A enterprise financial institution assertion is an official monetary doc issued by a financial institution that data all transactions made inside a particular timeframe. It offers a complete view of your small business’s monetary exercise — together with deposits, withdrawals, financial institution charges, and checks cleared.

On this information, I’ll go over a enterprise financial institution assertion’s key parts, present a enterprise financial institution assertion instance, and talk about the advantages of monitoring your statements successfully.

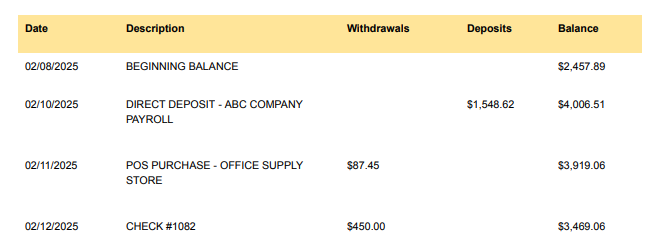

Enterprise financial institution assertion instance

By analyzing a enterprise financial institution assertion pattern, you possibly can acquire insights into your small business’s monetary well being, establish discrepancies, and make knowledgeable choices about operations. Through the years, I’ve helped many companies with questions on their financial institution statements.

Beneath is an instance of a enterprise financial institution assertion for example how monetary information is organized.

Key parts of a enterprise financial institution assertion

With so many alternative sections on a financial institution assertion, understanding every is useful. Beneath is a breakdown of the important thing elements.

1. Heading

- Assertion interval

- Assertion date

- Enterprise title

- Truncated account quantity

2. Abstract of account exercise

- Starting steadiness: The steadiness in the beginning of the assertion interval

- Whole deposits: The sum of all incoming funds

- Whole withdrawals and debits: The sum of all outgoing transactions

- Service price: Any extra charges charged through the assertion interval

- Curiosity earned: These are paid dividends

- Ending steadiness: The steadiness on the finish of the interval

3. Transaction particulars

- Date: The date of every transaction

- Description: A short abstract of the transaction (e.g., vendor cost, buyer deposit)

- Quantity: The worth of the transaction, both credited or debited

- Operating steadiness: The account steadiness after every transaction

Understanding charges and expenses on a enterprise financial institution assertion

Enterprise financial institution statements usually embody varied charges that may add up over time, resembling month-to-month upkeep, overdraft, wire switch, and transaction charges. Understanding enterprise checking account charges might help you discover methods to cut back prices.

Some banks waive charges if you happen to preserve a minimal steadiness, use on-line banking, or bundle companies. In case you discover sudden expenses in your assertion, evaluation your financial institution’s price schedule and contemplate switching to an account with higher phrases. Conserving observe of charges ensures that your banking prices stay manageable and don’t eat into your earnings.

Enterprise financial institution statements and tax preparation

Enterprise financial institution statements play an important position in tax preparation by offering a transparent file of earnings, bills, and deductions. Many tax deductions — resembling workplace bills, journey, and vendor funds — might be validated utilizing financial institution statements.

When submitting taxes, it is best to cross-reference statements with receipts and invoices to make sure accuracy. Conserving well-organized and categorized statements can streamline tax submitting, scale back errors, and assist keep away from potential audits.

Tip: Work together with your accountant or use tax software program that integrates banking information to simplify the tax course of.

Advantages of monitoring a enterprise financial institution assertion

- Monetary planning and budgeting

- ✔ Helps observe earnings and bills

- ✔ Permits for higher forecasting and monetary decision-making

- Fraud detection and error decision

- ✔Identifies unauthorized transactions

- ✔Helps catch errors earlier than they influence money circulate

- Tax preparation and compliance

- ✔Organizes data for tax submitting

- ✔Ensures accuracy in reporting enterprise earnings and bills

- Mortgage and credit score purposes

- ✔Gives documentation required by lenders to evaluate monetary stability

- ✔Demonstrates capacity to repay loans

Tip: In case your financial institution statements present frequent overdrafts, low balances, or extreme withdrawals, it might sign monetary instability and influence mortgage approval. To enhance creditworthiness, preserve a optimistic steadiness, restrict pointless bills, and guarantee regular deposits.

How one can reconcile a enterprise financial institution assertion

Reconciling your small business financial institution assertion is a vital course of to make sure your monetary data match your financial institution’s reported transactions.

- Step 1: Examine balances. Examine that the opening steadiness in your data matches the financial institution assertion, then examine discrepancies.

- Step 2: Match transactions. Confirm deposits, withdrawals, and bills towards your data, and search for lacking or unauthorized transactions.

- Step 3: Alter for charges and curiosity. File any financial institution charges, expenses, or curiosity earned that aren’t in your data.

- Step 4: Resolve discrepancies. Examine errors, right bookkeeping errors, and report unauthorized expenses.

- Step 5: Finalize and save. Make sure the adjusted steadiness matches the financial institution assertion, after which preserve a file for tax and audit functions.

How lengthy do you have to preserve enterprise financial institution statements? The IRS recommends retaining financial institution statements for 3 to seven years, relying on the character of the transactions. Doing so is crucial for tax compliance, monetary audits, historic record-keeping, and mortgage purposes.

Digital storage is usually preferable to paper data, because it reduces muddle and ensures safe, long-term accessibility. You can even use cloud accounting software program or safe native backups to arrange statements effectively.

What to do if there’s an error in a enterprise financial institution assertion

In case you discover discrepancies on your small business financial institution assertion, do the next:

- Step 1: Assessment the transaction particulars fastidiously.

- Step 2: Examine together with your accounting data to make sure accuracy.

- Step 3: Contact your financial institution’s buyer help for decision.

- Step 4: Dispute unauthorized expenses promptly to forestall monetary losses.

Tip: I like to recommend common reconciliation — ideally completed month-to-month — to assist preserve monetary accuracy, forestall fraud, and guarantee your books are updated for tax reporting and enterprise planning.

Automated instruments for monitoring enterprise financial institution statements

Managing enterprise financial institution statements manually might be time-consuming, however automation instruments can simplify the method.

- The finest small enterprise accounting software program like QuickBooks, Xero, or Wave integrates with financial institution accounts to robotically import transactions, categorize bills, and generate experiences.

- The finest financial institution reconciliation software program has options that flag discrepancies, lowering errors and saving time. Automated monitoring ensures real-time monetary visibility, making it simpler to watch money circulate, put together for taxes, and make data-driven choices.

By leveraging expertise, your small business can enhance monetary effectivity and keep away from pricey errors.

Private vs enterprise financial institution assertion

| Private financial institution assertion | Enterprise financial institution assertion | |

|---|---|---|

| Account holder | Particular person | Enterprise entity |

| File-keeping | Private bills, wage deposits | Enterprise earnings, bills, and payroll |

| File-keeping | Easier | Extra detailed for accounting and tax functions |

| Mortgage necessities | Used for private loans | Required for enterprise financing |

Enterprise financial institution statements are extra detailed and essential for monetary reporting, whereas private statements are usually used for particular person expense monitoring.

Continuously requested questions (FAQs)

How do I get a enterprise financial institution assertion from my financial institution?

Most banks let you obtain your small business financial institution assertion via on-line banking.

- Log in to your on-line banking account.

- Navigate to the “Statements” or “Paperwork” part.

- Choose the assertion interval.

- Obtain the file in PDF, CSV, or XLS format.

You can even request paper copies by visiting a department or calling customer support.

Why do lenders ask for enterprise financial institution statements when making use of for a mortgage?

Lenders use enterprise financial institution statements to evaluate an organization’s monetary well being, money circulate stability, and skill to repay debt. They evaluation earnings, bills, and common balances to find out creditworthiness earlier than approving a mortgage.

What ought to I do if I discover an unauthorized transaction on my enterprise financial institution assertion?

In case you spot an unauthorized transaction, contact your financial institution instantly to report the problem. Most banks have fraud safety insurance policies and will assist recuperate misplaced funds. Additionally, evaluation previous statements to examine for different suspicious exercise and contemplate updating account safety measures.