For years, the “development in any respect prices” mentality has pushed rental traders to scoop up as many properties as attainable, usually working towards a unit aim.

However in 2025, the tide is popping, and landlord expectations for 2025 have shifted relative to their sentiments in This fall 2024. As an alternative of actively buying new properties, extra landlords are specializing in sustaining and bettering the leases they already handle.

In case you’re a rookie or skilled investor, this shift is definitely excellent news. There are methods which you could apply proper now to strengthen your portfolio, even if you happen to don’t really feel prepared (or ready) to purchase your subsequent property.

Wouldn’t you reasonably have fewer properties to keep up, however nonetheless the identical money circulation? This is the place {dollars} are left on the desk by not stabilizing and maximizing the worth you have already got in properties.

Fewer Acquisitions, Extra Deal with Current Portfolios

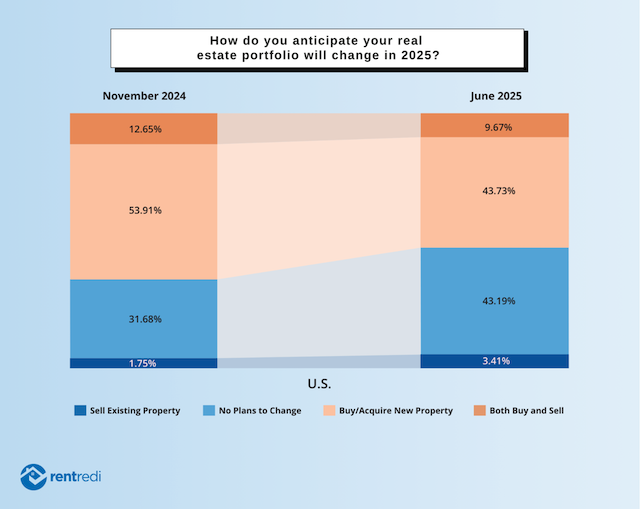

Between November 2024 and June 2025, the owner outlook modified notably. The proportion of landlords planning to purchase new properties dropped from 67% to 53%. These reporting no plans to alter their portfolio climbed from 32% to over 43%.

So, what does this imply? It indicators a strategic pivot: Somewhat than chasing enlargement, landlords are turning their consideration to optimization.

For rookies, it is a reminder that you just don’t want dozens of items to succeed. Even a small portfolio can carry out like an enormous one if you happen to maintain it working effectively.

What’s Stopping Landlords From Shopping for Extra?

When requested in regards to the largest obstacles to including new properties, landlords pointed to 2 main challenges (July 2025 survey, 1,756 respondents):

- Property costs (55%): The one largest barrier, with greater than half of respondents saying excessive acquisition prices are holding them again.

- Rates of interest (23%): Practically 1 / 4 of landlords say elevated financing prices are the rationale they’re urgent pause.

In brief, even motivated traders are discovering that present situations make acquisitions extra complicated and fewer engaging than up to now.

This indicators a possibility. Whereas many traders step again and sit on the sidelines, you possibly can strengthen your operations so that you’re ready to behave when offers return.

Oftentimes, traders scale too quick and neglect about asset administration of their enterprise mannequin. This is your likelihood to implement such a technique.

Asset administration includes monitoring and enhancing the efficiency of your present properties. Too usually, landlords assume development means extra doorways, however with out robust asset administration, each new property provides extra complexity, no more revenue.

Asset administration means monitoring revenue and bills carefully, recognizing methods to extend income, reducing pointless prices, and ensuring every unit is working at its full potential. Rookies particularly are likely to neglect this step, specializing in acquisitions as an alternative of optimization.

However in right now’s market, sharpening your asset administration expertise will be simply as highly effective as including one other property to your portfolio. One instance is getting quotes in your insurance coverage premium in your properties. Set a reminder to provide you with a warning forward of time when your coverage is about to run out. Store your coverage to get the perfect charge. This is one strategy to maintain money in your pocket.

A “Renovate and Optimize” Mindset

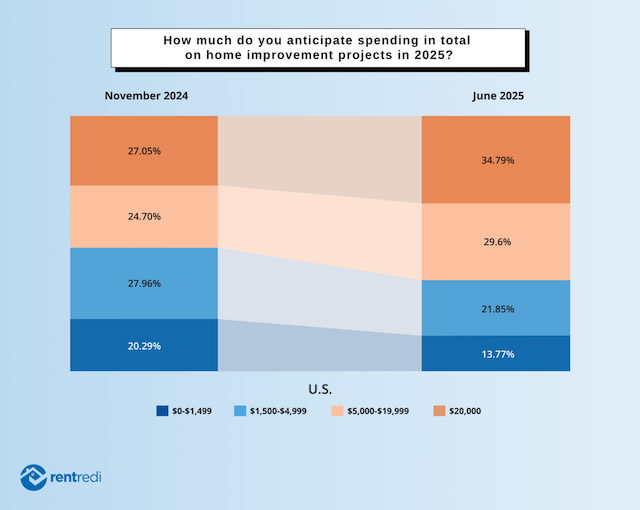

With acquisitions slowed, many landlords are discovering higher returns by reinvesting within the properties they already personal, similar to:

- Renovations that enhance rental worth

- Effectivity upgrades that lower prices

- Smarter and stronger techniques have gotten the go-to methods for bettering money circulation and tenant satisfaction.

Investing in rental properties includes extra than simply growing hire—it focuses on constructing long-term stability, enhancing tenant satisfaction, and fostering resilience by means of smarter property administration. This implies prioritizing components you possibly can management, like expertise that helps you keep organized.

For instance, when you’ve got a turnover at a property, it could be time to make use of your capital to tear out the carpets and put in luxurious vinyl plank, or improve the home equipment. These are simply two issues that may enhance the hire you cost in your property.

Regional Variations Stand Out

The RentRedi/BiggerPockets survey highlights notable regional variations because it pertains to funding intentions:

- Western U.S.: Landlords with no plans to alter their portfolios jumped 14 factors, from 39% to 53%.

- Northeast U.S.: This space continues to point out the strongest urge for food for acquisitions, with 57% of landlords planning to purchase extra property in 2025, outpacing the nationwide common.

These variations underscore the significance of tailoring funding technique to native market dynamics. What feels unimaginable in a single area should still be a powerful play in one other.

For traders contemplating long-distance investing, this regional knowledge can be a reminder that you just don’t must be locked into your native market. If offers aren’t penciling out the place you reside, you possibly can look elsewhere.

And if you happen to go for fashionable property administration software program, managing your leases from a whole lot (and even hundreds) of miles away is less complicated than ever. Platforms like RentRedi centralize communication and streamline hire assortment and digital signing of paperwork, like your lease agreements, whereas retaining upkeep requests organized so that you don’t have to be bodily on-site. This opens the door to alternatives in additional reasonably priced or higher-growth areas with out sacrificing oversight or peace of thoughts.

The Function of Expertise in a Shifting Market

When landlords have been requested what they needed to perform by leveraging instruments and assets of their rental enterprise, their solutions highlighted a transparent set of priorities.

For greater than one-third of respondents, the highest aim was growing income. About 30% stated their focus was on saving effort and time, adopted by reducing prices and growing property worth.

Environment friendly property administration is turning into much more important as landlords look to maximise returns with out including doorways. This is the place instruments like RentRedi are available. By automating hire assortment, tenant communication, and upkeep monitoring, landlords can focus extra vitality on sensible technique, profitable development, or just having fun with life outdoors managing leases.

By automating hire assortment, tenant communication, and upkeep monitoring, landlords unlock hours every week. These hours will be reinvested into technique, development, or just having fun with life outdoors of managing leases.

Ultimate Ideas

The actual property panorama in 2025 is shifting in the direction of strategic alternatives to boost money circulation. Landlords are specializing in portfolio optimization reasonably than fast acquisition.

Obstacles like property costs and rates of interest are actual, however they’re additionally prompting landlords to get sharper with techniques and techniques. This ought to be encouraging. You don’t must compete with massive traders shopping for dozens of items. As an alternative, you possibly can win by specializing in what you already personal by managing it smarter and leveraging instruments that maintain you organized and scalable.

Whether or not renovating, repositioning, or strategically buying properties, one factor is evident: success now depends on smarter administration, improved instruments, and adaptableness. The traders who succeed gained’t simply be these with essentially the most properties; they would be the ones managing their leases most successfully.