The on-chain analytics agency Glassnode has revealed the extent Bitcoin must rise to if it has to succeed in the historic high zone on this pricing mannequin.

Bitcoin Hasn’t Surpassed Final MVRV Pricing Band But

In a brand new publish on X, Glassnode has talked in regards to the excessive euphoria threshold of the Bitcoin Market Worth to Realized Worth (MVRV) Pricing Bands. The MVRV Pricing Bands is a pricing mannequin for the cryptocurrency that’s based mostly on the MVRV Ratio.

Associated Studying

The “MVRV Ratio” is a well-liked on-chain indicator that retains monitor of how the worth held by the Bitcoin buyers (that’s, the market cap) compares towards the worth that they initially put in (the realized cap). When the metric is larger than 1, the buyers are holding extra worth than their preliminary funding, which means that they’re in a state of internet revenue. Alternatively, it being underneath the brink suggests the market as a complete is underwater.

Traditionally, the holders being in an excessive amount of revenue has usually signaled overheated situations for Bitcoin, because of the truth that mass selloffs with the motive of profit-taking develop into possible in such situations. Equally, the dominance of loss has led to bottoms, as there aren’t many sellers left throughout these intervals.

The MVRV Pricing Bands goal to seize this relationship. It defines sure worth ranges for the cryptocurrency that correspond to vital ranges within the MVRV Ratio.

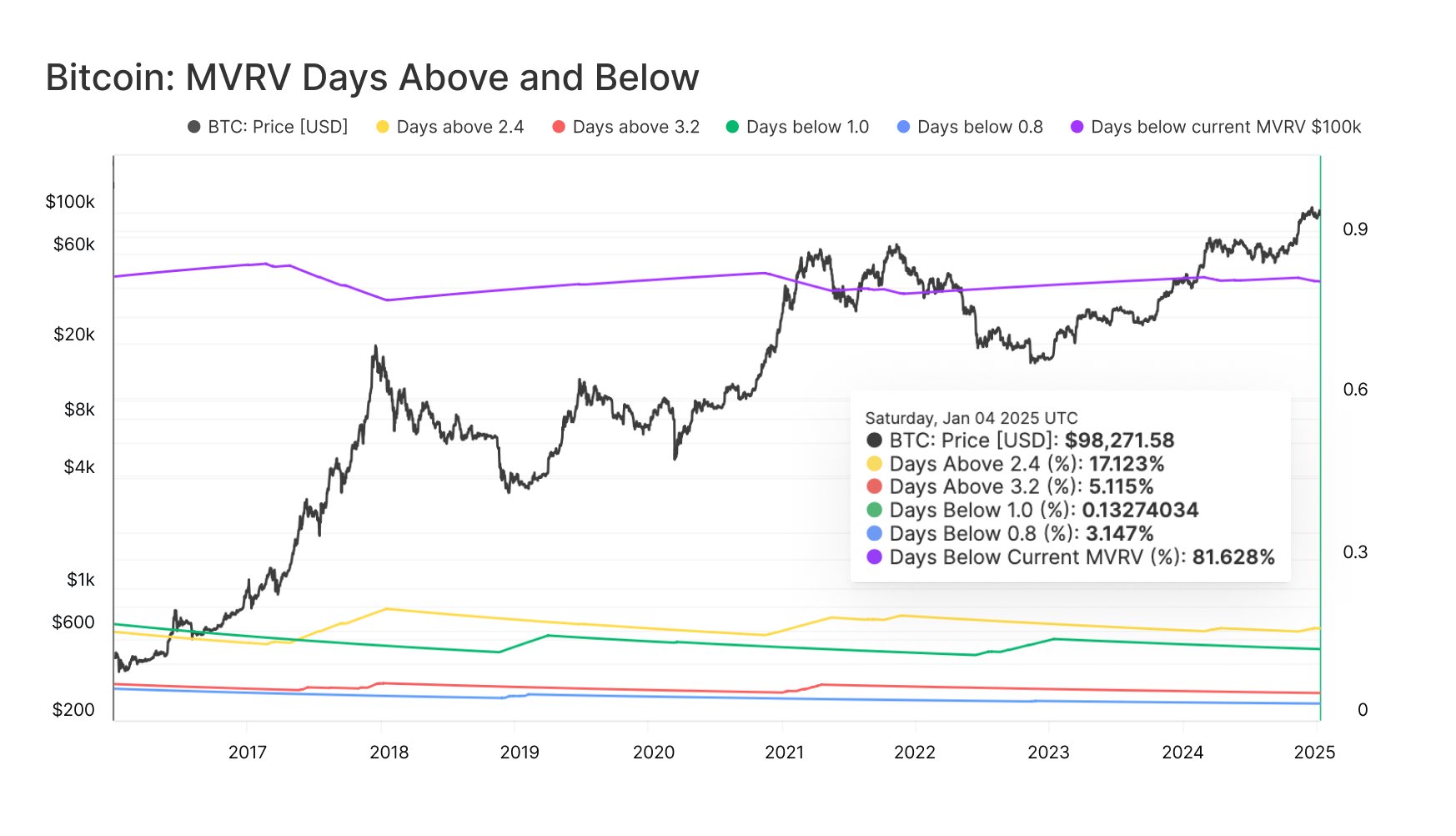

Right here is the chart for the mannequin shared by Glassnode that exhibits the pattern in these Bitcoin pricing bands during the last a number of years:

From the graph, it’s seen that the 0.8 pricing band, which is the place the MVRV Ratio assumes a worth equal to 0.8, has been round the place bear market bottoms have shaped for the asset. Proper now, BTC is much above this stage, located at $33,100. The coin’s worth can be at a major distance from the 1.0 stage of $41,300, which corresponds to the fee foundation of the common handle or investor on the community.

The pricing bands that BTC is at the moment buying and selling underneath are the two.4 and three.2 ranges, situated at $99,300 and $132,400, respectively. The previous of those has traditionally served as a sign that the bull market is getting heated.

Associated Studying

BTC can keep inside this zone for some time, however as soon as the market cap surpasses the three.2 stage, it turns into very possible that some sort of high goes to be hit quickly.

The chart beneath illustrates simply how uncommon it’s for the asset to commerce within the area above 3.2:

“BTC worth has traditionally spent solely ~5% of buying and selling days above the three.2 MVRV stage,” notes the analytics agency. “This highlights how uncommon such peaks are and reinforces why it’s usually thought-about an “excessive euphoria” zone.”

Up to now, Bitcoin hasn’t been in a position to surpass this line within the present cycle. If the previous bull markets are something to go by, the highest would solely happen above this stage, which might suggest extra room nonetheless left for the asset to run within the present cycle. It solely stays to be seen, although, whether or not the sample would really maintain this time or not.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $93,400, down greater than 3% during the last seven days.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com