Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The Chainlink worth has had its justifiable share of the early-2025 struggles, falling to a brand new low simply above the $12 degree earlier this week. The altcoin has needed to deal with the widespread bearish stress and worsening investor sentiment within the basic crypto market.

Chainlink Worth Overview

On Tuesday, March 11, the Chainlink worth succumbed to the market-wide downward stress that noticed the biggest cryptocurrency Bitcoin hit $77,000 for the primary time in over 4 months. Different large-cap property additionally suffered on this current market downturn, with the worth of Ethereum additionally dropping beneath $2,000.

Associated Studying

The worth of Chainlink seems to be recovering properly up to now few days, making a play for $15 on Friday, March 14. In a present of sturdy resurgence, the altcoin ranked as top-of-the-line day by day gainers with an nearly 10% constructive efficiency on the day.

After initially crossing $14.5 earlier within the day, the Chainlink worth has returned to under the psychological $14 degree. As of this writing, the value of LINK stands at round $13.83, reflecting an nearly 6% enhance up to now 24 hours.

This single-day efficiency, nonetheless, was not sufficient to wipe off the altcoin’s loss on the weekly timeframe. Based on knowledge from CoinGecko, the LINK worth is down by greater than 13% up to now seven days.

Can LINK Worth Climb To $16?

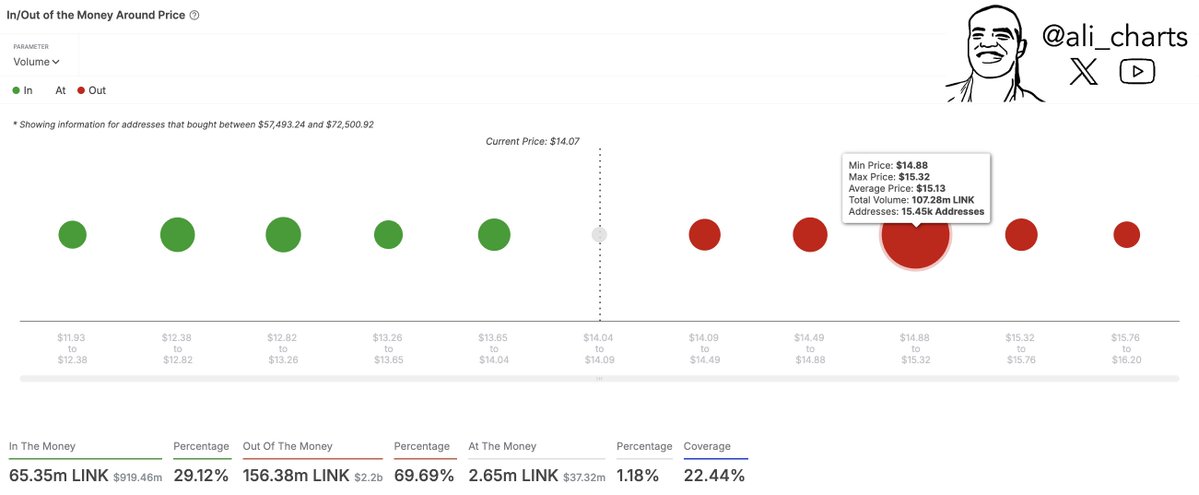

Whereas the fortunes of the Chainlink worth do seem like altering, a explicit worth degree is perhaps essential to its long-term trajectory. In a publish on X, well-liked crypto analyst Ali Martinez supplied insights into essential on-chain ranges for the LINK worth.

This evaluation revolves across the common value foundation of a number of LINK buyers. In cost-basis evaluation, the capability of a degree to function assist or resistance relies on the entire quantity of cash final bought by buyers within the area.

As seen within the chart above, the dimensions of the dot represents and instantly corresponds to the variety of LINK tokens acquired inside a worth bracket — whereas reflecting the energy of every degree. Primarily based on this evaluation, Martinez famous that the Chainlink worth faces main resistance across the $14.88 – $15 area the place 15,450 buyers purchased 107.28 million LINK tokens (price $1.62 billion at a median worth of $15.13).

The excessive investor exercise has led to the formation of a provide barrier across the $15.13 area. The Chainlink worth is more likely to witness important promoting stress resulting from buyers desirous to promote their tokens after returning to their value foundation, thereby hindering additional worth will increase and main to cost pullback.

Nonetheless, it’s price noting that no important resistance ranges lie past this $15.13 worth area. Therefore, buyers may see the value of LINK climb to as excessive as $16 ought to it efficiently breach the $15 resistance degree.

Associated Studying

Featured picture from Unsplash, chart from TradingView