Shopping for a rental property isn’t solely about how a lot cash you earn, but in addition how a lot debt you could have. For those who plan to get a mortgage to finance your investments, sustaining a wholesome debt-to-income ratio is important. For traders, significantly these with a number of properties of their portfolio, carrying a variety of debt might be a problem, which is why offsetting it with excessive earnings is paramount.

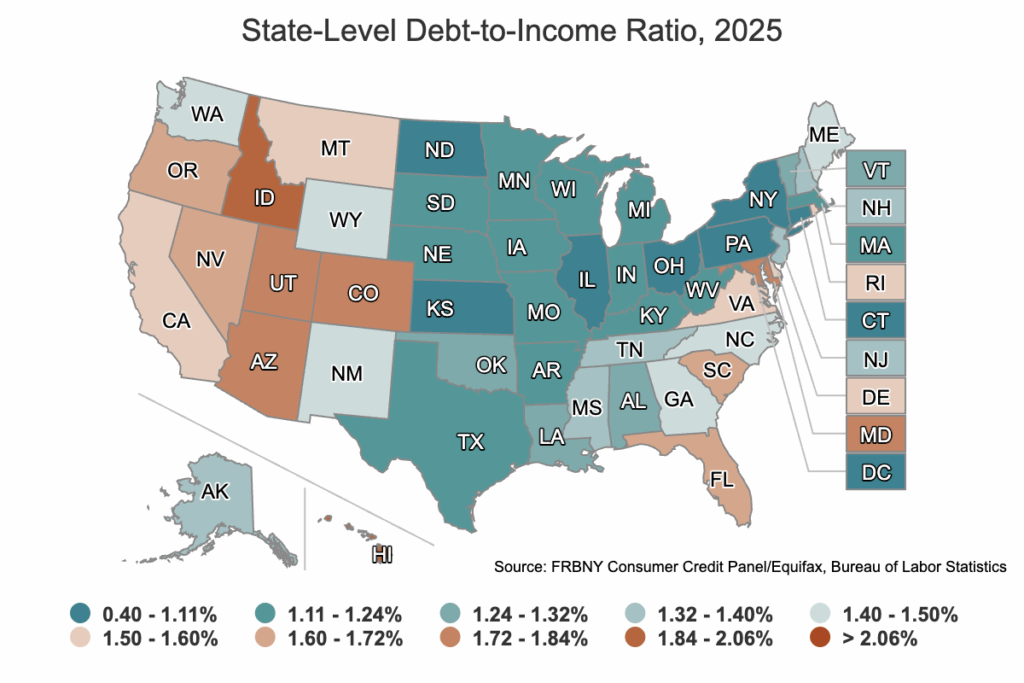

The Federal Reserve has simply launched its nationwide debt-to-income map, which exhibits the place the best-qualified consumers truly stay. For fix-and-flippers and landlords trying to purchase and maintain, it gives a useful snapshot of what lenders search for in debtors and the regional shifts at play.

The map exhibits that the majority certified consumers usually are not essentially the place you assume they’re.

What Is DTI?

A debt-to-income ratio, because the identify suggests, measures an individual’s debt when measured towards their earnings. The best DTI averages—over 2.0—imply residents carry $2 in debt for each $1 of earnings.

With regards to DTIs, much less is extra. The extra earnings, the much less debt wins. For instance, if half your month-to-month earnings went towards paying off your recurring month-to-month debt, your DTI can be 50%, which isn’t good. A DTI of 35% or much less is taken into account favorable by lenders.

Shifting Debt-to-Revenue Ratios: The 2025 Panorama

Traditionally, the wealthier states on each coasts have been famend for each excessive housing costs and equally excessive purchaser and rental demand. That’s as a result of many of those areas are thought-about “barrier” markets, i.e., there’s a barrier to land availability, forcing costs up.

In keeping with the Federal Reserve’s map, nonetheless, essentially the most favorable borrowing environments usually are not discovered the place the uber-wealthy stay in New York and California, however fairly within the Midwest—Pennsylvania, Wisconsin, and Ohio— right here, DTI charges are decrease, that means that certified consumers right here usually tend to obtain loans.

For flippers, it means these markets provide a higher probability of discovering certified consumers. For landlords, the lending setting right here is extra favorable for getting investments, assuming the potential purchaser falls into a good DTI class.

Mortgage Balances and Purchaser Limitations: Native Developments

This may not come as a shock, however debt in America is on the rise. The mixture of low stock and greater rates of interest creates a poisonous borrowing setting, pushing up home costs and mortgage balances, significantly in some coveted city areas.

The Quarterly Report on Family Debt and Credit score for the second quarter of 2025, primarily based on the New York Fed Shopper Credit score Panel, confirmed that whole family debt elevated by $185 billion from the primary quarter to $18.39 trillion. There are actually 67 cities within the U.S. the place the mortgage stability averaged $1 million or extra as of June 2025, based on the credit score reporting bureau Experian. Listed below are the highest 10, with the typical stability:

- Golden Oak, FL: $3,627,594

- Gulf Stream, FL: $3,206,007

- Golden Seashore, FL: $2,969,951

- Captiva, FL: $2,620,156

- Atlantis, FL: $2,585,199

- Montecito, CA: $2,487,787

- Hidden Hills, CA: $2,149,578

- Atherton, CA: $2,137,851

- Hunts Level, WA: $2,016,164

- Sagaponack, NY: $1,977,857

Because the listing exhibits, Florida, not California or New York, is the state with the highest 5 cities with the best mortgage balances. This signifies that right here, traders have to be ready for tighter margins and elevated competitors, whilst native incomes rise. Conversely, cities throughout the Midwest and the Rust Belt, akin to Cincinnati and Cleveland, nonetheless stay engaging propositions for traders attributable to decrease mortgage burdens and sustainable DTI profiles.

Decrease Home Costs Can Offset Price Fluctuations and DTI Ratios

“When individuals are looking at a 6% or 7% [mortgage] price, they simply begin to get reluctant,” Rick Arvielo, chief govt and co-founder of mortgage lender New American Funding, informed the Wall Avenue Journal in August. “Affordability remains to be a significant concern.”

Since then, the Fed has lower rates of interest twice, most lately in October, however charges stay risky, hinging on each phrase from Fed chair Jerome Powell. His latest feedback about halting price cuts on the Fed’s December assembly despatched charges again up after his latest lower.

Favorable neighborhoods for mom-and-pop traders—flippers and landlords—boil right down to decrease costs and neighborhoods with consumers with favorable DTI, making it the very best setting for investing and lending.

Hovering Nationwide Debt Might Pose Large Issues

A homebuyer’s revolving month-to-month debt is tied to their rate of interest, which in flip is tied to the nationwide monetary panorama. In Could, the New York Instances reported some evaluation that predicted President Trump’s “Large, Stunning Invoice” might inflate America’s debt to greater than 130% of the scale of its complete economic system.

“A disaster at all times feels far off till you’re in a single,” Natasha Sarin, president and cofounder of the Yale Finances Lab, mentioned. “We don’t know precisely the place that cliff is, the place you possibly can’t breach debt ranges” of a sure measurement. “However we all know that we’re inching nearer to no matter that time is.”

These sentiments had been echoed lately by Tesla CEO Elon Musk, who informed podcaster Joe Rogan, “It will be correct to say that even until you can go like tremendous Draconian…on reducing waste and fraud, which you’ll’t actually do in a democratic nation, then…there’s no method to resolve the debt disaster.”

Musk added that synthetic intelligence (AI) and robotics might be a means out of debt. “We have to develop the economic system at a price that permits us to repay our debt.”

Curiosity Price Cuts Would possibly Not Transfer the Needle

For actual property traders hoping that Fed price cuts can have the specified impact if the nationwide debt stays dangerously excessive, that might be wishful considering. Musk’s feedback from his look on Joe Rogan’s podcast earlier this yr seem to carry in unpredictable economies: Tangible property akin to actual property grow to be extra precious as a result of folks will at all times want a spot to stay, whatever the financial setting.

“It’s typically higher to personal bodily issues like a house or inventory in firms you assume make good merchandise, than {dollars} when inflation is excessive,” Musk suggested.

Remaining Ideas: Affordability and Lengthy-Time period Stability Are Keys to Sound Investing

The debt-to-income map is a blueprint that traders can comply with to find among the most steady housing markets within the nation, the place historically conservative investing ideas of low debt and paying payments on time prevail. They don’t seem to be essentially the most glamorous markets, however in addition they don’t have a big proportion of extremely leveraged residents. In turbulent financial instances, low debt-to-income states akin to Ohio, Pennsylvania, and North Dakota are a few of essentially the most resilient markets within the U.S.

Realtor.com and the Wall Avenue Journal named Manchester-Nashua, NH, as its high marketplace for the second straight quarter in its Fall 2025 Housing Market Rating attributable to its “sustained demand, brisk gross sales exercise, and notable year-over-year value progress,” coupled with its stability of “desirability with relative worth.” New Hampshire has a comparatively low DTI rating of 1.4.