Crypto staking is the spine of each Proof-of-Stake (PoS) blockchain. With out it, most crypto networks wouldn’t have the ability to safe their main mechanism for safety and transaction validation. That’s how necessary it’s.

Staking additionally ensures that validators have a monetary incentive to behave truthfully, as their staked tokens may be slashed, both partially or absolutely, for participating in malicious habits or failure to carry out their respective duties.

One other key level is that staking is essential for maintaining blockchain ecosystems decentralized. It gives a structured strategy to reward contributors for contributing to a community’s well being and general performance.

This text takes a deep dive into one of the best crypto staking platforms, every reviewed rigorously by their functionalities and quantity of property supported. It additionally goes by the fundamentals of staking and find out how to stake crypto in a number of methods.

Fast Navigation

What Is DeFi Staking?

Staking is the method of locking up cryptocurrency in a pockets to assist safe and keep a blockchain community that makes use of a Proof of Stake (PoS) consensus mechanism. In return for committing your tokens, you earn rewards—usually within the type of further cryptocurrency. By staking, you contribute to the community’s safety, validate transactions, and assist create new blocks on the blockchain.

In essence, staking incentivizes sincere habits. Customers who stake their cash can acquire rewards for supporting the community, whereas malicious or negligent validators threat having their tokens “slashed” (i.e., a portion of their stake is eliminated). This setup encourages lively participation and maintains the blockchain’s integrity.

Advantages of Crypto Staking

There are a number of benefits to crypto staking, not only for customers but in addition for blockchain networks and DeFi protocols:

- Passive yield era:

Staking permits you to earn rewards with out promoting cryptocurrency, making a constant passive revenue stream. If reinvested, these rewards can compound, boosting your general returns.

- Increased returns:

Relying on the blockchain and market surroundings, annual share yields (APYs) can vary from single digits to over 20%, making them a extra profitable choice than many typical monetary devices.

- Extra accessibility and community help:

Not like PoW blockchains, staking requires no specialised {hardware} or heavy power use as a result of PoS networks solely require comparatively smaller quantities, making it accessible to a broad vary of contributors.

Furthermore, by locking up tokens, you assist validate transactions on the blockchain, defending it towards threats like 51% assaults and sustaining long-term stability. This rewards customers for his or her function in community well being.

- Liquidity choices:

Liquid staking derivatives (Lido’s stETH, Rocket Pool’s rETH, and many others) allow you to entry your staked property in DeFi whereas nonetheless incomes staking rewards, offering flexibility for added buying and selling or lending actions.

- Restaking:

Some well-liked protocols like EigenLayer let you “restake” your already-staked tokens, utilizing them as collateral or deploying them in different staking methods. This technique can compound yields additional and improve engagement throughout the DeFi ecosystem. However, the largest perk is that restaking permits DeFi tasks to leverage the safety and capital of already established networks.

This can be defined additional within the article, however for now, word that restaking is way extra complicated than conventional or liquid staking, requiring extra tasks and technical information to hold out the method.

Finest Crypto Staking Platforms in 2025: Our High Picks

Under are a number of the finest staking platforms, offering a complete breakdown of their options, supported property, and different necessary info.

Jito – Solana’s Largest Liquid Staking Platform

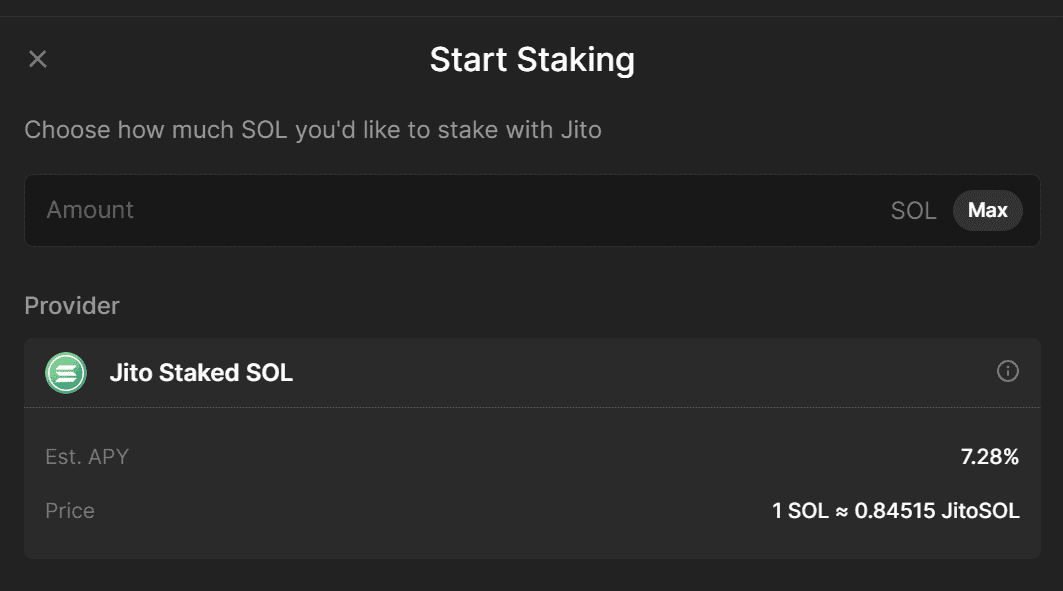

Jito is the largest liquid staking platform on the Solana blockchain. Members stake SOL and obtain JitoSOL in alternate, which is a liquid staking token (LST) that can be utilized in different Solana-based dApps. This enables customers to lock their staked tokens however use a tokenized model in different DeFi tasks to generate extra yields.

The venture’s MEV strategy—typically controversial—has drawn consideration. Some critics argue that MEV exploits merchants by front-running orders or reordering transactions, whereas others see it as a method to enhance market effectivity and guarantee lenders are repaid.

Jito tackles MEV by implementing an public sale system the place merchants bid on worthwhile transaction sequences. Third-party block engines simulate these bids to determine essentially the most useful transaction groupings. The ensuing earnings are funneled again to validators and JitoSOL holders, successfully curbing spam advantages and rising staking rewards.

Key Options of Jito

- Liquid staking with JitoSOL: Customers stake SOL and obtain JitoSOL, representing their staked property. JitoSOL may be deployed throughout DeFi (e.g., lending, buying and selling, or liquidity swimming pools) whereas persevering with to earn staking rewards.

- MEV Integration: Jito captures MEV by optimizing transaction ordering inside blocks, redistributing additional income to JitoSOL holders, and boosting general staking yields.

- Full decentralization: The protocol’s governance token, JTO, grants holders voting rights on delegation methods, treasury administration, and protocol updates, whereas the Jito DAO ensures community-driven oversight.

- Safety and transparency: Jito depends on audited sensible contracts and delegates SOL to established validators throughout the Solana ecosystem. Governance by the Jito DAO additional enhances transparency.

Supported Property

Given Jito’s unique integration with the Solana blockchain, it solely helps SOL tokens.

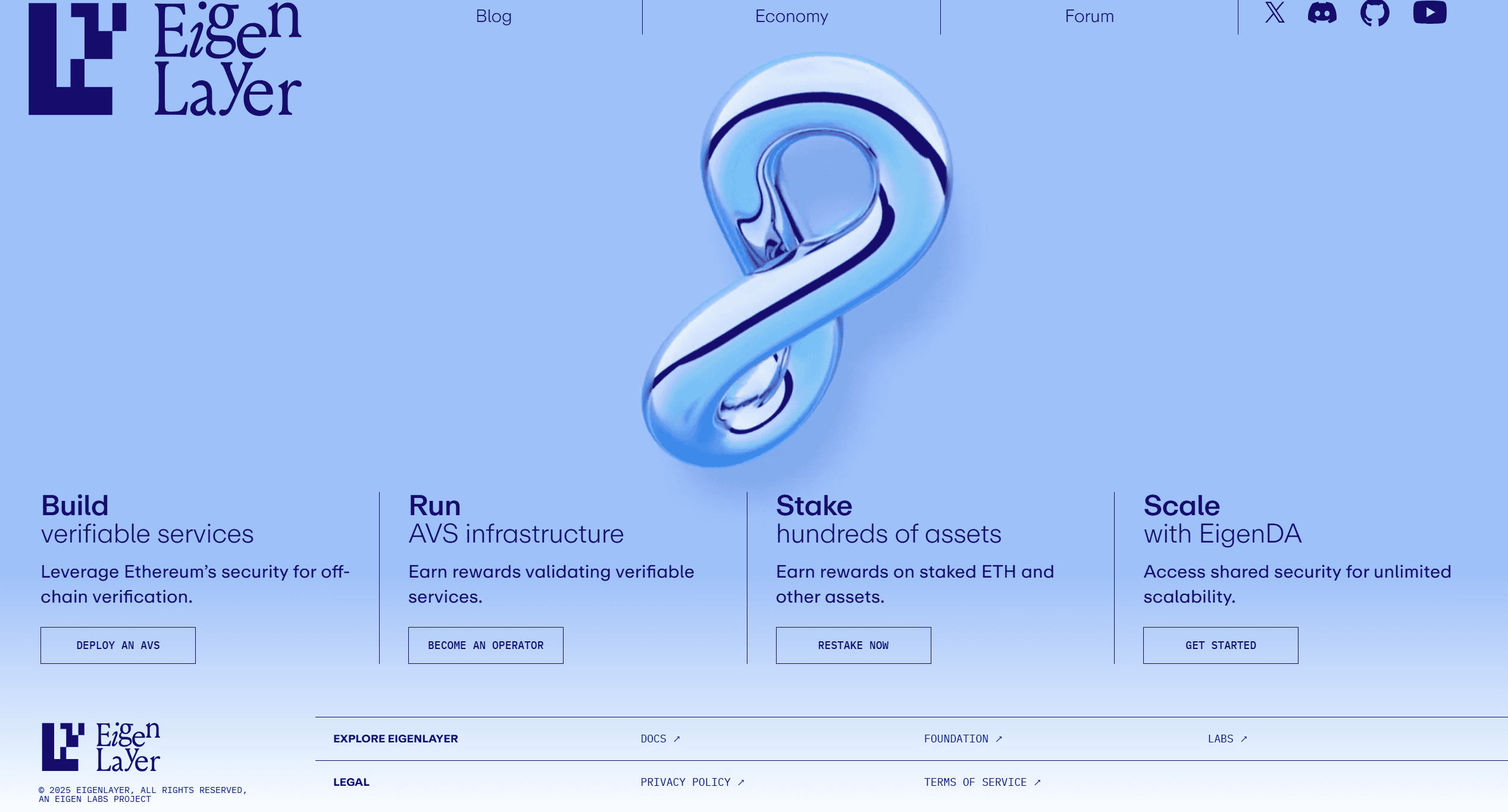

EigenLayer – The Restaking King

EigenLayer is a middleware protocol constructed on Ethereum that pioneered the thought of restaking, that means you’ll be able to deposit staked ETH (like stETH) into a brand new set of liquidity swimming pools. These staked tokens are then distributed throughout numerous decentralized functions or AVS (Actively Validated Providers), oracles, Layer 2s, knowledge availability layers, cross-chain bridges, and extra.

By doing so, EigenLayer permits these providers to faucet into Ethereum’s strong safety with out creating their very own separate validator networks.

Key Options of EigenLayer

- Restaking market: In a way, EigenLayer is a form of market the place validators and protocols negotiate pooled safety for a price. Protocols should buy staked tokens or stETH as an “additional layer” of safety. In the meantime, validators can select which protocols they wish to safe, evaluating them for threat and reward. In addition they management how a lot staked capital is allotted, stopping overexposure to any single protocol.

- Versatile staking choices: Customers can go for solo staking, run their very own nodes, delegate their stake to 3rd events, and even carry out twin staking, requiring each ETH and a local token to be staked. This manner, the protocol welcomes extra superior validators, customers, and builders.

- Programmability: Builders can customise validation guidelines and safety parameters for his or her EigenLayer-based functions, permitting for extra nuanced safety, together with multi-token quorums tailor-made to particular threat profiles.

- Modular safety: EigenLayer helps a modular strategy, letting stakers safe particular functionalities or “modules,” akin to decentralized storage, DeFi functions, or cross-chain bridges. This flexibility tailors safety to every venture’s distinctive necessities.

Supported Property

EigenLayer solely helps ETH, any ERC-20 token, and liquid staking tokens akin to Lido’s stETH and Rocketpool’s rETH.

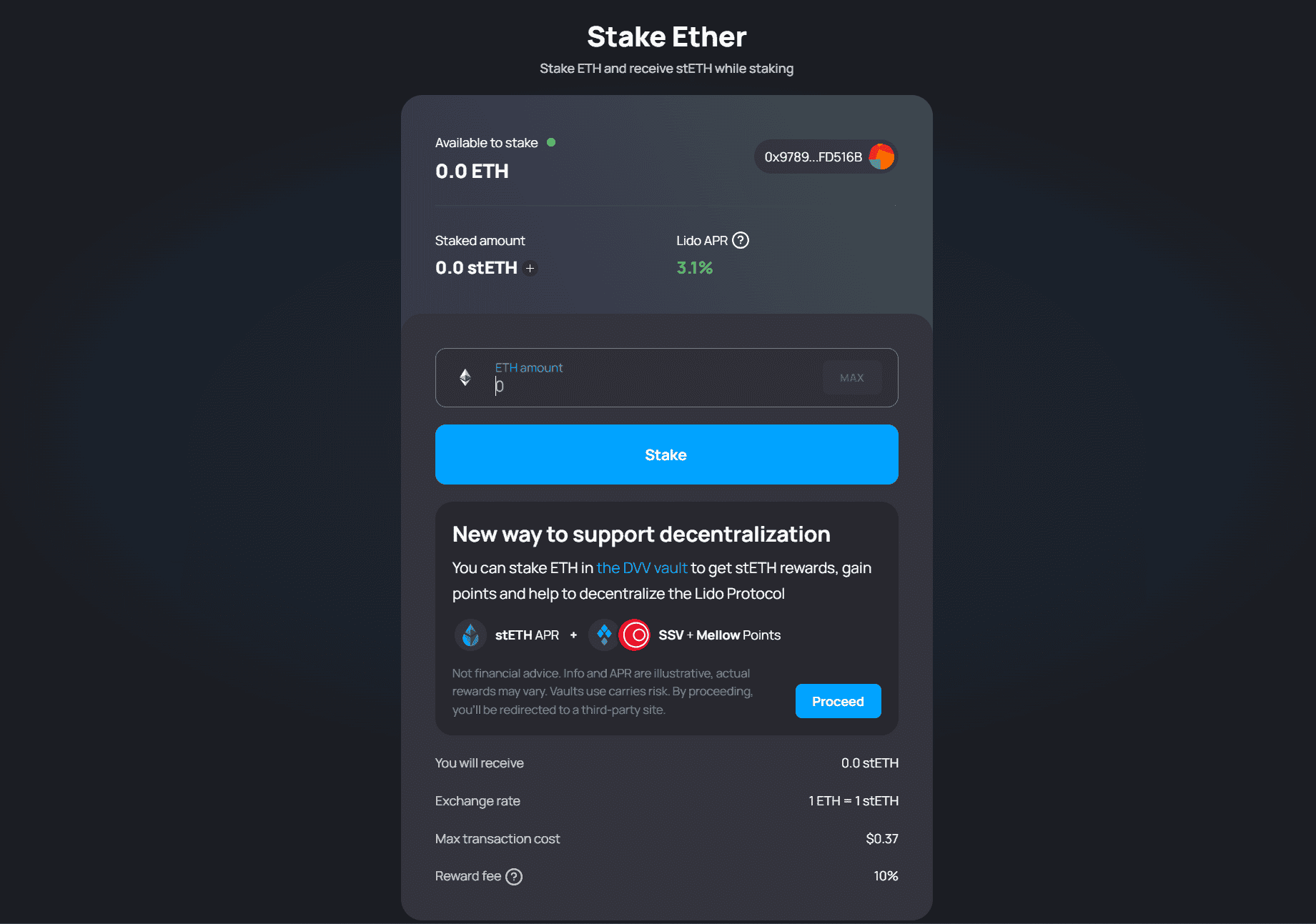

Lido Staking

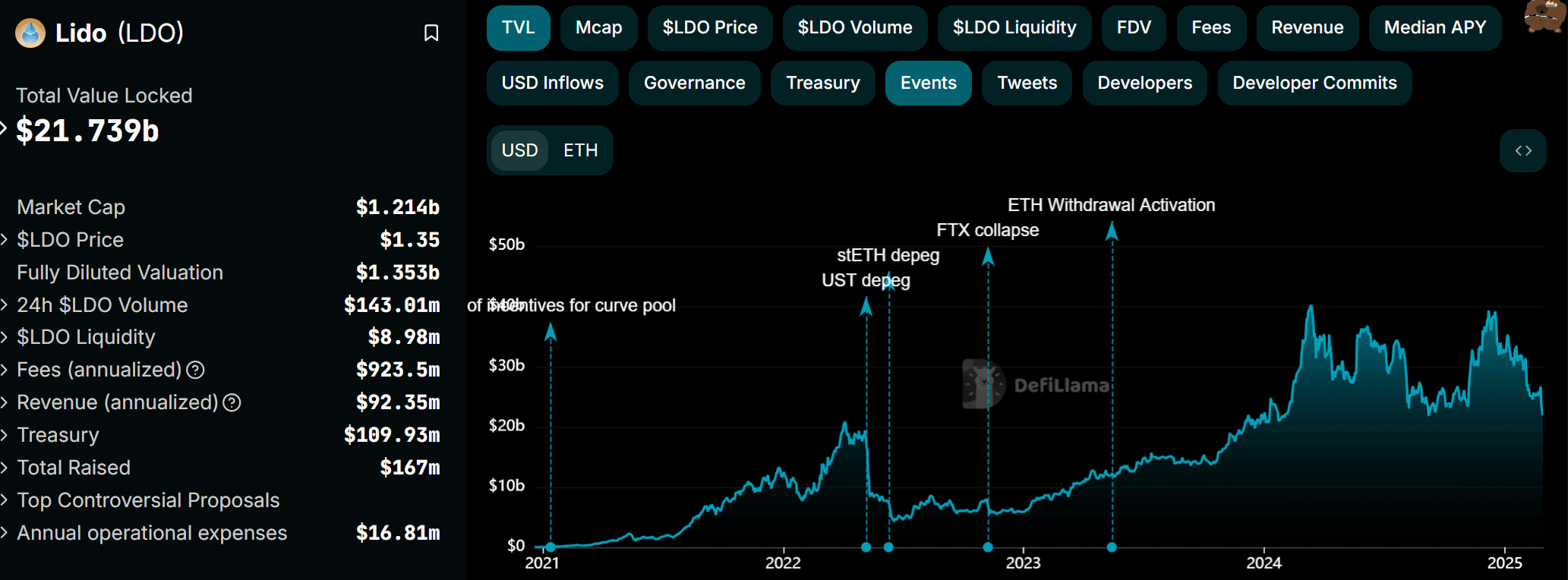

Lido is the biggest decentralized liquid staking platform within the business, reaching a peak of roughly $40B in complete worth locked (TVL) in mid-2024, representing an enormous share of the full DeFi TVL.

Lido’s enchantment is simple: It permits customers to earn staking rewards on numerous PoS cryptocurrencies with out requiring them to unstake their property. This makes Lido the pioneer of liquid staking: The protocol points a tokenized model of ETH, stETH, which represents the staked property.

Customers can deploy stETH throughout a number of DeFi tasks in Ethereum, permitting them to earn further yield on high of their staked property.

Key Options of Lido

- Liquid Staking: While you stake with Lido, you obtain a spinoff token, like stETH, on a 1:1 foundation. Furthermore, customers can stake any quantity of crypto, aside from validators, which require the standard 32 ETH deposit.

- Validator Distribution: Staked tokens are unfold throughout a community {of professional} validators chosen by the Lido DAO, decreasing dangers tied to validator downtime or slashing penalties.

- Open supply and audited: Lido’s sensible contracts are publicly obtainable and often audited. Audits may be discovered on GitHub.

- Charge construction: Lido expenses a ten% charge on staking rewards, which is shared between node operators and the Lido DAO treasury.

Supported Property

Lido helps all kinds of crypto property, together with:

- ETH is essentially the most extensively used staking choice on Lido.

- Polygon (MATIC): Tokenized as stMATIC.

- Kusama (KSM): Tokenized as stKSM.

- Polkadot (DOT): Tokenized as stDOT.

Nevertheless, help for SOL was discontinued because of disagreements and group votes over unsustainable long-term charges on each blockchains.

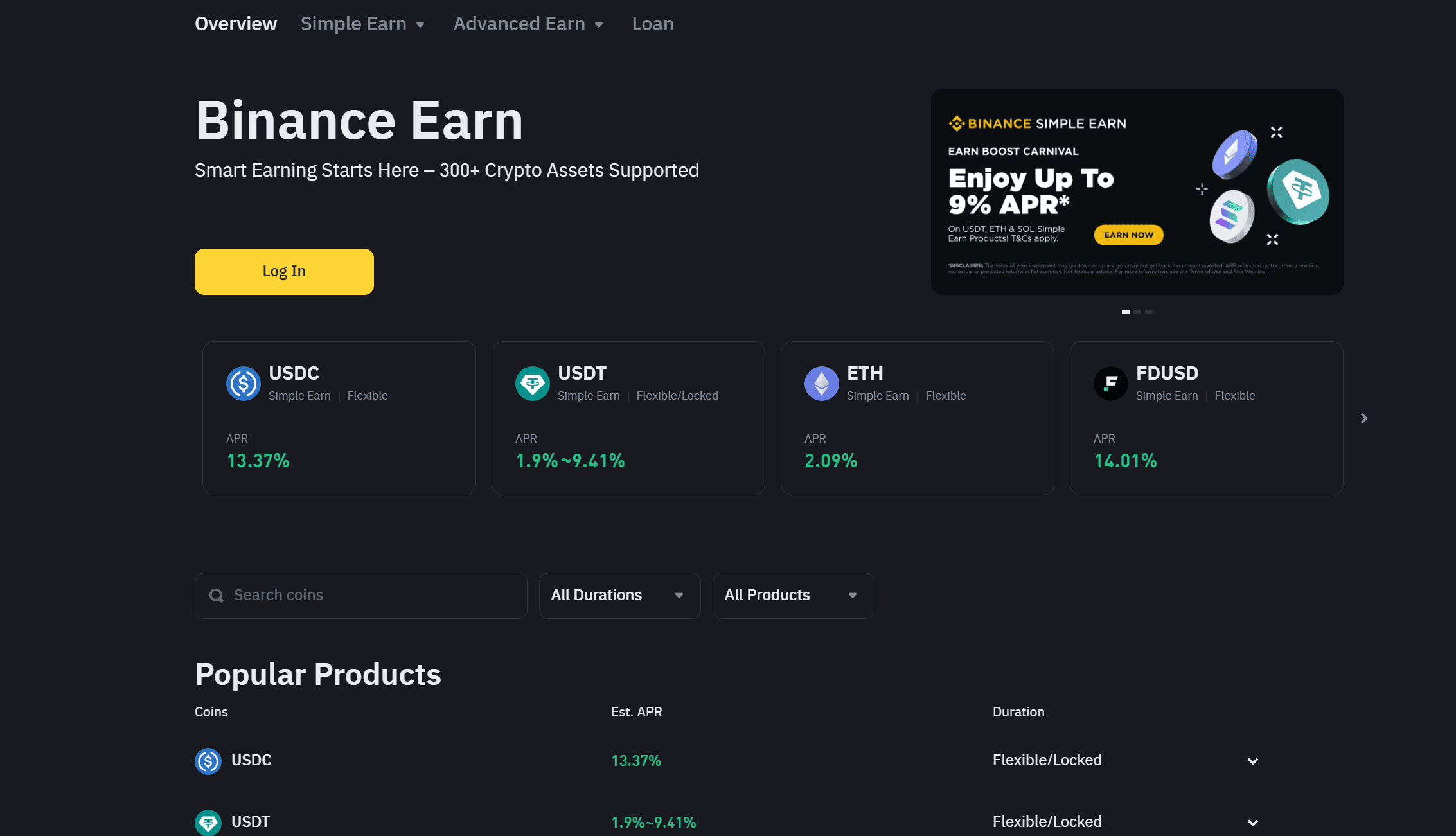

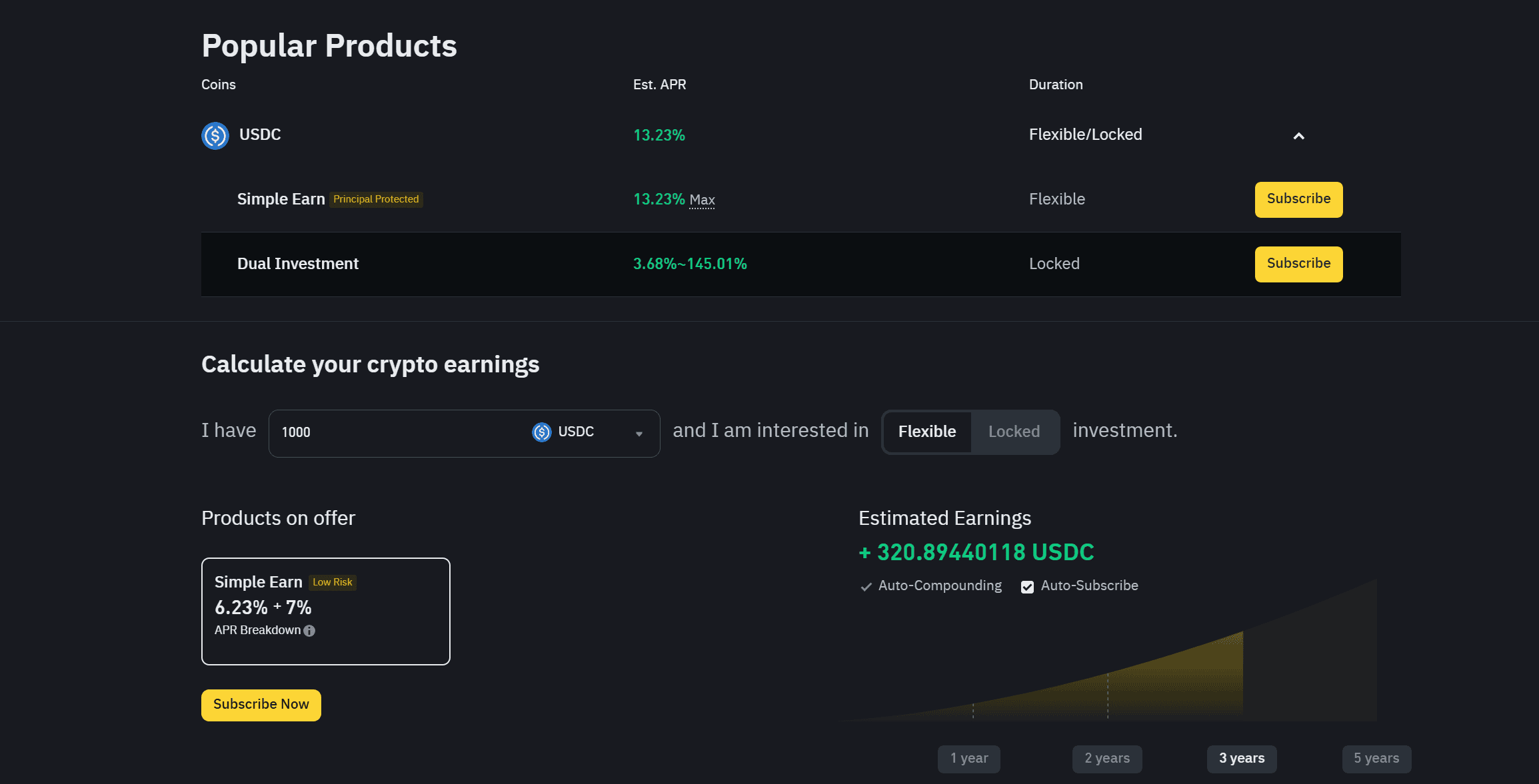

Binance Earn

Binance Earn is a yield-focused providing throughout the Binance ecosystem, designed to assist each novice and skilled traders earn passive revenue on their cryptocurrency holdings.

It serves as a one-stop resolution for a number of funding merchandise, championed by its in depth staking program, the place customers can select Locked Staking, the place they deposit their crypto for a set period (e.g., 30, 60, or 90 days) to earn increased rewards.

Key Options of Binance Earn

- DeFi and liquid staking: Connects customers to exterior protocols, providing increased APYs however carrying common dangers related to utilizing these DeFi platforms. Binance additionally helps ETH 2.0 Staking, enabling contributors to stake Ethereum with out working their very own validator node; in return, customers obtain BETH as a tokenized illustration of their staked ETH.

- Financial savings merchandise: Apart from staking, Binance Earn gives Versatile Financial savings, which permits quick entry to funds however provides extra modest rates of interest. Locked Financial savings, alternatively, require customers to commit their property for a predefined interval in alternate for increased yields.

- Twin funding: The platform provides extra superior merchandise like Twin Funding, a high-yield choice involving two totally different cryptocurrencies with returns contingent on market circumstances.

- BNB Vault: A well-liked function for Binance Coin (BNB) holders. It combines mixing staking, financial savings, and liquidity farming multi functional to maximise returns on BNB holdings.

Supported Property

Binance Earn helps over 180 cryptocurrencies up for staking, together with main property like Bitcoin, Ethereum, Solana, and Cardano, in addition to stablecoins akin to USDT and USDC.

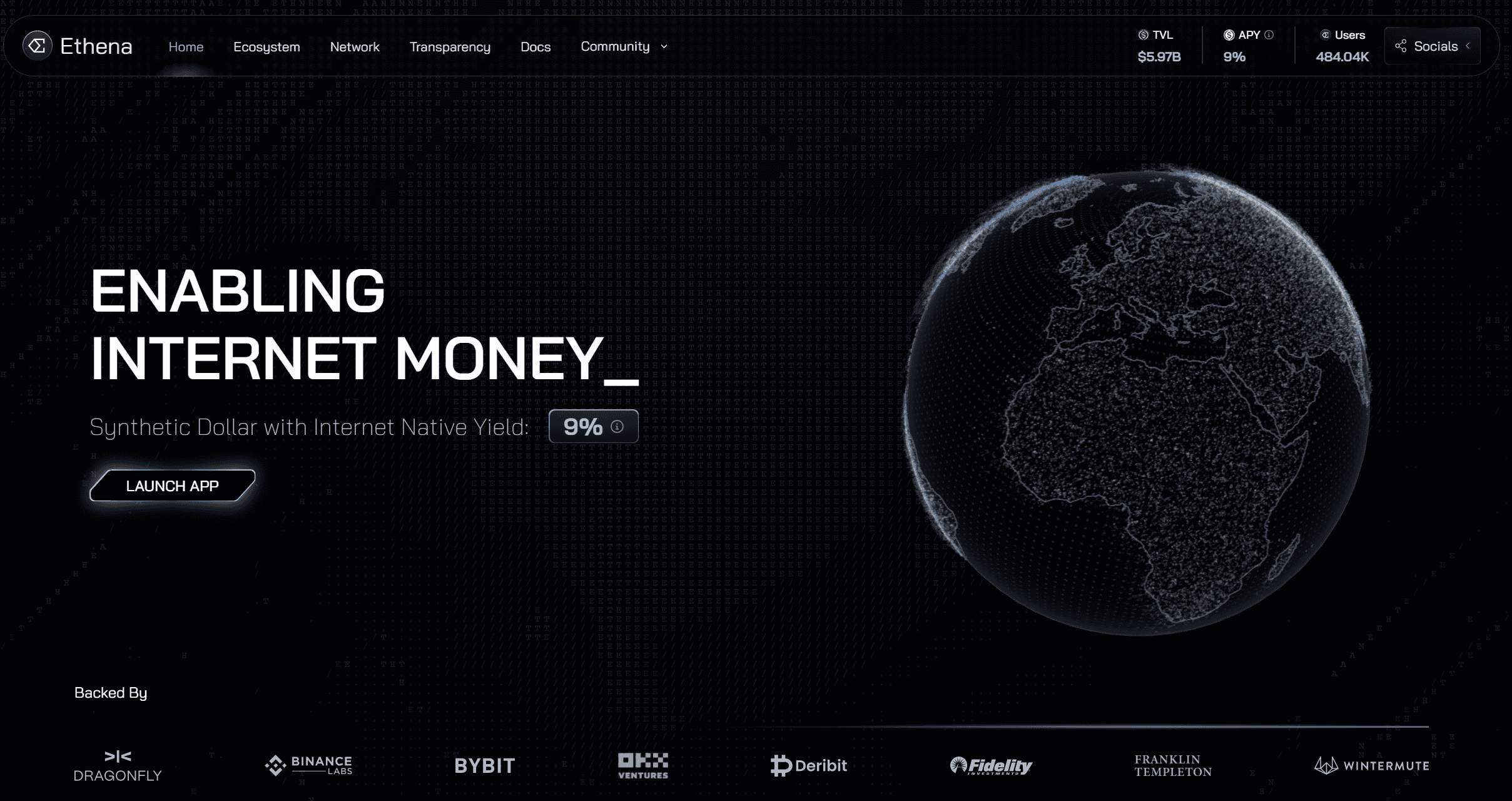

Ethena – A Yield-Bearing Stablecoin Backed by Crypto

Ethena USDe is an artificial greenback stablecoin constructed on Ethereum, designed to keep up a 1:1 peg with the U.S. greenback by delta-neutral hedging and on-chain collateral.

Launched by Ethena Labs, the platform provides a censorship-resistant various to conventional stablecoins. It’s backed solely by crypto property akin to ETH, BTC, and liquid staking derivatives.

Key Options of Ethena

- USDe: Ethena’s USDe employs a delta-neutral hedging mannequin to steadiness any fluctuations within the worth of its underlying collateral. The protocol takes quick positions on derivatives contracts to maintain the stablecoin pegged at $1 with out relying on fiat reserves or conventional custodians.

- Crypto collateral: All minted USDe is backed by on-chain cryptocurrencies, together with ETH, stETH, BTC, and numerous different stablecoins. This maintains a constant ratio of collateral to excellent tokens.

- Yield-bearing token: One in all Ethena’s hottest choices is the power to stake USDe to earn sUSDe, a yield-bearing spinoff token that appreciates over time. All returns on investments are generated by 1) Ethereum staking rewards and a couple of) the funding spreads earned by delta-neutral derivatives positions. The staking course of follows the ERC-4626 Token Vault normal.

- Insurance coverage fund: Ethena is among the few DeFi protocols to supply a reserve fund that acts as a purchaser of final resort. This fund is a security web in case of utmost eventualities, like unfavorable funding charges or sudden market shocks.

Supported Property for Staking

Ethena helps staking primarily with its native token, USDe. Upon staking, customers obtain sUSDe, which captures amassed rewards from each derivatives funding spreads and Ethereum staking yields.

How you can Stake Crypto In a Few Steps

There are a number of methods to stake crypto. However whichever method, you should first get a correct crypto pockets to start your staking journey. You possibly can take a look at our information on one of the best DeFi wallets to research and evaluate a number of the high choices in 2025.

Staking With Crypto Wallets

Some crypto wallets like Belief Pockets, Exodus, and Phantom let you stake property straight with out leaving the app.

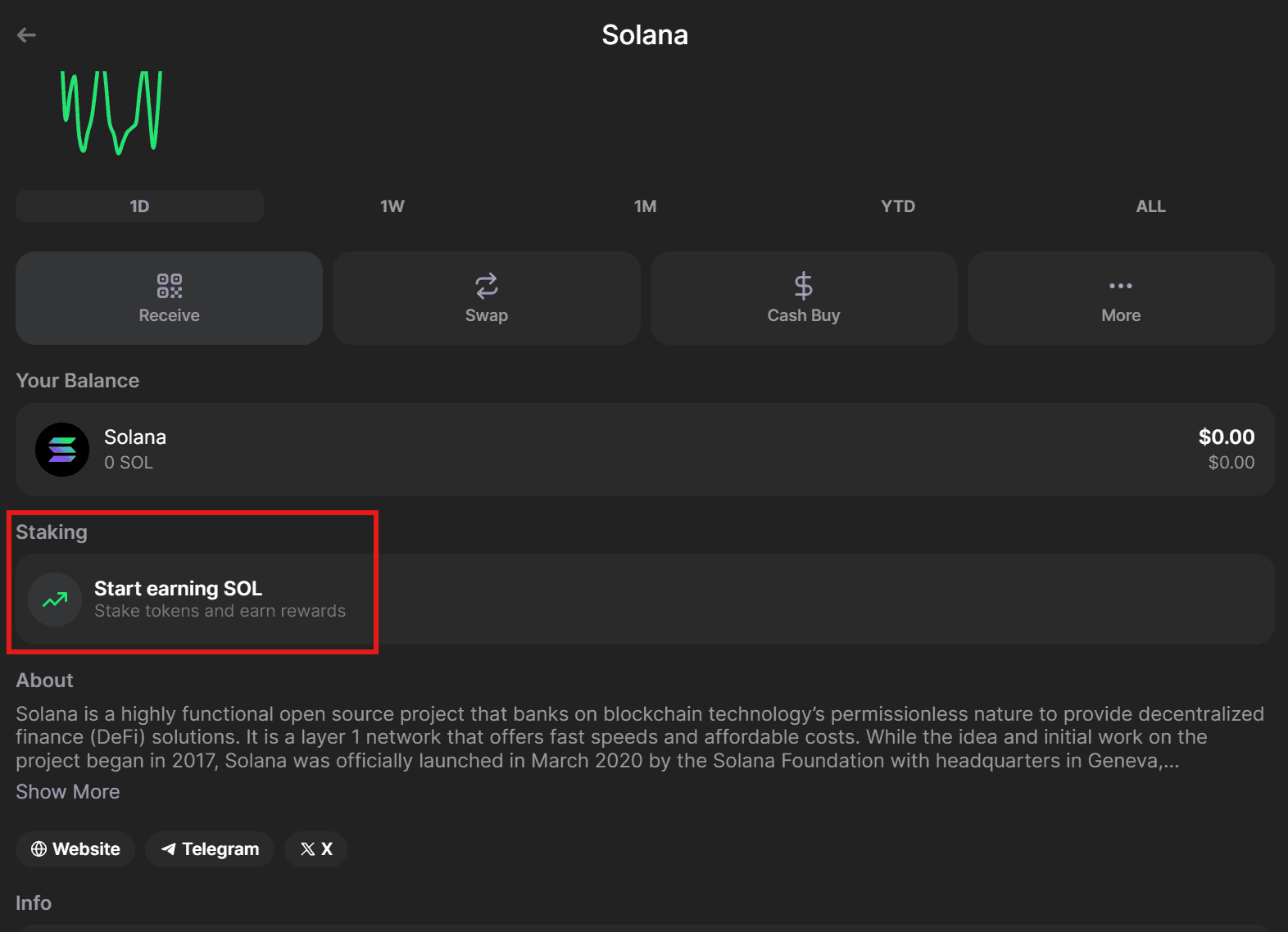

For instance, if you wish to stake utilizing the Phantom pockets, merely go to your account and select an asset. Subsequent, click on on the asset and choose Staking.

Phantom provides two choices: native staking, the place you merely lock up property within the Solana blockchain, and liquid staking utilizing Jito.

In the event you select native staking, then you need to choose a validator. The Phantom Validator is the preferred because of its trustworthiness and safety, however rewards are normally decrease. Afterward, simply enter the quantity you want to stake. Observe that with native staking, your property are locked, so you can not use them throughout dApps for additional yield till the cooldown interval ends.

Alternatively, staking with Jito might lead to larger rewards and decrease charges. When you deposit your property, you’ll get JitSOL, which you need to use throughout DeFi protocols to win some additional rewards.

Utilizing a Staking Platform

Utilizing a crypto pockets, you’ll be able to be part of a crypto staking pool the place customers deposit their funds to extend the probabilities of incomes rewards. That is perfect for these with smaller quantities of crypto or who can’t meet minimal staking necessities in a given protocol.

For instance, if you wish to stake ETH, you’ll be able to merely go to Lido, select the variety of tokens you want to stake, click on on proceed, and, after getting completed so, obtain stETH tokens representing the staked quantity. This lets you use the tokenized model of your funds throughout Ethereum-based DeFi protocols.

Node Staking

Node staking is extra sophisticated and reserved for individuals who run a validator node on Solana or Ethereum. This implies validators get to stake their very own forex plus the forex of different liquid stakers. You earn rewards by yourself staked property and a fee charge based mostly on the rewards your node generates for liquid stakers.

Probably the greatest swimming pools for node staking is Rocketpool, one of many largest ETH staking swimming pools. It requires at the least 16 ETH to function a node however comes with a 14% minimize from rewards. Different platforms are StakeWise V3 and Marinade Finance for Solana customers.

Change Staking

An alternate choice could be centralized staking, by which exchanges like Binance or Coinbase deal with the staking course of in your behalf, simplifying the expertise however requiring belief of their safety measures.

As an illustration, Binance Earn permits you to select from totally different staking merchandise, from well-liked cryptocurrencies to stablecoins, with totally different durations and APRs.

Ceaselessly Requested Questions

Can I Unstake My Property?

Sure, you’ll be able to unstake property after a cooldown interval, which will depend on the protocol you’re utilizing. That is to stop validators from instantly withdrawing their funds, which may permit malicious actors to keep away from penalties, akin to slashing. It additionally helps keep financial stability by stopping large-scale, sudden withdrawals.

What’s the Distinction Between Native Staking and Liquid Staking?

Native staking requires the consumer to lock property to generate rewards. In the meantime, Liquid staking platforms give customers a tokenized model of their already staked property, which can be utilized throughout totally different DeFi tasks, boosting their incomes potential.

What Makes Restaking Extra Complicated Than Conventional Staking?

Restaking permits you to reuse already staked tokens as collateral in different protocols. This enables customers to compound rewards whereas providing additional safety for a number of decentralized functions and blockchain protocols. The problem is that restaking requires numerous technical experience in DeFi for the reason that consumer is interacting with a number of sensible contracts and DeFi tasks and should handle a better degree of threat.

The publish The 5 Finest Crypto Staking Platforms in 2025: Every little thing You Must Know appeared first on CryptoPotato.