January 15, 2025

“Money poor” means having wealth in property however inadequate liquid cash out there for spending and saving.

A troubling report has revealed that borrowing prices for cash-poor People dwelling paycheck to paycheck are considerably larger than they anticipate to pay again. SoLo’s 2025 Money Poor Report reveals People paid greater than $39 billion in charges past the marketed Annual Proportion Price when borrowing cash from some monetary establishments to cowl unplanned bills.

In accordance with Experian, being “money poor” means having wealth in property however inadequate liquid cash out there for spending and saving. SoLo, the one Black-owned fintech licensed B Corp within the U.S. and Canada, says the figures in its report revealed a 32% enhance from 2023.

What’s much more alarming within the report is that cash-poor shoppers aren’t simply the working class. In addition they signify middle-class People with school levels, individuals who personal properties, and those that think about themselves buyers. Money-poor shoppers embody People who’ve six-figure incomes.

“One in seven cash-poor People makes over $75,000 a yr,” the report from SoLo reads. “Troubling traits present that almost half of People dwelling paycheck to paycheck have lower than $200 Of their checking and financial savings accounts.”

SoLo analysts, in partnership with Opinium Analysis, Tempo College, the World Black Financial Discussion board, Aspen Institute, Monetary Safety Program, and the Impartial Ladies’s Discussion board, surveyed 2,000 American adults spanning Gen Z, millennials, Gen X, boomers, and the Silent Technology. Their knowledge in contrast charges as a proportion of a $1,000 mortgage.

The Finest and Worst Choices For Money Poor People, In accordance with Report

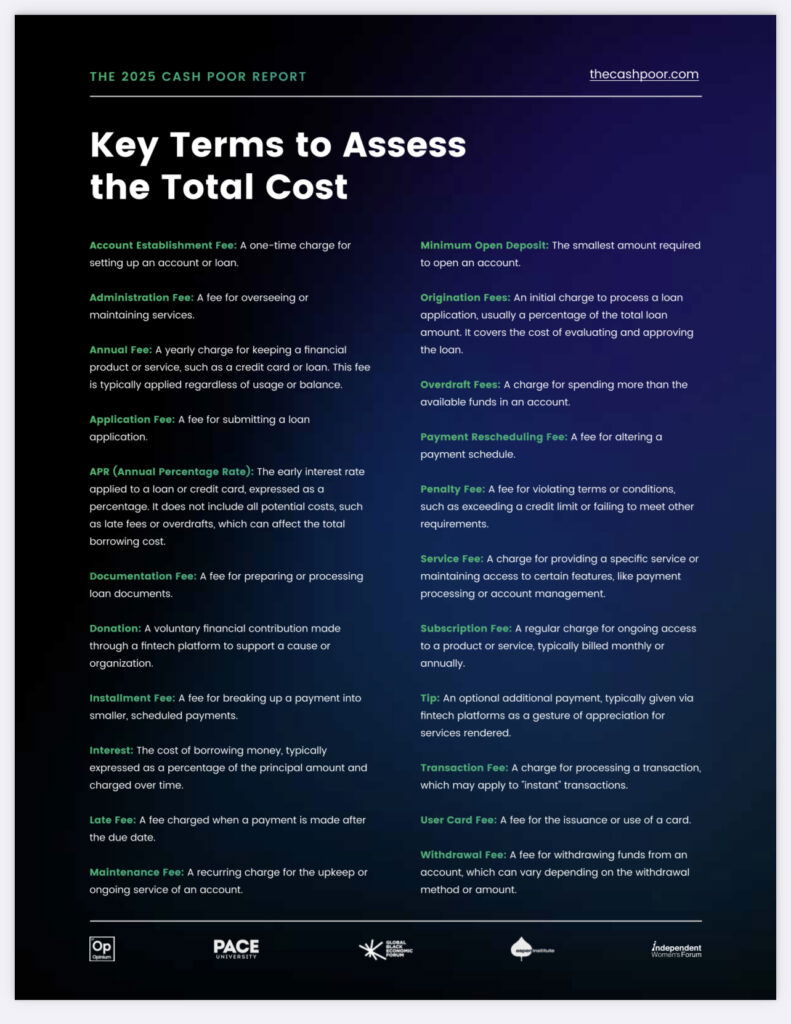

In accordance with the report, the APR charge doesn’t embody late charges, origination charges, subscription charges, transaction charges, or different bills that create what analysts name “debt traps” for shoppers in a monetary disaster.

The info reveals that subprime bank cards are the most costly choice for unplanned bills. The common value elevated to 48%, up from 41% in 2023. Due to excessive complete charges, penalties, and month-to-month upkeep charges, the utmost charges can attain 90% of the principal borrowed.

“These playing cards account for $19.6 billion in combination borrowing prices in 2024, marking an $8 billion enhance from final yr,” in keeping with the report.

Payday loans have the best minimal borrowing value amongst all choices. Most prices attain 67% because of origination charges, late charges, and penalties. In accordance with the report, combination prices for payday loans elevated to $6.7 billion in 2024 from $6.2 billion in 2023.

Financial institution small-dollar loans are a comparatively new providing that emerged final yr. It had the third-highest prices, simply behind subprime bank cards and payday loans. Nonetheless, there are vital obstacles to entry.

“They averaged a 25% borrowing value this yr, with a minimal charge of 12%, largely because of obligatory account stability and deposit necessities,” the report says.

Mixture prices for financial institution small-dollar loans are estimated at $5.8 billion in 2024.

Earned wage entry options provided one of many lowest common borrowing prices this previous yr at 13%. Nonetheless, charges can rise to 26% because of optionally available tipping and transaction prices.

Mixture borrowing prices for payroll advances elevated to $3.8 billion in 2024, up from $3.2 billion in 2023.

Peer-to-peer loans, or P2P loans, like these provided by SoLo, remained essentially the most inexpensive choice concerning combination borrowing prices. They totaled simply $1 billion in 2024, down from $1.3 billion in 2023.

Borrowing will be free for disciplined customers who pay on time, however common prices because of suggestions and late charges can attain as much as 17%.

“Being cash-poor is a lifestyle for many People,” stated Rodney Williams, president and co-founder of SoLo, who says this lifestyle creates vulnerability in managing variable and unplanned bills.

“The vulnerability isn’t the time for an absence of choices however relatively a chance for innovation and competitors. We wish Congress and regulators to embrace innovation and permit extra handy and accessible frameworks given the identical taking part in discipline as conventional monetary establishments,” he provides.

Learn the total report at www.theCashPoor.com

RELATED CONTENT: SNAP Will increase Revenue Eligibility Necessities