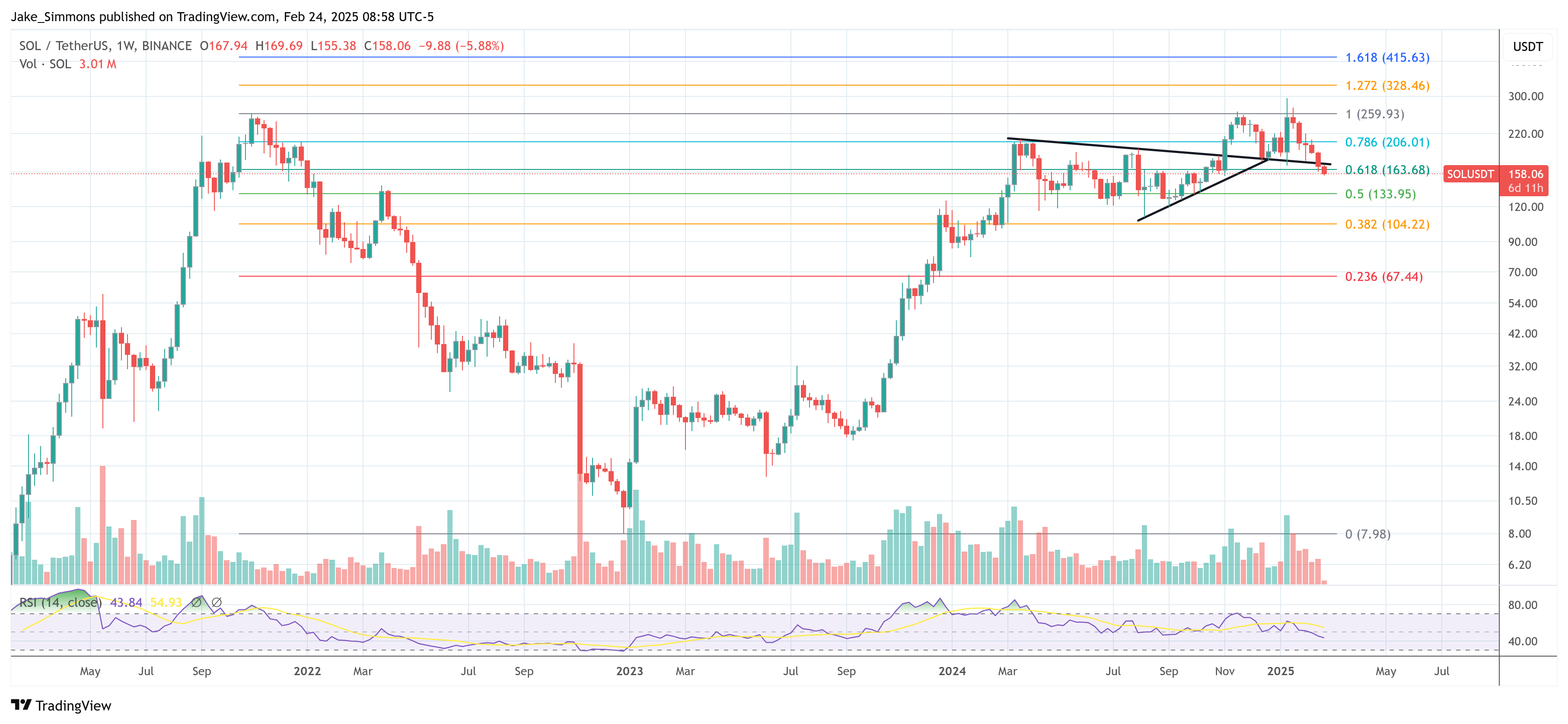

In a technical chart shared at the moment, crypto analyst Koroush Khaneghah, Founding father of Zero Complexity Buying and selling, underscores Solana’s ongoing downtrend, highlighting pivotal assist and resistance ranges on the SOL/USDT Perpetual (Binance) every day timeframe. In response to the chart, Solana has misplaced a number of key zones and is at the moment hovering close to the $157 space—what Khaneghah labels because the “final main assist stage.”

The Bearish Argument For Solana

“The downtrend continues as SOL will get rejected by one other S/R flip and crashes right down to the $150 stage. Sentiment at an all-time low. Assume continuation till confirmed in any other case,” Khaneghah writes through X.

A distinguished characteristic of the evaluation is a assist/resistance (S/R) flip round $180.58. Earlier in February, Solana tried to reclaim this stage however was met with robust promoting stress. The failure to safe a every day shut above $180.58—now appearing as resistance—signaled renewed draw back momentum.

Following the drop, Solana has settled simply above $157, marked on the chart because the “Final main assist stage.” Costs have briefly dipped beneath this zone, suggesting fragility available in the market’s present stance. A failure to carry $157 on every day closes will increase the potential of additional decline towards the following vital horizontal line round $127.05—seen on the decrease finish of the chart.

Associated Studying

Koroush’s annotations additionally point out that crossing again above $180.58 would shift the market bias from bearish to “impartial.” Till that occurs, the analyst cautions that sellers seem like in management, with destructive sentiment round meme cash reinforcing the continuing downtrend.

The Bullish Argument For SOL

In the meantime, crypto analyst RunnerXBT (@RunnerXBT) has shared a orderflow evaluation of the Solana (SOL) futures chart (2-hour timeframe on Binance) at the moment. The chart underscores notable value factors, liquidations, and modifications in positioning forward of the upcoming March 1 unlock—when 11.2 million SOL (valued at roughly $1.77 billion) are scheduled for launch.

Within the annotated chart, the worth peaked in mid-January, reaching $295, earlier than starting a gentle descent that has most just lately seen SOL hovering within the mid-$150 vary. The chart exhibits that from early to late January, there was a major drop in open curiosity (OI) alongside a slide within the value, with Cumulative Quantity Delta (CVD) suggesting it was pushed primarily by lengthy positions closing. RunnerXBT’s notes attribute this to SOL weak spot shifting largely in tandem (1:1) with Bitcoin.

By late January, after a extra pronounced downward transfer, the worth and OI each settled at decrease ranges. OI briefly rebounded in early February, although the chart signifies that preliminary lengthy positioning was quickly adopted by quick protecting as merchants pivoted to profit-taking or closed dropping quick positions. Regardless of this exercise, SOL’s value was unable to mount a sustained uptrend, reinforcing a broader sense of hesitancy amongst merchants.

Associated Studying

Round mid-February (February 16–18) and once more on February 24, the chart highlights phases of “aggressive shorting and spot promoting,” which contributed to persistent downward stress on the worth. Although there have been cases of quick protecting (notably round February 21, the place CVD ticked up barely), the general momentum has remained subdued, with few indicators of latest lengthy accumulation.

On the suitable facet of the chart, RunnerXBT has positioned a vertical purple line marking March 1 because the date of what he calls the “largest SOL unlock recognized to mankind.” Many market individuals seem like “front-running” the occasion by promoting in anticipation of a flood of latest tokens hitting the market. This has the potential to drive heightened volatility.

But, in his put up, RunnerXBT warns towards shorting SOL at present ranges, explaining that he initially began monitoring this case when the token traded just below $200 and is now searching for a scalp lengthy after the unlock has occurred. He factors out that makes an attempt to catch each 5–10% every day drop are harmful and that merchants who achieve this threat frequent stop-outs or liquidations.

“I dont suppose its a smart “new” quick right here of SOL. I began posting in regards to the state of affairs at jus below $200 per SOL. I’m in search of a scalp lengthy AFTER the unlock, folks “frontrunning” it are getting stopped out or liquidated. You aren’t a hero catching -5% to -10% every day falling knives. […] TLDR: On the lookout for longs (not 5 days earlier than unlock). NOT shorts. if folks can’t learn, i can’t aid you,” he writes through X.

At press time, SOL traded at $158.

Featured picture from Shutterstock, chart from TradingView.com