Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

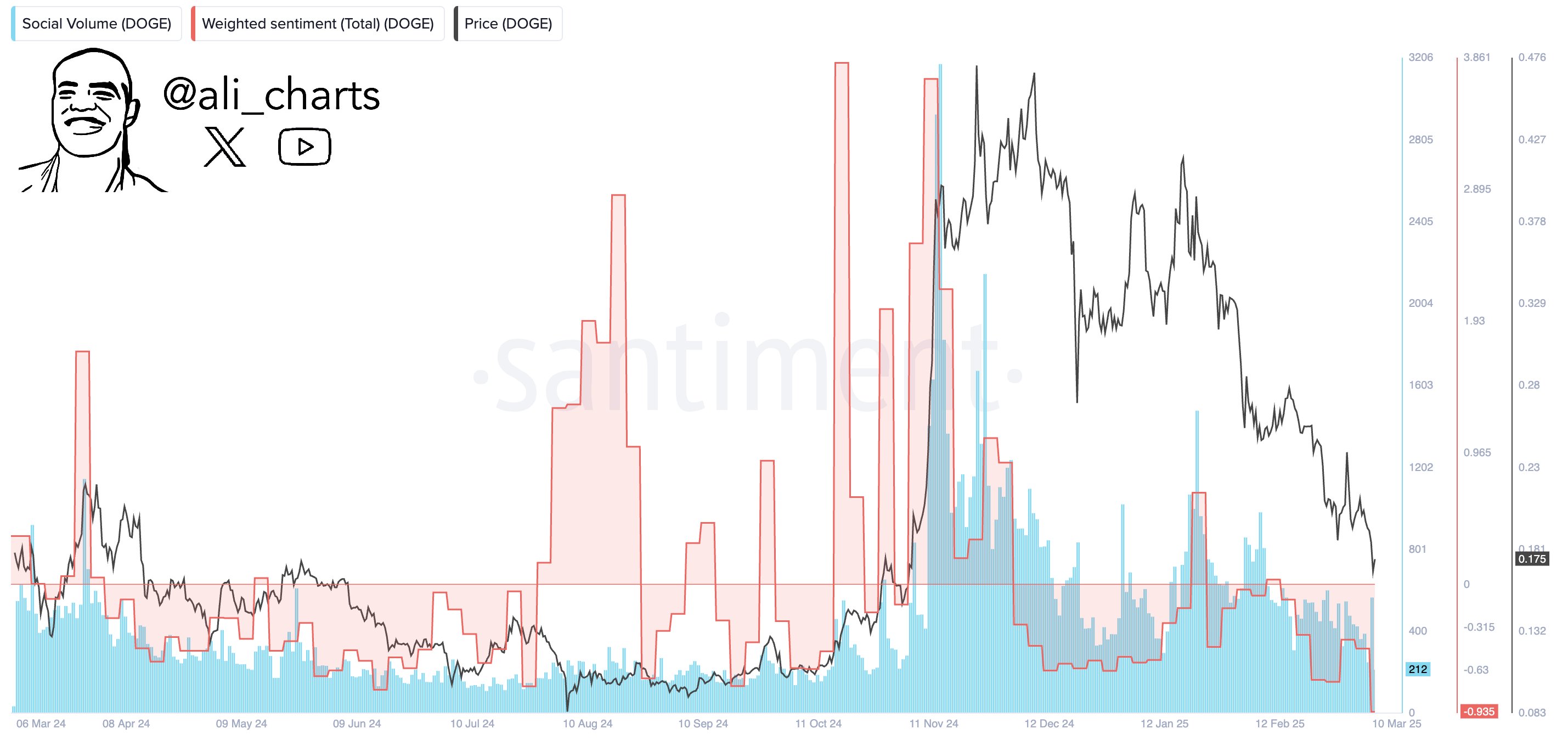

Dogecoin’s sentiment has reportedly reached its most unfavourable stage in over a 12 months. Crypto analyst Ali Martinez (@ali_charts) shared the beneath chart illustrating the present panorama of Dogecoin’s social sentiment and famous: “Investor sentiment round Dogecoin is at its most unfavourable in over a 12 months. Traditionally, excessive concern has set the stage for main reversals. This may very well be a chief alternative to be a contrarian.”

What This Means For Dogecoin

Inside the chart, the crimson line—the Weighted Sentiment—now sits at roughly -0.93, marking the steepest unfavourable studying in additional than 12 months. Weighted Sentiment considers each the amount of social media mentions (Social Quantity) and the general polarity of discussions (optimistic vs. unfavourable). Spikes above zero usually point out widespread bullish sentiment (and might coincide with surging costs), whereas sharp dips counsel that market individuals are overwhelmingly bearish.

Associated Studying

Alongside this unfavourable flip in Weighted Sentiment, the chart’s blue bars—Social Quantity—present reasonable ranges in comparison with the dramatic spikes seen mid-November by December. In that interval, Social Quantity soared above 3,000 mentions, correlating with extraordinarily optimistic Weighted Sentiment (above +3 on the chart) and a considerable value rally.

Now, Social Quantity hovers round simply over 200 mentions, which underscores that whereas unfavourable sentiment dominates, the general dialog frequency about DOGE is comparatively low.

Associated Studying

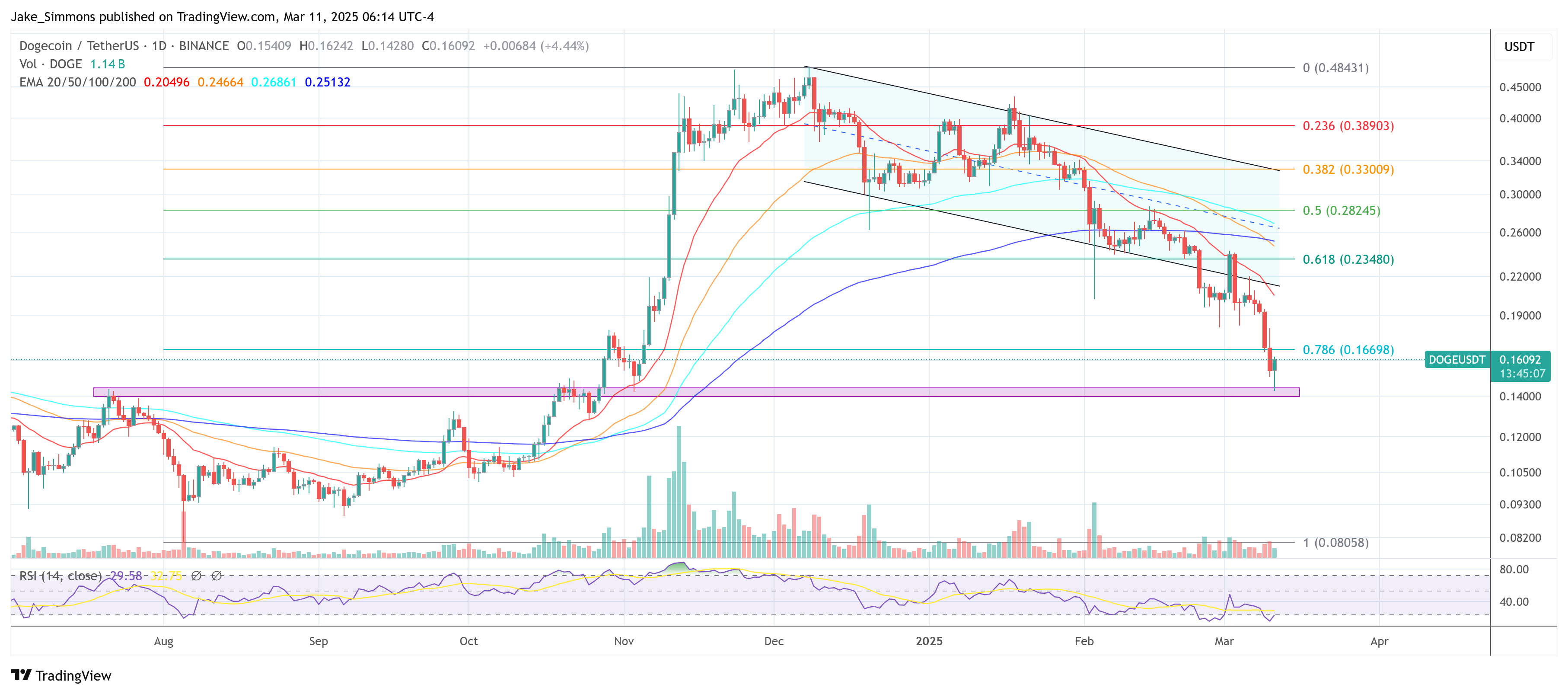

One other widespread analyst, Lumen (@Lumen0x), factors out that Dogecoin has dropped 20% in every week—sliding from $0.22 to $0.17. Regardless of the pullback, whale addresses reportedly scooped up 1.7 billion DOGE (roughly $298 million) up to now 72 hours, suggesting that larger gamers could be positioning for an eventual rebound.

Lumen additionally speculates {that a} potential Dogecoin ETF approval may act as a bullish catalyst. In accordance with him, if Dogecoin’s value reclaims $0.20 forward of any ETF-related announcement, it may pave the way in which for a surge towards $0.50, citing the liquidity these funding autos may convey and the opportunity of renewed social media pleasure.

In accordance with Lumen, the speedy help sits round $0.17–$0.18, reflecting latest lows on the chart. The psychological pivot level is at $0.20, a stage often talked about by analysts as a key threshold for bullish continuation. A mid-term potential upside goal is at $0.50, per Lumen’s outlook if important market catalysts (e.g., an ETF) materialize.

Total, Dogecoin’s plunge in social sentiment underscores the volatility intrinsic to meme-based cryptocurrencies. The Sentiment Weighted metric’s deep dive means that the majority of social media commentary has taken a distinctly pessimistic flip. But, some analysts like Martinez and Lumen imagine this excessive unfavourable sentiment may mark the beginning of a rebound, particularly in gentle of notable whale accumulation and potential ETF catalysts on the horizon

At press time, DOGE traded at $0.16.

Featured picture created with DALL.E, chart from TradingView.com