Ethereum spot exchange-traded funds (ETFs) have logged 16 consecutive days of optimistic day by day inflows, renewing optimism for ETH’s potential new all-time excessive (ATH) within the coming weeks. Nevertheless, for ETH to achieve this milestone, it should surpass the important resistance stage of $4,000.

Ethereum Spot ETFs Attracting Constant Inflows

In keeping with information from SoSoValue, Ethereum spot ETF inflows have remained persistently optimistic since November 22. The cumulative web inflows complete $2.32 billion, with a big $1.5 billion added between November 22 and December 16 alone.

Associated Studying

Breaking it down by weekly inflows, the week ending December 13 noticed web inflows of $854.85 million, intently adopted by $836.69 million through the week ending December 6. Furthermore, the full web belongings held by Ethereum ETFs have climbed to $14.28 billion, which represents roughly 2.93% of ETH’s complete circulating provide.

Grayscale’s Ethereum Belief (ETHE) ranks as the most important holder with $5.87 billion in web belongings, adopted by Blackrock’s iShares Ethereum Belief (ETHA) with $4.02 billion. These sturdy inflows into Ethereum ETFs have bolstered bullish sentiment, with Ethereum bulls anticipating a potential rally to a brand new ATH for the second-largest cryptocurrency by market cap.

Crypto analyst Momin Saqib took X to share his ideas on ETH value motion. The analyst famous that ETH seems to be poised to interrupt via the native highs of the $4,000 vary and is eyeing the $4,500 value stage. He added:

Ethereum inflows have been coming in continuous for the previous few weeks! After seeing $BTC at $107K…. I feel establishments don’t have a lot choices left to guess on increased upside of crypto trade! Increased!

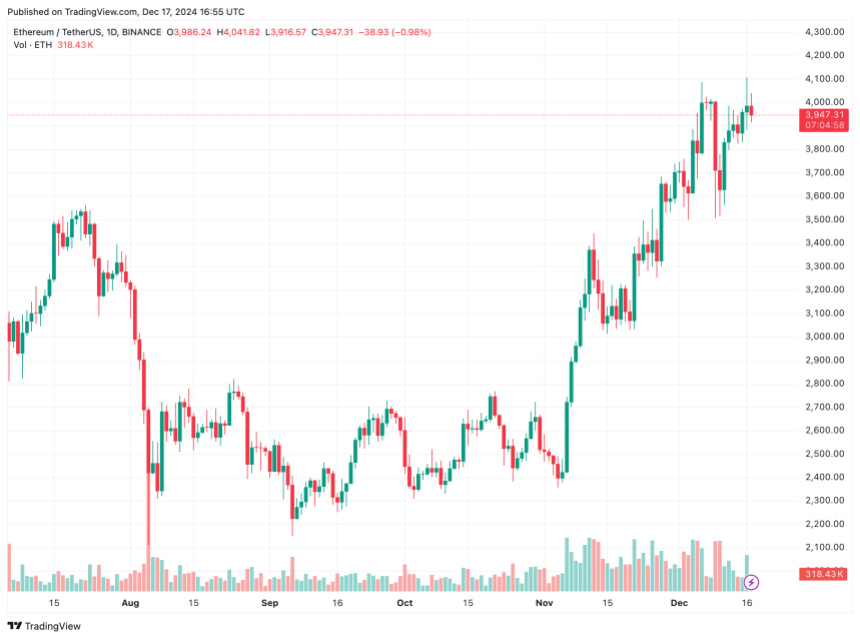

Ethereum’s weekly chart, the digital asset has made 4 vital makes an attempt to interrupt via the $4,000 resistance stage. Whereas it briefly surpassed this stage throughout its second try, creating its present ATH of $4,878, it finally proved to be a false breakout, adopted by a protracted bear market over the following two years.

Analyst Rekt Capital famous that ETH’s post-breakout retest of the $3,100 value stage was profitable, propelling the cryptocurrency again into the $4,000 zone. They highlighted that ETH has held above the $4,000 zone as assist for the second consecutive week, a key growth that would pave the way in which for additional upward momentum.

Regardless of The Potential Upside, ETH Merchants Stay Cautious

Whereas strengthening fundamentals, bullish technical indicators, and protracted ETF inflows paint a optimistic image for Ethereum, some analysts stay cautiously optimistic about ETH’s short-term value motion.

Associated Studying

As an illustration, analyst CryptoBullet emphasised that ETH might even see a fast wick to $3,700 earlier than rebounding. The analyst added that ETH’s potential to carry above key resistance ranges signifies its sturdy bullish momentum.

One other issue doubtlessly dampening short-term optimism is Justin Solar, founding father of Tron (TRX), who just lately unstaked $208 million value of ETH from Lido Finance. This transfer has raised considerations about potential promoting stress. ETH trades at $3,947 at press time, down 0.2% up to now 24 hours.

Featured picture from Unsplash, Charts from SoSoValue, X and TradingView.com