transactions: 3.5% + 15 cents per transaction

- Keyed-in funds (digital terminal) transactions: 3.5% + 15 cents per transaction

- ACH financial institution transfers: 1% with a $1 minimal transaction

- Invoiced funds: 3.3% + 30 cents per transaction

- Afterpay: 6% + 30 cents per transaction

- CBD program transactions: From 3.5% + 10 cents per transaction

- Chargeback price: Waived as much as $250/month

Sq. POS {hardware}

To simply accept in-person and cellular funds, Sq. provides varied low-cost {hardware} choices (interest-free installment plans are additionally accessible) to allow you to swipe, insert, or faucet playing cards to finish a sale. All {hardware} listed under work on smartphones and iPads utilizing Sq.’s free POS app.

- Sq. Reader for Magstripe: First free, further reader $10

- Sq. Reader for Contactless and Chip (2nd technology): $59

- Sq. Terminal: $299 ($27/month with financing)

- Sq. Stand (2nd technology, USB-C): $149.00 ($14.00/mo with financing)

- Sq. Register: $799.00 ($39.00/mo with financing)

How lengthy does Sq. take to course of fee?

Sq. enables you to switch funds from accomplished transactions to your checking account at various speeds. By default, fund transfers are accomplished the following enterprise day, and these are free.

Funds taken earlier than 5 p.m., PT/8 p.m., ET can be accessible in a service provider’s checking account the following enterprise day. Funds accepted on Friday earlier than 5 p.m., PT can be posted to a service provider’s checking account by Monday morning (relying in your financial institution’s processing speeds).

Prompt and same-day payout choices are additionally accessible for an added price – 1.75% of the quantity.

Sq.’s drawbacks

Regardless of loads of advantages with Sq., the service nonetheless comes with limitations and downsides. Listed here are a number of areas the place Sq. falls in need of its opponents:

- Enterprise limitations: Sq. doesn’t work with high-risk companies (on-line playing, age-restricted objects, and extra).

- Fee processing charges: Sq.’s charges aren’t the bottom in the marketplace, despite the fact that it is rather clear with its flat-rate pricing. Sq. solely will get you decrease processing charges once you attain $250,000 in annual gross sales. Different suppliers, comparable to Stripe and PayPal, could provide decrease charges at decrease annual gross sales thresholds.

- Buyer assist: Sq. offers restricted assist hours outdoors its premium plans and is essentially supported by on-line tutorials and chat. Actual-world person critiques additionally say that assist is inconsistent as the extent and high quality you get extremely rely upon the agent you come into contact with.

- Account stability: There are complaints on third-party person evaluate websites about Sq.’s account holds and freezes, which generally happen when you’ve got extreme chargebacks or fraudulent costs. These points take time to resolve and may have a big effect on enterprise operations.

Associated: 7 Greatest Sq. options reviewed by specialists

Tips on how to arrange a Sq. enterprise account

To get began on utilizing Sq., you want to enroll in a enterprise account. Comply with the steps under to arrange a Sq. enterprise account:

Step 1: Select your corporation construction. Sq. will ask you to supply data relying in your construction, which could be a sole proprietorship, restricted legal responsibility firm (LLC), personal firm, public firm, partnership, or charity (nonprofit). Sq. has a listing of necessities primarily based on the enterprise construction you’ll select.

Step 2: Confirm your private id. Monetary establishments like Sq. are ruled by federal legislation and banking trade rules, in order that they would want to confirm and report data that identifies every one that opens an account.

Step 3: Hyperlink your checking account. I like to recommend utilizing a enterprise checking account; open one for those who don’t have one but.

Step 4: Arrange switch choices. Sq. transfers are set to a Subsequent Enterprise Day schedule by default. You may ship on the spot or same-day transfers for a further price.

Step 5: Log in to your Sq. account as soon as you’re finished with the preliminary setup. You are able to do this from the Sq. Level of Sale app or your Sq. Dashboard (net browser).

Step 6: Order Sq. {hardware} for those who promote in-person.

Step 7: Create your product listings. Your Sq. dashboard has an merchandise library the place you’ll be able to create, edit, and handle merchandise.

Step 8: (elective) Add staff members (staff) if wanted. You are able to do this out of your Sq. Level of Sale app or Sq. Dashboard by going to Workers > Workforce > Workforce members, and deciding on Add staff member.

Step 9: (elective) Arrange your free Sq. on-line retailer, for those who plan to take orders or promote on-line.

Additionally Learn: Tips on how to use Sq.: An in-depth information for brand new customers

Tips on how to use the Sq. fee system

As talked about, you should utilize the Sq. fee system to just accept cellular, on-line, and in-store funds and even course of guide funds and recurring funds. Beneath, I listing the steps concerned in processing cellular and in-person gross sales.

For cellular funds:

- Obtain the Sq. POS cellular app (iOS or Android) and guarantee you’ve got the newest model.

- Check in to your Sq. cellular app.

- Join your cellular card reader to just accept faucet, dip, and swipe funds. Plug it in your telephone or join it by way of Bluetooth, relying on the cardboard reader you’ve got.

- Choose objects for the sale transaction by going to the merchandise library within the cellular app.

- As soon as the objects are chosen, faucet Checkout, and if you find yourself prepared to just accept the fee, faucet Cost.

- Choose the shopper’s chosen fee methodology—swipe, faucet, or dip; money, keyed-in, ship fee hyperlink, QR code, and so on.

**You may course of offline funds briefly for twenty-four hours for those who lose Web connection. Toggle Enable Offline funds from Settings > Checkout > Offline funds. The 24-hour window contains importing the fee information of your sale transactions. As soon as the window expires, the Sq. app will be unable to gather the funds anymore.

For in-person funds:

- Order your Sq. {hardware} of selection.

- Arrange your POS app in your chosen {hardware} by logging into your account and organising your retailer.

- To log a sale, will probably be just like logging gross sales utilizing the cellular app. As an alternative you will notice the Merchandise library via a much bigger display screen.

- Accumulate funds via the Sq. Terminal or Sq. Stand/Sq. Mount. This step can be just like cellular funds.

Often requested questions (FAQs)

Is paying via Sq. protected?

Sure, paying via Sq. is protected. Its {hardware} and card readers have end-to-end encryption, and its software program is PCI-compliant. Its built-in fee system makes use of encryption and tokenizations and employs 24/7 fraud prevention on its servers, defending information for each vendor and purchaser.

How a lot does Sq. cost?

Sq. costs a set, flat charge for bank card processing. In-person gross sales are charged 2.6% + 10 cents per transaction, whereas on-line gross sales are charged 2.9% + 30 cents per transaction.

Can I withdraw cash from Sq.?

Sure, you’ll be able to switch funds out of your Sq. account to your checking account in several methods: customary next-business-day switch, subsequent day, and on the spot. You can even arrange intervals on once you need transfers to occur and this may occur mechanically primarily based in your set interval.

Does Sq. course of recurring funds?

Sure, Sq. can. Sq. customers can course of recurring funds via the Card on File function on the Sq. app, Sq. Invoices, and the net Sq. Dashboard.