Bitcoin has had a whirlwind few days, hitting an all-time excessive (ATH) final Tuesday earlier than tumbling into a pointy 15% correction. This era of heightened volatility has left buyers divided, with some anticipating a continued uptrend whereas others brace for extra draw back. The market is intently watching Bitcoin’s potential to reclaim its bullish momentum.

Associated Studying

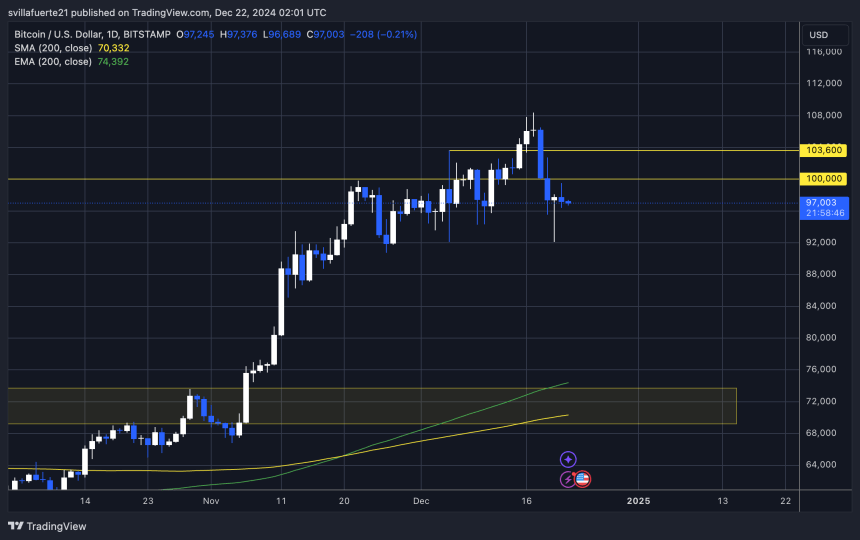

Prime analyst Ali Martinez has highlighted vital knowledge from the Bitcoin price foundation distribution, pointing to $97K as an important help stage. Martinez stresses that holding this stage is crucial for BTC to take care of its uptrend and fend off deeper corrections. Nevertheless, Bitcoin’s value motion stays unsure because it struggles to interrupt by means of the psychological barrier at $100K.

Whereas many buyers see the current correction as a wholesome reset after BTC’s meteoric rise, the failure to push larger might sign a extra extended consolidation section. With Bitcoin buying and selling close to pivotal ranges, the approaching days might be vital in figuring out whether or not it would resume its climb to new highs or face further headwinds.

Bitcoin Holding Above Key Demand

Bitcoin is holding regular above a vital demand stage round $97,000, providing a beacon of hope for bulls after current volatility. This stability follows a quick take a look at of decrease demand at $92,000, which strengthened the market’s potential to soak up promoting strain. Whereas the short-term restoration is encouraging, the value stays at a pivotal level that would decide its trajectory heading into the brand new 12 months.

Martinez just lately shared insights from the Bitcoin price foundation distribution, emphasizing the significance of the $99,000–$97,000 vary. His knowledge highlights this zone as essentially the most important help threshold for Bitcoin, appearing as a vital line within the sand for the present uptrend.

Nevertheless, Martinez warns of the potential draw back danger if Bitcoin fails to carry this vary: “We actually don’t need this stage to grow to be resistance.”

As Bitcoin consolidates close to these key ranges, sentiment throughout the market stays indecisive. Bulls are desperate to see BTC reclaim momentum and push towards all-time highs, however the psychological resistance round $100,000 continues to loom massive. In the meantime, bears argue that the current pullback could possibly be an indication of an impending bigger correction.

Associated Studying

The approaching days might be essential because the 12 months attracts to an in depth. With market contributors in search of readability, Bitcoin should maintain this vital help zone or danger shedding its bullish construction. Whether or not the subsequent main transfer is up or down will rely closely on how BTC reacts inside this value vary.

BTC Testing Liquidity

Bitcoin is buying and selling at $97,000, exhibiting resilience after rebounding from native lows of $92,000. This bounce highlights the market’s sturdy demand at decrease ranges, reinforcing the bullish narrative for now. The value construction stays intact above $97,000, indicating that BTC is well-positioned to stage one other rally towards its ATH.

Nevertheless, the $100,000 psychological barrier looms massive as the subsequent main hurdle for bulls. This stage has confirmed troublesome to beat, with earlier makes an attempt falling brief. A profitable breakout above $100,000 within the coming days would possible reignite bullish momentum and set the stage for Bitcoin to succeed in new ATHs, restoring confidence amongst buyers and merchants.

Associated Studying

On the flip facet, failure to breach this vital resistance might set off a much less favorable situation. If Bitcoin struggles to achieve traction above $100,000, market sentiment could waver, resulting in elevated promoting strain. In such a case, BTC might face one other downturn, testing key help ranges as soon as once more.

Featured picture from Dall-E, chart from TradingView