Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Based on crypto entrepreneur Arthur Hayes, Bitcoin (BTC) is more likely to backside round $70,000, marking a 36% correction from its newest all-time excessive (ATH) of $108,786. Hayes said that such corrections are “very regular” in a bull market.

Bitcoin To Dip Additional?

Yesterday, Bitcoin hit a four-month low of $76,606 as each the worldwide cryptocurrency and inventory markets tumbled amid rising fears of an financial recession. For context, the S&P 500 (SPX) has dropped practically 8% over the previous month.

Associated Studying

Newest information from predictions market platform Polymarket assigns a 39% probability of a US recession in 2025. On February 28, the platform gave a 23% chance of a US recession this yr.

Regardless of these financial considerations, Hayes advises crypto buyers to stay affected person. In an X put up printed yesterday, the previous BitMEX CEO said that BTC will doubtless discover a backside round $70,000, finishing a routine 36% correction from its ATH in January.

Hayes additional famous that after BTC hits $70,000, conventional monetary markets – together with the S&P 500 (SPX) and Nasdaq (NDX) – would want to expertise a pointy decline, accompanied by failures in main monetary establishments.

This, in flip, would immediate central banks just like the US Federal Reserve (Fed), the European Central Financial institution (ECB), and the Financial institution of Japan (BOJ) to provoke quantitative easing (QE), creating an optimum shopping for alternative. He added:

You then load up the truck. Merchants will attempt to purchase the dip, in case you are extra danger averse watch for the central banks to ease then deploy extra capital. You won’t catch the underside however you additionally received’t need to mentally endure by way of a protracted interval of sideways and potential unrealised losses.

Historic information means that QE has been extremely helpful for BTC’s worth. Over the last QE interval, from March 2020 to November 2021 – amid the COVID pandemic – BTC surged from $6,000 to as excessive as $69,000, marking an astonishing 1,050% achieve.

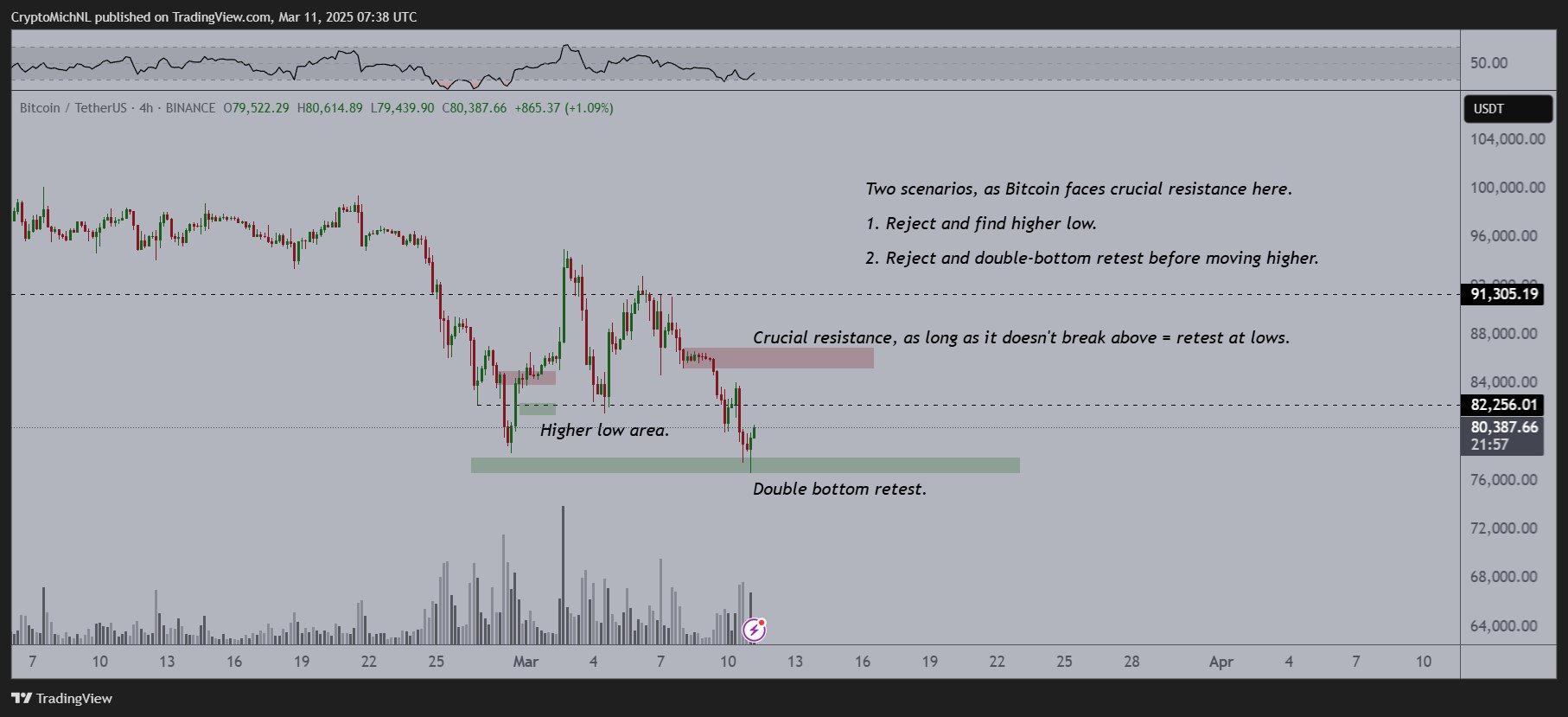

Equally, crypto analyst Michael van de Poppe shared the next chart, noting that BTC doubtless accomplished a double-bottom re-test and skilled a powerful bounce after yesterday’s potential low. He additional urged that if BTC breaks previous $83,500, it might see an excellent stronger transfer to the upside.

Information Factors Towards BTC Pattern Reversal

Whereas Hayes predicts that BTC has but to backside, a number of indicators counsel the flagship cryptocurrency might quickly witness a pattern reversal. As an example, BTC’s Relative Power Index (RSI) is at present at its lowest stage since August 2024, signaling {that a} potential restoration could also be imminent.

Associated Studying

Moreover, the US greenback index (DXY) not too long ago skilled one among its largest weekly declines since 2013, elevating hopes for a rally in risk-on property like Bitcoin. At press time, BTC is buying and selling at $80,008, up 0.1% prior to now 24 hours.

Featured picture from Unsplash, charts from X and TradingView.com