There are various nice causes to remain at unbiased lodges and trip leases. Sadly, the convenience of incomes rewards on these stays isn’t one in all them — or so that you would possibly assume. Over time, I’ve loved a wide range of unforgettable stays and picked up a number of tips to maximize my financial savings and rewards on them. This is what I’ve realized.

Associated: Finest lodge rewards packages on the planet: Which one is best for you?

Why I really like unbiased boutique lodges

Typically I keep at unbiased boutique lodges or trip leases out of necessity — possibly the small mountain city I am visiting does not have any chain lodges, or my good friend group wants extra space and may save large bucks by splitting an Airbnb. Different occasions, I select unbiased lodges due to the distinctive facilities and experiences they supply.

As an example, I as soon as spent an evening outdoors Mount Rainier Nationwide Park in a cabin with an genuine Ukrainian restaurant and “cannibal” sizzling tub heated by a wooden hearth. One other memorable keep was at a Kyoto ryokan full with a seven-course Japanese meal and an in-room onsen. I additionally spent every week in an Airbnb in Paris, which gave me extra of a glimpse into “actual” Parisian life than I might get at a factors lodge within the prime vacationer neighborhood.

The draw back is that there are normally no elite advantages or factors to be earned at these properties. Fortunately, I’ve nonetheless discovered loads of methods to maximise my journey once I keep at unbiased lodges and trip leases.

Associated: The right way to use factors to e-book trip residence leases

How I get monetary savings on unbiased lodge stays

It’s attainable to redeem rewards for stays at unbiased lodges, corresponding to by reserving with factors or miles via a bank card journey portal. However since this does not present nice worth for my rewards, I normally e-book these stays with money and deal with attempting to save cash.

Use bank card journey credit

I maintain the Chase Sapphire Most popular® Card, which supplies an annual $50 lodge credit score for properties booked via Chase Journey℠, and the Capital One Enterprise X Rewards Credit score Card, which supplies a $300 journey credit score for flights and stays booked via Capital One Journey. Each of those are available in very useful once I e-book unbiased lodges.

As an example, I just lately used my Enterprise X credit score on a two-night keep at a bed-and-breakfast within the Wicklow Mountains outdoors of Dublin (no factors lodges there) and a rental automobile to get there. After my $300 credit score was utilized, I spent a grand whole of $4 on my two-day mountain climbing journey.

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Listed here are another playing cards with journey credit you can put towards stays at unbiased lodges:

Earn money again with purchasing portals

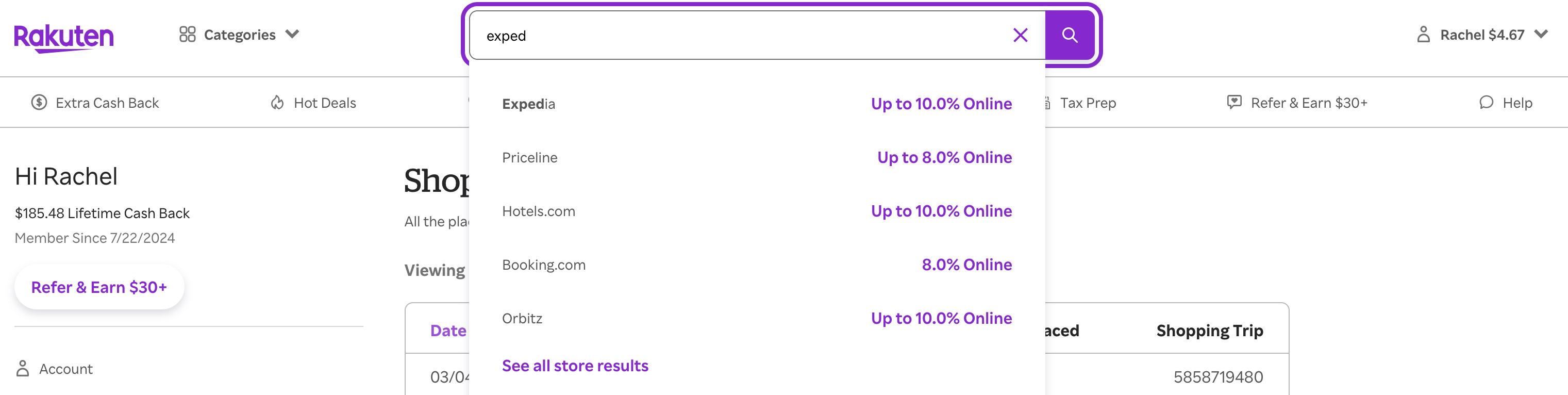

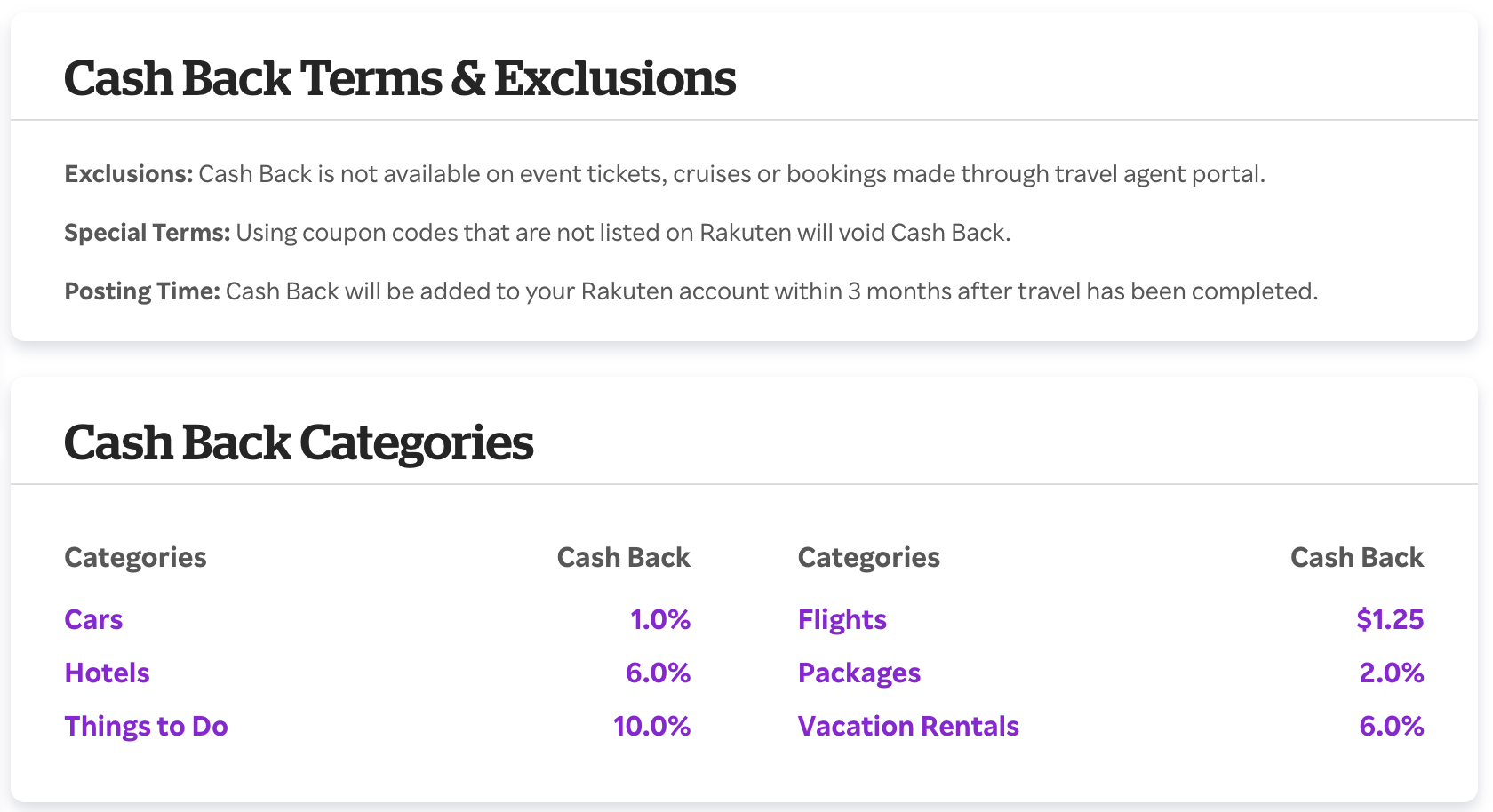

I really like utilizing purchasing portals to earn money again on my on a regular basis purchases. However they are not only for retail purchasing — you may earn money again at many hotel-booking platforms, like Reserving.com, Accommodations.com, Expedia, Priceline, Orbitz and Tripadvisor.

Although reward charges range from everyday, they usually aren’t too shabby. On the time of writing, Rakuten was providing as much as 10% money again at a few of these websites.

Nevertheless, it is necessary to learn the wonderful print on Rakuten earlier than you determine which web site to e-book via. On this instance, Rakuten is providing 6% again on lodges and trip leases however just one% again on automobiles and a measly $1.25 again on flights.

Vacationers who maintain a card that earns Amex Membership Rewards factors can get further worth out of Rakuten by switching their incomes desire to Amex factors as a substitute of money again.

Different purchasing portals to contemplate embrace Extrabux, Mr. Rebates and TopCashback. You may as well generally discover hotel-booking websites on airline purchasing portals and bank card portals like Capital One Purchasing. A purchasing portal aggregator like Cashback Monitor may help you notice which portals supply the perfect returns on your buy.

Seek for offers

Earlier than I e-book a keep, I at all times verify a number of websites as a result of costs can range broadly. As an example, a part of my current journey to Dublin concerned spending two nights within the metropolis with my husband and a good friend. We needed an residence with room for the three of us, however most Dublin Airbnbs required a four-night minimal keep. I settled on an apartment-style lodge with a number of bedrooms and a kitchen that was working a sale for 10% off on direct bookings — saving me roughly $100 on our keep.

Value is not the one factor I examine from one web site to a different. I take a look at cancellation insurance policies too, and I usually prioritize reserving via a web site with a versatile cancellation coverage, even when it prices slightly extra. That method, if my plans change or I discover a higher charge later, I can cancel free of charge and rebook.

Associated: When plans go unsuitable: Your information to reserving refundable journey

How I maximize rewards on unbiased lodge stays

The extra factors I can earn on a lodge I booked with money, the earlier I can redeem these factors for my subsequent free flight or Hyatt keep.

Earn transferable factors with bank card journey portals

Many widespread journey playing cards supply portals via which you’ll be able to e-book lodges, flights, rental automobiles and extra — and earn bonus factors on these purchases. The variety of factors you may earn will depend on which card you maintain, however it’s usually 5 or extra factors per greenback spent.

For instance, I can earn 10 Capital One miles per greenback spent on lodges booked via Capital One Journey once I pay with my Capital One Enterprise X Rewards Credit score Card. And I can earn 5 Chase Final Rewards factors per greenback spent on lodges I e-book via Chase Journey with my Chase Sapphire Most popular Card.

Different playing cards that earn bonus rewards on their respective reserving platforms embrace:

Since I am not loyal to anybody lodge program, incomes transferable factors is extraordinarily invaluable to me. I can switch my Chase factors to Hyatt or Marriott, for instance, or switch my Capital One miles to Selection or Wyndham, relying on which lodge chain makes probably the most sense for my journey.

Associated: How (and why) it’s best to earn transferable bank card factors

Earn further miles with airline reserving platforms

Most airline reserving platforms supply subpar incomes charges. Nevertheless, I really like Southwest Accommodations as a result of you may earn as much as 25 factors per greenback spent on choose properties, so I at all times search right here first.

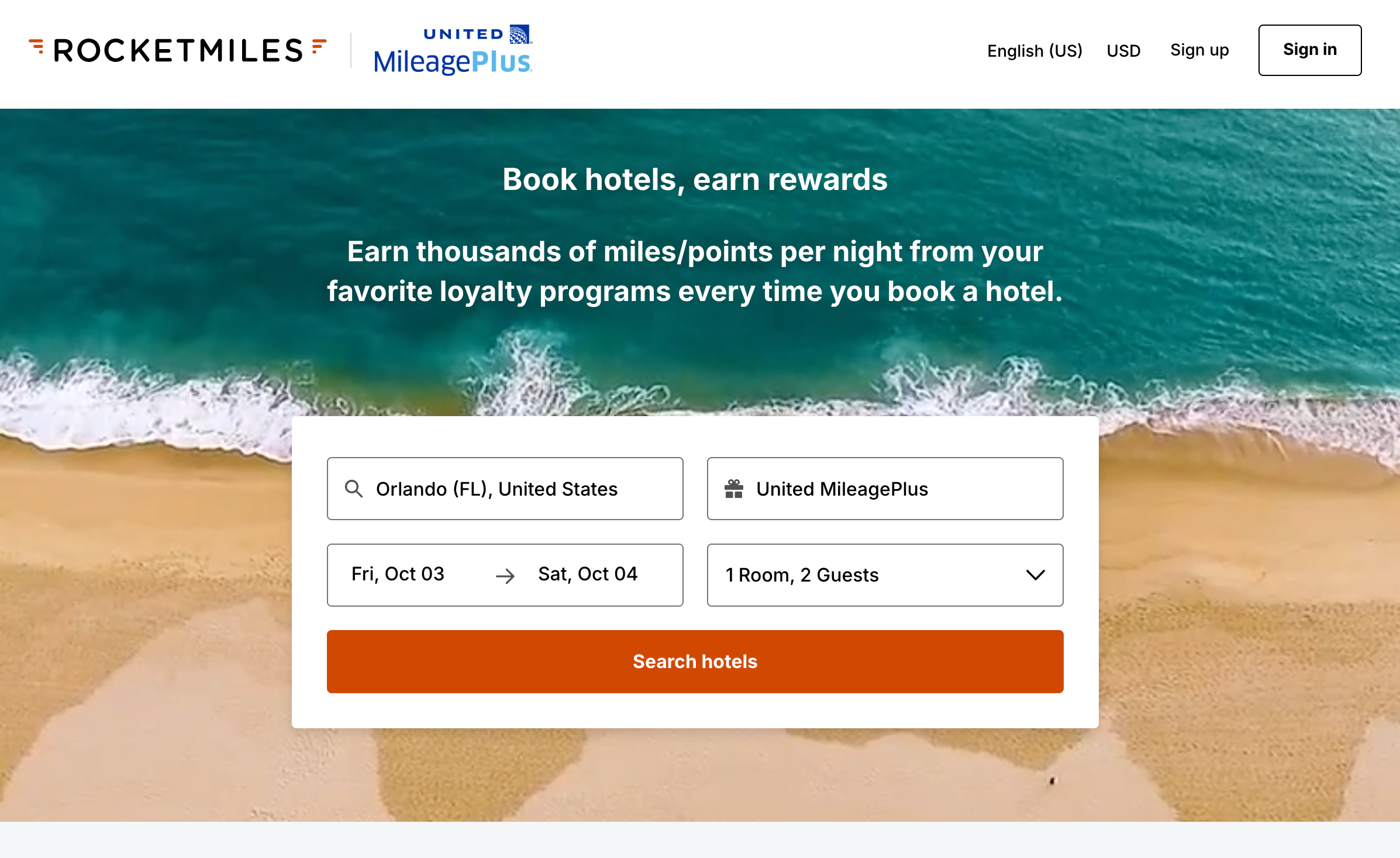

Rocketmiles works equally however helps you to select which rewards to earn from an extended record of airline loyalty packages, together with Alaska Airways Mileage Plan, Air France-KLM Flying Blue and United MileagePlus.

Earn airline miles on trip leases

Trip leases could also be slightly behind the occasions on the planet of factors and miles, however this does not imply you may’t earn any invaluable rewards in your subsequent residence away from residence.

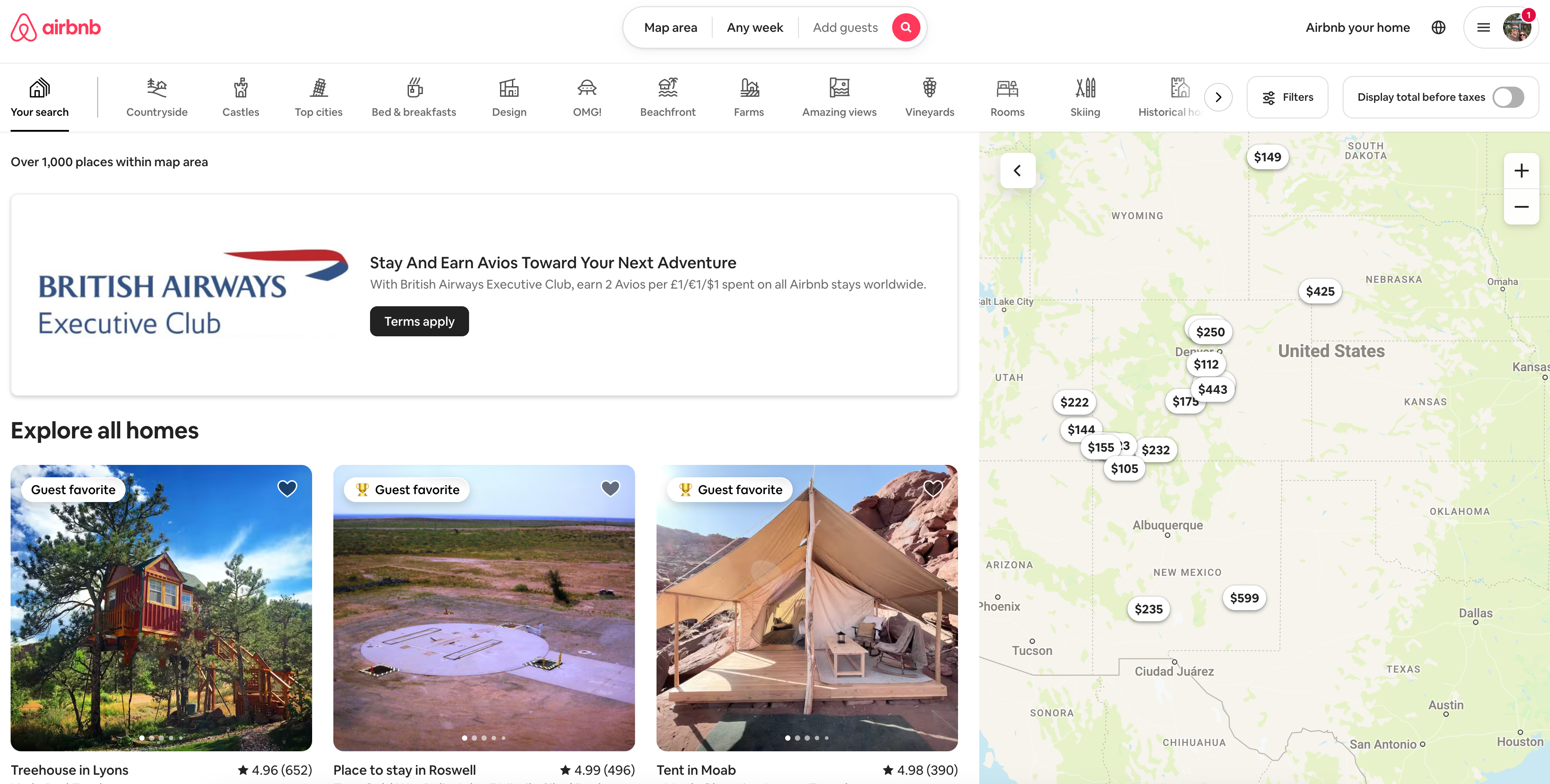

I’ve arrange my Airbnb account to earn British Airways Avios by getting into my frequent flyer quantity right here.

That is as a result of I can earn 2 Avios per greenback spent on Airbnb bookings, and I’ve discovered Avios helpful for reserving worldwide flights out of Denver. Nevertheless, you may as well choose to earn 1 Delta Air Strains SkyMile per greenback or 1 Qantas level per Australian greenback ($0.64) spent on Airbnb bookings. Select the foreign money that is most respected to you.

If you happen to favor Vrbo, you may earn 3 United Airways miles per greenback spent on Vrbo leases if you e-book via this web page along with your MileagePlus quantity.

Associated: The right way to earn money again or factors when reserving Airbnbs, Vrbo leases, hostels and extra

Earn free journey with One Key

Launched in 2023, Expedia’s One Key is a comparatively new loyalty program for Expedia, Accommodations.com and Vrbo. Members cannot solely save 10% on stays booked via these websites but in addition earn OneKeyCash to spend towards lodges, flights, rental automobiles and extra ($1 in OneKeyCash saves you $1 on purchases via these websites).

Since OneKeyCash is redeemed at a flat charge, you will not get the outsize worth that you could possibly with different lodge loyalty packages’ award charts and candy spots. Nevertheless, One Key’s simplicity may very well be a draw for some vacationers, particularly since you can select from the large number of lodges on three completely different websites.

Though I normally find yourself reserving via a bank card portal as a substitute, I am very intrigued by the One Key loyalty program, and I am contemplating including a One Key bank card to my pockets. I am additionally anxiously awaiting the day when Airbnb comes out with a cobranded bank card.

Which bank card do you have to use to e-book unbiased lodges?

If I can e-book a lodge via a bank card portal corresponding to Chase Journey or Capital One Journey, I at all times use the relevant card to earn bonus factors. It is a no-brainer.

However generally I have to e-book a lodge instantly to be able to get a deal, or I need to keep in an Airbnb, which is not out there on any platform mentioned above. Although it’s attainable to redeem factors for Airbnb reward playing cards, corresponding to redeeming my Chase Final Rewards factors at 1 cent per level, that is far under TPG’s March 2025 valuation of Chase factors and does not get me the perfect worth for my factors.

Due to this fact, my finest guess is to e-book with a card that earns bonus rewards on journey purchases — however that is not the one factor I take into account.

Remember that many journey playing cards include built-in journey insurance coverage. If you find yourself canceling a nonrefundable lodge reserving, these perks can put numerous {dollars} again in your pockets. And for those who’re reserving a lodge overseas, be sure you pay with a card with no overseas transaction charges.

For me, this implies I e-book most unbiased lodges with my Chase Sapphire Most popular. This card gives journey safety and no overseas transaction charges, and it earns 2 Final Rewards factors per greenback spent on all journey purchases plus a ten% factors increase each account anniversary. Since Chase factors are value 2.05 cents apiece primarily based on TPG’s March 2025 valuations, that is a 4.5% return.

Different playing cards that supply bonus earnings on journey embrace:

Backside line

There are many methods to save cash and maximize your rewards on unbiased lodges and trip leases. It could take slightly further effort to sift via these choices, however it’ll repay in the long term.

Plus, I really like the range unbiased lodges supply. Since there are such a lot of selections, you are sure to search out one thing distinctive and excellent to make for a memorable journey.

For charges and charges of the Bilt Mastercard, click on right here.

For rewards and advantages of the Bilt Mastercard, click on right here.

TPG founder Brian Kelly is a Bilt adviser and investor.