Bitcoin is trying to ascertain a short-term course after efficiently holding the $90K stage however struggling to reclaim the $100K mark. The worth continues to commerce inside a good vary, fluctuating between $94K and $100K, creating uncertainty amongst traders. Whereas Bitcoin’s long-term outlook stays bullish because it holds above important demand ranges, short-term worth motion has but to offer a transparent pattern.

Hypothesis is mounting, with analysts suggesting that the present interval of consolidation is the calm earlier than the storm. Many consider {that a} breakout is inevitable, however the query stays whether or not Bitcoin will push into new all-time highs or face a deeper correction earlier than resuming its uptrend.

Key information from CryptoQuant reveals that small addresses have slowed their accumulation, signaling a cautious stance from retail traders. Usually, retail accumulation will increase throughout bull markets, however this isn’t taking place now, suggesting hesitation amongst smaller traders. In the meantime, institutional and whale exercise could also be driving the market, indicating that the following transfer might be dictated by bigger gamers.

Bitcoin Consolidates – Is a Large Transfer Coming?

Bitcoin has been in a quiet consolidation part beneath the $100K mark, making a boring but tense market atmosphere. The worth motion stays range-bound, fluctuating between $94K and $100K, with no decisive transfer in both course. Analysts and merchants are speculating concerning the subsequent huge transfer, however uncertainty dominates. Most traders count on an aggressive breakout, however opinions are break up on whether or not Bitcoin will push into new all-time highs or face a sell-off into decrease demand ranges earlier than resuming its uptrend.

CryptoQuant analyst Axel Adler shared a key market evaluation on X, revealing that the gradual accumulation of small addresses displays a cautious stance from retail traders. Traditionally, retail traders have a tendency to extend their accumulation throughout bull markets, anticipating additional worth features. Nevertheless, this pattern is presently absent, suggesting that smaller traders lack confidence in Bitcoin’s short-term worth motion.

This shift in sentiment not directly suggests that giant traders and establishments are the first forces behind Bitcoin’s present market actions. Whales proceed accumulating whereas retail traders hesitate, making a market imbalance that would result in an explosive worth transfer as soon as confidence returns.

BTC Testing Essential Liquidity Ranges

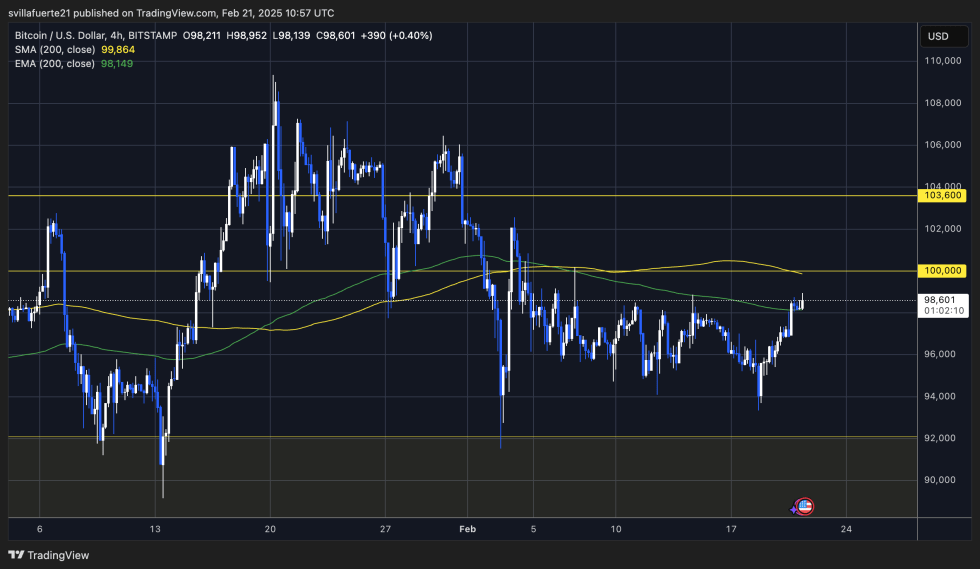

Bitcoin is buying and selling at $98,600 after days of sideways buying and selling, ranging between the $94K help stage and the $100K psychological barrier. This consolidation part has lasted over two weeks, retaining traders on edge as they await a decisive transfer. Traditionally, such extended intervals of tight-range buying and selling are likely to precede aggressive breakouts, making the following few buying and selling periods essential.

If BTC manages to interrupt above the $100K stage and maintain it as help, the following goal would be the vary highs round $109K. A breakout above this stage may push Bitcoin into worth discovery, fueling renewed bullish momentum. Nevertheless, if BTC fails to reclaim the $100K mark and faces rejection, a retest of decrease help ranges is probably going. A drop beneath $94K may set off additional promoting strain, bringing Bitcoin nearer to the $90K demand zone.

Market sentiment stays blended, with retail traders displaying warning whereas giant traders accumulate. The continuing consolidation means that Bitcoin is increase for a big transfer, and merchants are intently expecting a confirmed breakout or breakdown. The approaching days might be essential in figuring out whether or not BTC resumes its uptrend or faces a deeper correction.

Featured picture from Dall-E, chart from TradingView