Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) continues to commerce under the $85K stage, fueling fears of additional draw back because the bearish pattern stays intact. Bulls are dropping momentum, failing to reclaim key resistance ranges and maintain decrease demand zones, elevating issues a couple of potential continuation of the correction.

Associated Studying

Macroeconomic uncertainty and volatility stay key drivers of value motion, with erratic coverage choices from U.S. President Donald Trump including to the turbulence in each crypto and conventional markets. The worldwide commerce battle narrative and tightening financial situations proceed to weigh closely on danger belongings, contributing to Bitcoin’s incapacity to maintain a significant restoration.

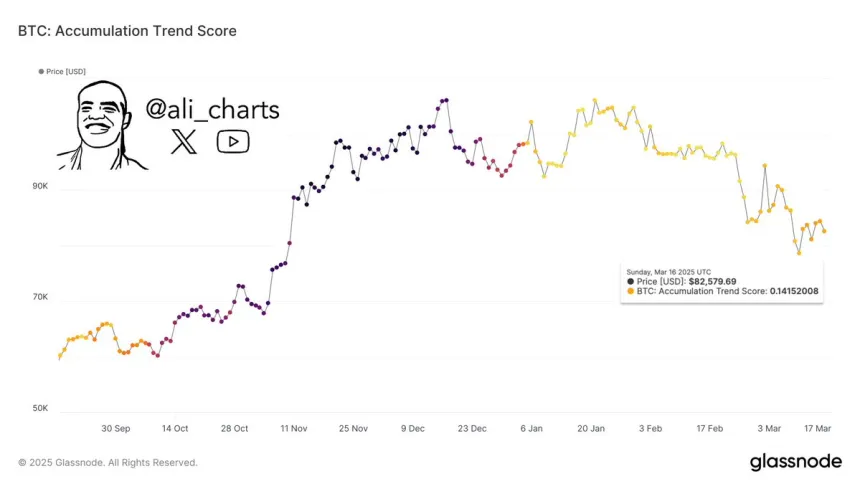

Nevertheless, there’s a shift in market conduct that would point out a turning level. Key metrics from Glassnode reveal that after three months of distribution, Accumulation Pattern Scores trace at early indicators of BTC accumulation. Traditionally, a transition from distribution to accumulation has usually preceded a restoration section, suggesting that traders could be stepping again in at these decrease ranges.

The subsequent few weeks shall be essential, as Bitcoin’s capacity to carry assist and entice recent demand will decide whether or not the market is getting ready for a rebound or a deeper correction.

Bitcoin In Correction Mode – Accumulation Developments Trace At A Attainable Shift

Bitcoin has formally entered correction territory after dropping the $100K mark, and the bearish pattern was absolutely confirmed when BTC failed to carry above $90K. Since reaching its all-time excessive (ATH) of $109K in January, Bitcoin has dropped over 29%, and it seems this pattern might proceed as world macroeconomic situations stay unfavorable.

Associated Studying

Commerce battle tensions between the USA and key world economies like Europe, China, and Canada proceed to strain monetary markets, resulting in uncertainty and risk-off sentiment. As these geopolitical points intensify, each crypto and conventional markets stay extremely risky, struggling to search out stability.

Nevertheless, not all indicators are bearish. Ali Martinez shared insights on X, revealing that the tide is popping for Bitcoin. After three months of distribution, the Accumulation Pattern Scores mannequin is hinting at early indicators of BTC accumulation. Traditionally, these phases sign that enormous traders are re-entering the market, positioning themselves forward of a possible restoration.

This accumulation section is a important turning level that may decide whether or not Bitcoin sees a quick restoration above key provide ranges or a protracted consolidation interval earlier than the following main transfer. The subsequent few weeks shall be decisive for BTC’s short-term outlook.

$80K Retest on the Horizon?

Bitcoin is presently buying and selling at $83,000, caught in a decent consolidation because it struggles to interrupt above $85K whereas sustaining assist at $82K. This range-bound value motion has left traders unsure, with bulls making an attempt to reclaim greater ranges and bears urgent for additional draw back.

If bulls need to regain management, BTC should push above $89K, a key resistance stage aligned with the 4-hour 200 shifting common (MA). A profitable breakout above $90K might verify a restoration pattern and open the door for additional positive factors towards $95K and past.

Associated Studying

Nevertheless, if Bitcoin fails to interrupt above $90K within the coming periods, the danger of a deeper correction will increase. Shedding $82K might ship BTC right into a downward spiral, doubtlessly retesting $80K and even decrease ranges. With market sentiment nonetheless fragile, the following main transfer will possible decide the short-term trajectory of Bitcoin’s value motion.

Featured picture from Dall-E, chart from TradingView