Newest report from Galaxy Digital’s Crypto and Blockchain Enterprise Capital has revealed some fascinating development recorded within the crypto market final yr particularly regarding the VC sector.

In line with the report, within the fourth quarter of 2024, almost half of all enterprise capital funding within the cryptocurrency and blockchain sector was directed towards startups primarily based in america.

Moreover, 46% of the full invested capital flowed to US-based startups. This determine far exceeded the share acquired by different jurisdictions, with Hong Kong coming in second at 16% and Singapore and the UK following behind.

Early and Late-Stage Funding Traits

Assessing the report additional, it reveals that the US additionally led in deal quantity, accounting for 36% of all enterprise capital offers in the course of the quarter. Regardless of the continuing regulatory uncertainty and pressures throughout the US, the nation’s dominance in attracting each capital and deal exercise was evident.

Galaxy head of analysis Alex Thorn in a put up on X identified that the favorable outlook for the sector, mixed with the potential for a pro-crypto administration taking workplace, could additional strengthen the US’s place within the world digital forex enterprise capital panorama.

In the meantime, Enterprise capital exercise in This fall 2024 revealed a continued urge for food for each early and late-stage digital forex startups. Roughly 60% of the capital raised went to early-stage corporations, highlighting sustained curiosity in new and revolutionary blockchain tasks.

The remaining 40% was directed towards later-stage corporations, pushed partially by vital offers reminiscent of Cantor’s $600 million funding in Tether.

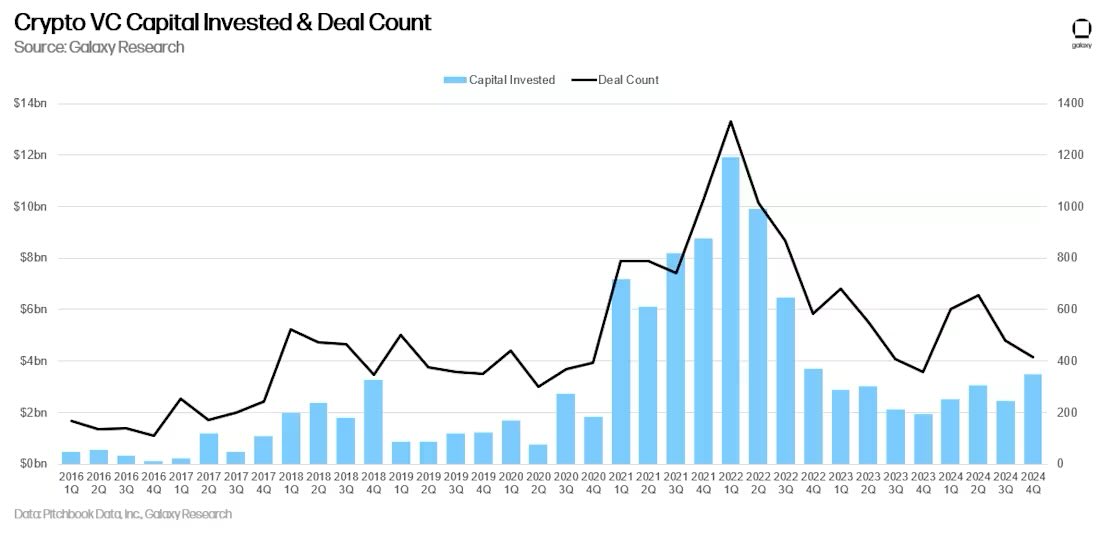

The information additionally confirmed that median deal sizes elevated over the yr, reflecting a development seen throughout the broader enterprise capital market. Whereas the variety of offers declined barely, the general greenback quantity invested reached $3.5 billion for the quarter, a 46% improve quarter-over-quarter.

Nevertheless, regardless of the rise in funding ranges, crypto enterprise funds themselves confronted challenges, with simply $1 billion allotted throughout 20 new funds—near quarterly lows seen way back to early 2021.

The Street Forward for US Crypto Startups

Because the US solidifies its standing as the highest vacation spot for digital forex enterprise funding, business observers wish to 2025 for additional development.

The election of a extra crypto-friendly administration might assist deal with regulatory uncertainties, paving the way in which for even larger funding within the sector. As well as, the sturdy exercise in early-stage offers alerts that entrepreneurs with contemporary concepts are nonetheless in a position to safe funding, guaranteeing a gradual pipeline of innovation.

Trying past the US, the report highlighted key themes within the world crypto enterprise market, together with the rise of Web3 tasks, decentralized finance (DeFi), and blockchain infrastructure.

These sectors led by way of capital allocation, indicating the place traders see essentially the most promise for development. Because the market matures, these areas are anticipated to drive additional capital flows and form the way forward for the crypto ecosystem.

Featured picture created with DALL-E, Chart from TradingView