MIDiA has simply launched its annual recorded music market shares report. Listed here are some highlights from the report.

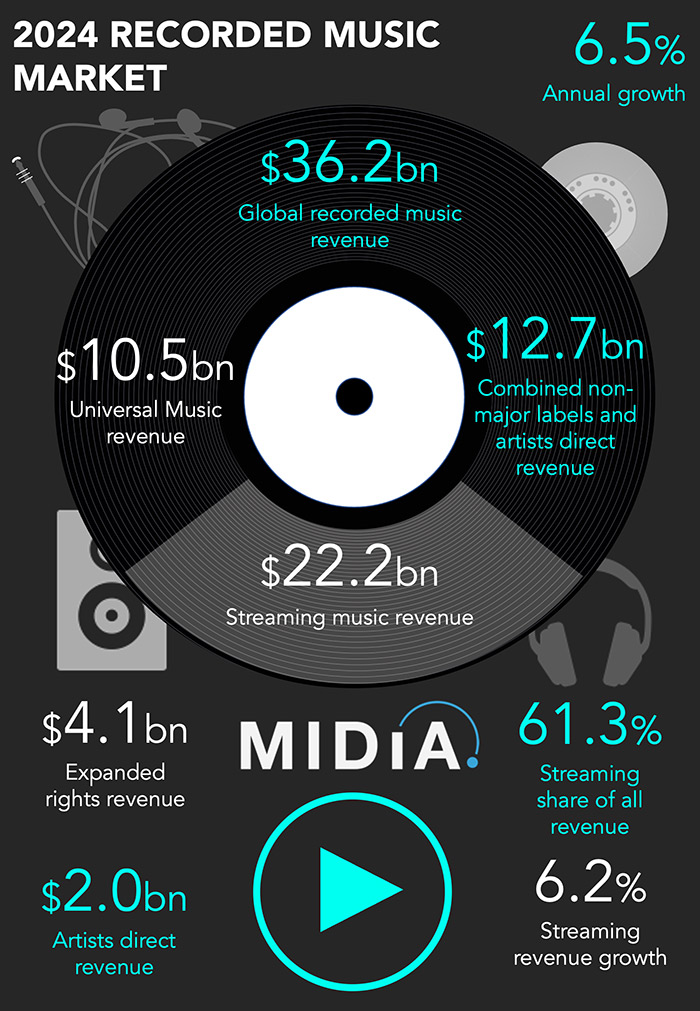

International recorded music progress has oscillated by the 2020s and 2024 continued that sample, up 6.5% to $36.2 billion after 9.4% progress in 2023 (excluding expanded rights, the whole was $32.1 billion). On condition that the primary half of the 2020s was characterised by international upheaval and uncertainty, formed by components such because the pandemic and rising inflation and rates of interest, 6.5% progress was no small achievement. However international disruption is just not going away – 2025 has to date picked up the baton and sprinted with it. The music enterprise goes to should get used to working in difficult international circumstances, even earlier than contemplating a rising catalogue of disruptive trade particular developments comparable to bifurcation, the rise of the International South, and a fast-maturing streaming market.

Streaming nonetheless dominates revenues, however its influence is lessening. For the primary time ever, its share of whole revenues declined barely in 2024, down from 61.5% to 61.3%, with streaming rising barely slower than the whole market to succeed in $22.2 billion. Streaming is not the market maker. Its contribution to whole market progress was down by greater than a fifth in comparison with 2022. The streaming income slowdown has been on the horizon for a few years and – regardless of value will increase – it has now arrived, a minimum of within the West. Not all Western markets slowed to the identical diploma however some grew beneath the speed of inflation regardless of value will increase being above the speed of inflation. Tremendous premium can’t come quickly sufficient.

On high of this, bodily was down -4.8%, carrying on its very personal 2020s yo-yo progress sample (up, down, up, down). So the place did all the expansion come from? ‘Different’ – i.e. efficiency, sync, and expanded rights. Expanded rights (merch, and so forth.) had been as much as $4.1 billion, reflecting the recorded music companies success in monetizing fandom. ‘Different’ as an entire was up 17.3%, whereas Sony Music pulled up a forest of bushes, seeing its ‘different’ income up by 38.6% in 2024.

In reality, Sony Music had a superb 12 months all spherical. UMG remained comfortably the world’s largest label with revenues of $10.5 billion however for the second successive 12 months, Sony Music Group (SMG) was the quickest rising main label, rising revenues by 10.2% to develop market share 700 foundation factors to 21.7%. SMG was the quickest rising main label within the first half of the last decade, rising by a complete of 73.9% between 2020 and 2024. The one different market constituent to develop share was non-major labels, as much as 29.7% market share. In the meantime, Artists Direct (self-releasing artists) felt the pinch of latest royalty buildings, with revenues slower than the market to succeed in $2.0 billion. That is although the variety of self-releasing artists grew by 17.2%, with Chinese language streaming providers Tencent and NetEase seeing notably sturdy progress. Streaming income is not an efficient measure of the influence of the lengthy tail.

One of the necessary market developments, nevertheless, is the rising hole between DSPs and labels and distributors. Streaming providers are each rising income sooner than rightsholders and are widening the expansion hole. DSPs grew income 3 times sooner than labels in 2024 and the speed of progress was up three years working. Regardless of working inside tightly set rightsholder constraints, DSPs are studying methods to enhance margin by a various mixture of techniques together with content material combine (e.g., podcasts, audiobooks), buying cheaper music (e.g., manufacturing libraries, unique commissions, generative AI), licensing reductions (e.g., audiobook bundles) and charging labels for entry to audiences (e.g., Spotify Discovery Mode).

All in all, it was a strong 12 months for the recorded music market, however with warning indicators: labels usually are not maintaining tempo with DSP progress, and regardless of maintaining the lengthy tail of Artists Direct quiet with new licensing buildings, extra artists than ever are selecting to launch with out labels. Ultimately they (and smaller indie labels) will take heed of the ‘you aren’t welcome right here’ signal on streaming’s door and construct their audiences elsewhere. This can be a short-term win for larger labels, however long-term danger, with this new lane being the place a lot of tomorrow’s tradition can be made. In case you forgot, Bifurcation is coming.