The hope of an Ethereum upsurge is fading because the primary altcoin worth dropped considerably inside the final 4 days. Between 20 and 23 October the ETH worth fell by 9.6% after dealing with a rejection on the $2,700 resistance stage. That worth dip erased Ethereum positive factors accrued inside the final 10 days. At this level, the value of ETH has stabilized across the $2,500 stage.

On the time of writing, ETH is buying and selling at $2,519 ETH/USDT at Gate.io alternate. Nevertheless, its worth dropped by 2.2% inside the final 24 hours. The yearly chart, although, exhibits that it has gained by round 37.2%. Inside the final earlier week its worth decreased by 3.82% regardless of an increase in its buying and selling quantity. The next graph exhibits ETH’s worth motion inside the final 7 days.

Ethereum Value Motion – CoinMarketCap

As seen on the picture, the present ETH worth downtrend began on 10 October and is about to proceed. It’s nonetheless exhibiting a lot bearish stress.

Causes for ETH Value Decline

The opportunity of an ETH rebound above $2,800 is diminishing as there may be low optimism in its market. There may very well be various causes for the poor efficiency of the primary altcoin. Nevertheless, the best contributor to the Ethereum poor market efficiency is prone to be its excessive transaction charges. The exorbitant transaction charges are forcing crypto buyers to spend money on different altcoins akin to Solana, BNB and Cardano (ADA). After all, the listing of enticing cryptocurrencies is rising by day. As an illustration, FET, SEI, TON, NOT and WLD are performing comparatively higher than ETH.

Ethereum’s previous worth efficiency is affecting its present market exercise as nicely. For instance, the latest drop in Ethereum market capitalization is one other contributing issue to its worth drop. It is because a lower in its market cap has generated pessimism among the many buyers. For instance, between 22 and 23 October ETH market capitalization fell by 5%. And within the final 24 hours, it fell by 2.32% , exacerbating the already dire scenario.

Congestion on the Ethereum community can be contributing to its poor market efficiency. What’s making the scenario worse is that the builders are taking a lot time to resolve the challenges that the customers have been experiencing for a very long time. Thus, the buyers are relocating their funds to extra user-friendly blockchains akin to Solana, Polygon, Avalanche and Arbitrum. Though the cited challenges don’t have an effect on sensible buyers in a major method they’ve an important impact on these utilizing it on a day-to-day foundation akin to merchants.

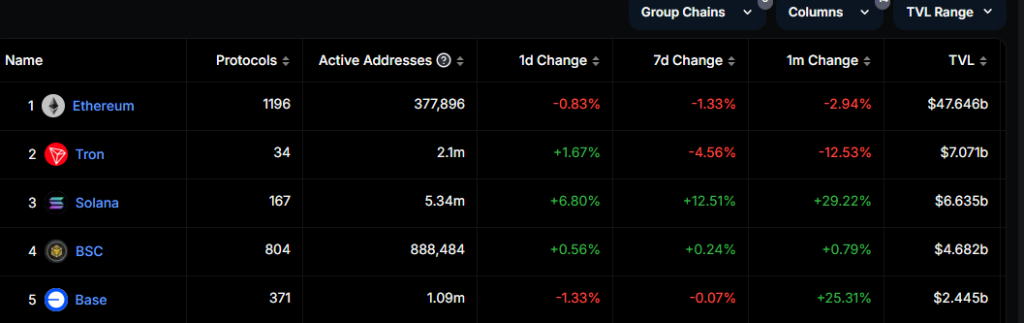

For example the decline in community exercise on Ethereum, we are able to examine it to what’s occurring on different blockchains akin to Solana and Binance Chain. Knowledge on Defilama exhibits that Solana recorded $13.4 billion in quantity over the last 7 days. That was a whopping 67% greater than Ethereum buying and selling quantity throughout that interval. Additionally, Solana’s whole worth locked is rising as the following image exhibits.

Solana Whole Worth Locked – Defilama

Whereas, the entire worth locked on Solana is rising Ethereum’s TVL is reducing. This clearly exhibits the challenges that the Ethereum blockchain is dealing with. The subsequent graph exhibits the present pattern of the Ethereum whole worth locked.

Ethereum Whole Worth Locked – Defilama

By comparability the Ethereum TVL elevated by a smaller proportion than the Solana’s. And that’s not all. Different blockchains like Binance Chain and Avalanche have been performing higher than ETH in numerous methods. Extra considerably, the buying and selling quantity of decentralized exchanges that exist on the Ethereum blockchain has been reducing as nicely. For instance, in the course of the 7-day interval ending on 23 October the buying and selling quantity of those DEXes decreased by 13%. That adopted a major drop of buying and selling volumes on Curve Finance and Uniswap, each working on the Ethereum community.

The lower in a community’s whole worth locked might create a lot unfavourable sentiment amongst its customers. Particularly, a discount within the variety of depositors exhibits a unfavourable improvement in its provide and demand dynamics. This turns into direr if the validators are unstaking their ETH. There are different metrics that present Ethereum’s poor efficiency. As an illustration, Ethereum has skilled a decline within the variety of lively addresses.

Adjustments in Energetic Addresses – Defilama

Now we have mentioned a number of metrics that present that Ethereum will not be performing as anticipated. That is likely to be contributing to its present bearish stress.

Ethereum Value Evaluation

ETH has been dealing with a lot resistance round its descending channel. This has pressured its worth to repeatedly decline inside the previous few days. As of 24 october, the ETH worth dropped beneath its 50-day Exponential Transferring Common (EMA) at $2,564. That may have confirmed the rise in promoting exercise. The present worry is that if the vendor’s exercise stays excessive its worth might fall additional to $2,461. Alternatively, if it rebounds above the 50-day EMA it might head in the direction of $2,820, its 24 August excessive.

As of now, ETH has damaged the ceiling of the falling channel. Which will point out a decelerate of the downward pattern. Nevertheless, the likelihood of a continued worth fall is excessive.

Ethereum Value Motion – Investtech

As noticed on the graph, the ETH worth has gained barely to interrupt above the trendline. The quick time period bullishness it has proven is supported by its Relative Power Index which is rising. The RSI has a present studying of 58. Contemplating ETH’s efficiency inside the previous 7 days, its worth rise above the trendline might transform a false escape .

Gate.io P2P: Empowering Accessibility for Ethereum

One of many vital methods Gate.io has enhanced Ethereum’s accessibility is thru its Peer-to-Peer (P2P) buying and selling platform. The Gate.io P2P service allows customers to commerce Ethereum and different cryptocurrencies instantly with each other utilizing their native foreign money, eliminating the necessity for intermediaries. This characteristic gives a seamless and cost-effective answer for customers throughout completely different areas, particularly in nations with restricted entry to conventional monetary techniques.

Gate.io P2P’s integration into the Ethereum ecosystem is especially useful during times of market volatility. By providing aggressive charges and safe transactions, it permits buyers to enter or exit Ethereum positions rapidly. Moreover, the platform’s escrow mechanism ensures that transactions are secure and clear, constructing belief amongst customers.

As Ethereum faces challenges like excessive transaction charges and congestion, Gate.io P2P gives an alternate pathway for customers to accumulate ETH with out incurring hefty community charges. This ease of entry may play a vital position in sustaining person engagement and supporting Ethereum’s broader adoption regardless of its ongoing struggles.