The latest value hunch in Bitcoin, attributable to a turbulent cryptocurrency market, has despatched many traders into panic mode, forcing them to dump their BTC holdings at a loss.

Nonetheless, blockchain analytics agency Glassnode famous {that a} group of Bitcoin traders remained resilient regardless of the crypto market volatility, saying that long-term holders of the firstborn crypto are unshaken by the present market hunch.

Associated Studying

Lengthy-Time period Holders ‘Largely Unaffected’

Glassnode stated that Bitcoin, like different cryptocurrencies, skilled a shaky week through which merchants noticed the world’s most dominant digital asset crash beneath the $100,000 degree.

At one level, Bitcoin’s value practically hit the $90,000 degree, at $92,800, on February 3, which was the bottom since BTC recorded $90,890 on January 13.

On the brighter aspect, the blockchain analytics agency famous that BTC’s long-term holders appear insulated from all of the chaos surrounding the cryptocurrency neighborhood, saying, “#BTC’s long-term holders (LTHs) stay largely unaffected.”

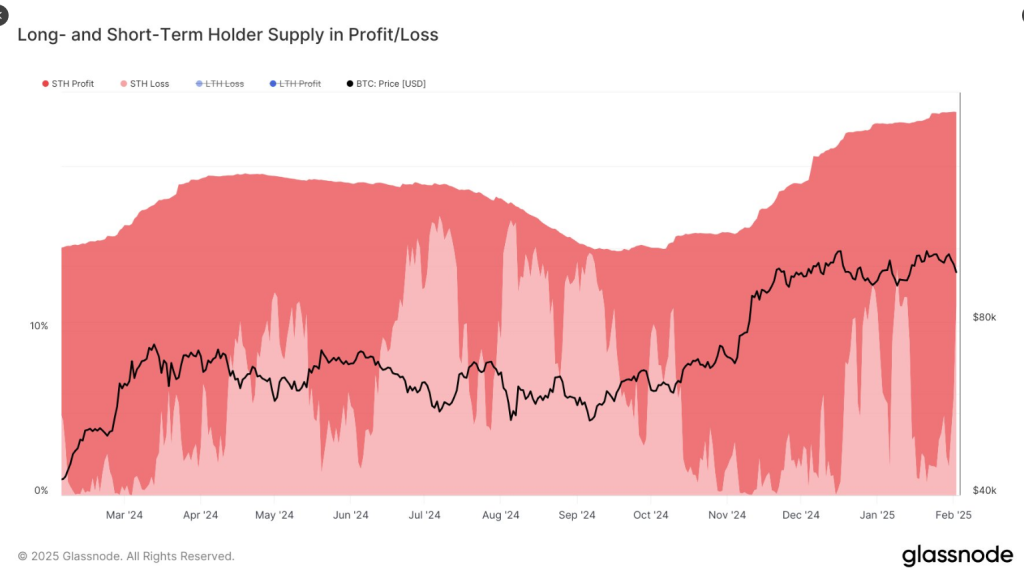

Glassnode revealed that knowledge confirmed practically 0.01% of the provision of those BTC holders was in loss, emphasizing the resiliency of long-term traders in occasions of market turbulence. Nonetheless, the crypto agency remarked that these Bitcoin traders skilled a lowering unrealized revenue.

“Nonetheless, their unrealized revenue share has steadily declined since November, now at its lowest since September – suggesting no renewed accumulation but,” Glassnode stated in a publish.

The analyst famous that BTC holders will not be aggressively shopping for at present costs, probably ready for higher market alerts earlier than resuming accumulation.

Bitcoin Quick-Time period Holders Bleed

In the meantime, knowledge confirmed that one other section of Bitcoin traders suffered probably the most from the market crash – short-term holders.

In response to Glassnode, short-term BTC holders skilled a big loss after the crypto’s value slid beneath the $100,000 degree, inflicting panic amongst these merchants.

#Bitcoin dipped beneath $100K over the weekend, pushing a notable quantity of short-term holder (STH) provide into loss. At $97K, the provision in loss & revenue held by STHs was evenly break up at ~11% – the most important loss publicity for STHs since early January: https://t.co/Drjy6ahQMm pic.twitter.com/gypNiJ0BqX

— glassnode (@glassnode) February 3, 2025

Glassnode stated that when Bitcoin plummeted to $100,000 over the weekend, it pushed “a notable quantity of short-term holder (STH) provide into loss.”

“At $97K, the provision in loss & revenue held by STHs was evenly break up at ~11% – the largest loss publicity for STHs since early January,” the blockchain analytics agency stated in an X publish.

Bearish Market Sentiment

An analyst famous that Bitcoin briefly dipped so low that it practically hit $90,000 per coin, because the dominating crypto suffered after the market crash.

“Bitcoin plummeted to as little as $91.2K as all of crypto has dipped with world inventory markets beginning the week with heavy bleeding. Media shops appear to be attributing plummeting sectors to ‘Trump’s commerce conflict’,” market intelligence platform Santiment stated in a publish.

😰 Bitcoin plummeted to as little as $91.2K as all of crypto has dipped with world inventory markets beginning the week with heavy bleeding. Media shops appear to be attributing plummeting sectors to ‘Trump’s commerce conflict’.

Whether or not that is the first purpose or if there are different… pic.twitter.com/ij1bQ6xfUu

— Santiment (@santimentfeed) February 3, 2025

Associated Studying

Santiment added that there have been overwhelmingly destructive reactions from traders within the cryptocurrency neighborhood on account of the value decline, and for a second it appears BTC is about to enter bearish territory.

The market intelligence platform famous that in the meanwhile, Bitcoin was capable of pull again to $96,000.

“Was this flush orchestrated to get trigger-happy retail merchants to promote at a neighborhood backside? Traditionally, markets nearly at all times transfer the wrong way of the group’s expectations,” Santiment requested in a publish.

Featured picture from Pexels, chart from TradingView