Giant holders of Ethereum, additionally referred to as Ethereum whales, have been on an accumulation development for some time now, with on-chain knowledge revealing an interesting improve of their collective holdings. Significantly, knowledge from blockchain analytics agency IntoTheBlock exhibits that Ethereum whales now maintain about 43% of the full circulating provide of ETH.

The imbalance in ETH holdings raises necessary questions on its implications for Ethereum’s worth and market dynamics shifting ahead.

Whale Accumulation Surges By Over 90% Since Early 2023

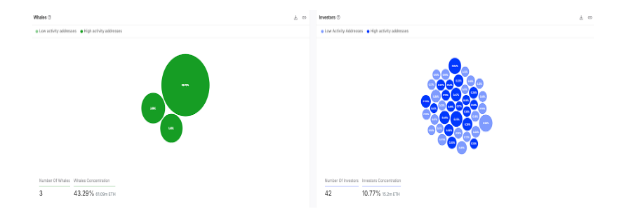

In accordance with IntoTheBlock, the full focus of ETH in whale addresses is at present at 61.09 ETH, which represents about 43% of the full provide. This marks a big shift from early 2023, when whales held simply 22% of Ethereum’s circulating provide. IntoTheBlock classifies whale addresses as these holding greater than 1% of the full circulating provide of ETH.

Associated Studying

The practically twofold improve in Ethereum whale holdings inside only a 12 months is a noteworthy improvement. Naturally, such a focus of a giant provide of cryptocurrency into just a few wallets would spell doom for the asset, as it might imply just a few gamers would be capable to manipulate worth dynamics as they want. Nonetheless, Ethereum’s case deviates from this narrative because of the distinctive nature of its ecosystem and up to date structural shifts throughout the community since 2022.

The sharp rise in whale focus might be attributed to 2 main elements: the Ethereum merge and the rising attraction of ETH staking to earn rewards. The Ethereum merge, which came about in 2022, transitioned the blockchain from a proof-of-work (PoW) system to a proof-of-stake (PoS) mechanism.

As such, in-depth knowledge from IntoTheBlock, which exhibits the 61.09 million ETH concentrated in solely three whale addresses, makes a lot sense.

What this implies is that these ETH are largely these locked within the proof-of-stake staking algorithm utilized by block validators on the Ethereum community. By locking up their Ethereum, ETH miners and huge holders haven’t solely decreased the circulating provide but in addition contribute to cost appreciation by decreasing the quantity of Ethereum accessible for buying and selling.

Ethereum Holder Dynamics – Buyers And Retailers

The rise in ETH amongst whale addresses has meant much less ETH is out there for buyers and retail house owners. IntoTheBlock classifies buyers as addresses holding between 0.1% and 1% of the full circulating provide, whereas retail are these with lower than 0.1% of the full circulating provide.

On the time of writing, there are 42 investor addresses they usually collectively personal 15.2 million ETH, which interprets to 10.77% of the full circulating provide. Protecting in thoughts that the three whale addresses don’t do a lot with worth dynamics, investor addresses holding vital however extra liquid parts of ETH have a larger capability to have an effect on market actions. Any substantial selloff from these investor addresses may set off a pointy decline in Ethereum’s worth.

Associated Studying

Then again, retailers, which represent over 99% of ETH addresses, are left with 46% of the full circulating provide. On the time of writing, Ethereum is buying and selling at $3,225 and is down by 2% prior to now 24 hours.

Featured picture from Pexels, chart from TradingView