Unhealthy information for followers of factors and miles: Some U.S. senators are attempting to push the Credit score Card Competitors Act as a “poison capsule” modification in pending laws that is up for a vote in Congress.

Sen. Roger Marshall, a Republican from Kansas, filed an modification final week on behalf of himself and Sen. Dick Durbin, a Democrat from Illinois, so as to add the CCCA to the Guiding and Establishing Nationwide Innovation in U.S. Stablecoins Act.

The GENIUS Act has acquired bipartisan help, and initially, it appeared more likely to go the Senate with greater than the important thing threshold of 60 votes. Proponents of the laws declare it could enable for higher regulation of the cryptocurrency market and supply extra stability in digital foreign money markets total.

Senate Majority Chief John Thune is permitting amendments to the invoice, which opens up the opportunity of the CCCA getting hooked up to the invoice if senators vote to approve the addition. Nonetheless, a minimum of one senator has mentioned he’ll withdraw his earlier help for the GENIUS Act if the CCCA does find yourself being hooked up.

“If it have been to be adopted in GENIUS, I’d withdraw my help on the Senate flooring,” mentioned Sen. Thom Tillis, a Republican from North Carolina, in response to the Washington Reporter.

And several other different senators are calling for a “clear” GENIUS Act vote with out amendments.

They embrace Senator Cynthia Lummis, a Republican from Wyoming and Senator Invoice Hagerty, a Republican from Tennessee.

Vice President JD Vance can also be demanding a “clear” vote with out the CCCA hooked up laws.

Sadly, if Marshall and Durbin are profitable and the Senate votes to approve the modification, the CCCA might be added to the invoice. This might drive senators to decide on between voting towards in any other case common laws to keep away from passage of the controversial modification or permitting the total invoice to go and coping with the CCCA’s penalties.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Inform Congress not to remove your bank card rewards: Shield Your Factors

“It is a political favor to [the bill’s] supporters’ largest marketing campaign donors,” mentioned Richard Hunt, govt chairman of the Digital Funds Coalition.

The Digital Funds Coalition is a commerce affiliation representing credit score unions, group banks and fee card networks.

“This invoice has by no means been by a related committee, by no means been debated, and was by no means even reintroduced this Congress,” Hunt mentioned. “In contrast to the sponsors of the GENIUS Act, the sponsors of Durbin-Marshall [the Credit Card Competition Act] haven’t achieved their due diligence.”

TPG is strongly against the CCCA as a result of we imagine it could destroy the consumer-friendly advantages of bank cards.

What’s the Credit score Card Competitors Act?

The CCCA places worth controls on interchange charges and will nearly eradicate the profitable sign-up bonuses and points-earning capacity for a lot of financial institution, airline and lodge bank cards.

When related laws was handed on debit playing cards in 2010, customers have been promised decrease costs on items and providers as a result of smaller debit card transaction charges could be handed on to customers within the type of decrease costs. That did not occur. As an alternative, points-earning and sign-up bonuses on these playing cards disappeared, and costs elevated.

A research by the Worldwide Middle for Regulation and Economics estimated that the cap on interchange charges for debit transactions hit giant banks’ annual revenues to the tune of $6.6 to $8 billion. This loss in income instantly contributed to the discount in free checking accounts and rewards packages.

The Electronics Funds Coalition advised TPG that “the Durbin-Marshall invoice lets company mega-stores like Walmart, Goal and Dwelling Depot select the most cost effective bank card processing possibility — with out contemplating client safety or advantages.”

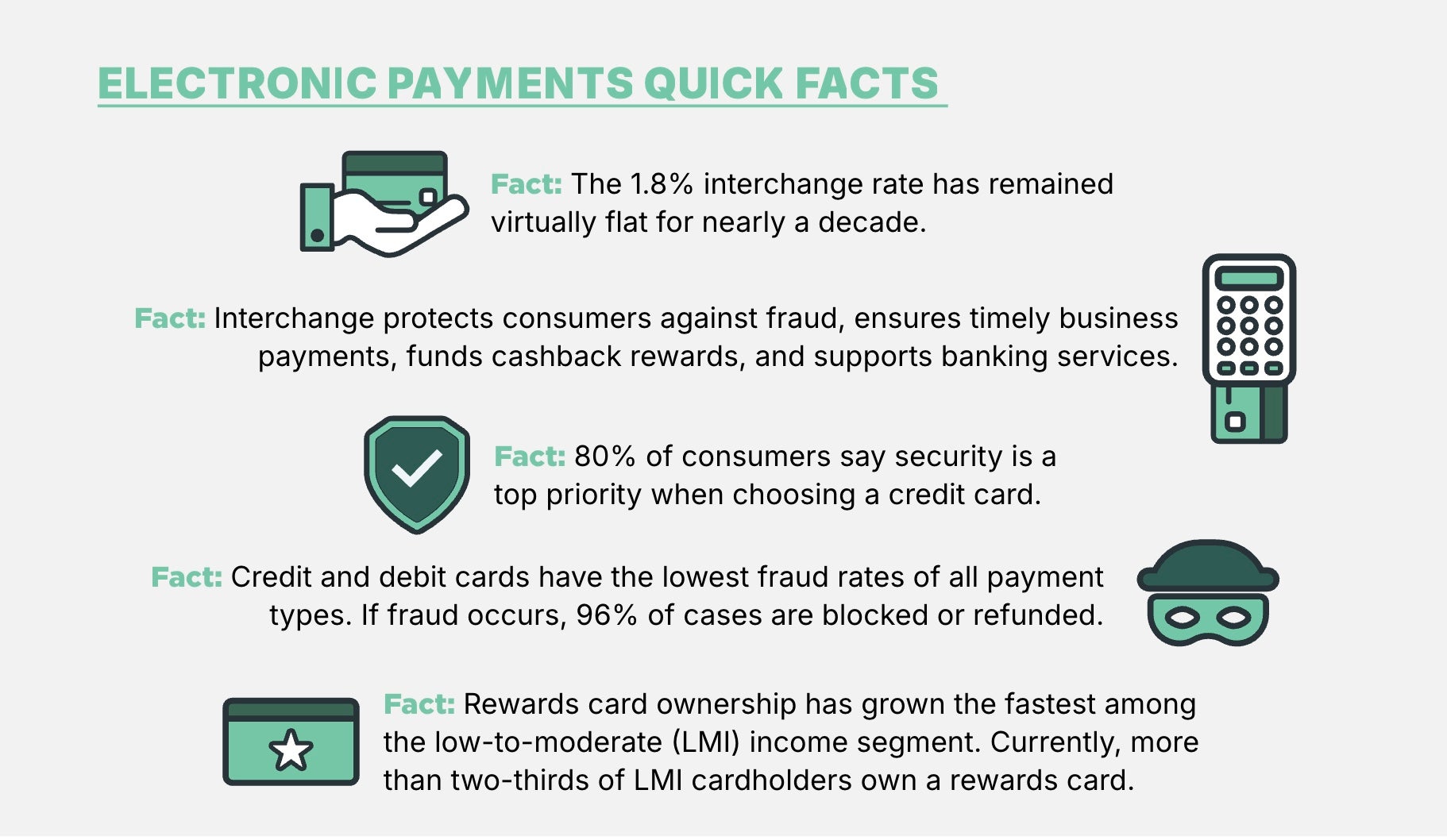

The Digital Funds Coalition additionally factors out:

- This invoice may drive transactions onto unproven networks, weakening fraud protections and elevating prices for companies and customers.

- It threatens bank card rewards, together with money again advantages that assist customers combat inflation and profit small companies.

- Small companies may face greater prices and fewer advantages from accepting card funds.

Analysis exhibits that this invoice may additionally trigger an financial slowdown for the U.S., costing $227 billion in misplaced financial exercise and roughly 156,000 in misplaced jobs.

A College of Miami research discovered that the CCCA would considerably scale back income for group banks and credit score unions whereas additionally curbing entry to credit score and banking providers in smaller markets throughout the nation, disproportionately affecting rural and low-income households.

As an organization based partly on the precept of utilizing bank card rewards packages to assist get monetary savings on journey, TPG is among the many many organizations with a vested curiosity on this trigger.

A various and wide-ranging set of organizations and industries, together with labor unions, small-business homeowners, monetary establishments (corresponding to credit score unions and group banks) throughout all 50 states, coverage institutes, commerce associations, assume tanks and airways, strongly oppose the laws.

How one can assist shield Your factors

Whereas we do accomplice with main bank card issuers at TPG, our workers members and tens of millions of our readers have seen firsthand how rewards packages can unlock journey that will be in any other case out of attain. By making journey extra accessible, we assist our readers broaden their horizons, open their minds and expertise totally different cultures — all of which might be jeopardized if the CCCA have been allowed to go as an modification to the GENIUS Act.

“This might be disastrous for customers,” TPG founder Brian Kelly mentioned. “… [They] would lose out on rewards, buy protections and fraud protections, whereas retailers would add to their backside line.”

In partnership with the Digital Funds Coalition, TPG has launched Shield Your Factors, an advocacy platform for TPG readers to precise opposition to the invoice to their native representatives and senators.

Click on on this hyperlink to submit a fast type. Please take 30 seconds as we speak to inform your senator to vote towards the CCCA modification to the GENIUS Act.

Associated studying: