Chainlink (LINK) has skilled a big surge in its worth, which analysts are attributing to the extra acquisition of World Liberty Monetary (WLFI) and the rumors of a brewing partnership with Cardano.

Associated Studying

Chainlink could possibly be off to a superb begin because the crypto token was capable of pull off a giant run that propelled the coin from its lowest degree to succeed in over $26 per coin.

Chainlink 30% Value Surge

Analysts mentioned that Chainlink has efficiently positioned itself within the blockchain panorama after breaking the hunch that noticed the token at its lowest degree this 12 months and gaining momentum to surpass its March 2024 excessive of $22.87

Knowledge confirmed that the crypto token’s worth skyrocketed by 40% to hit $26.85 per coin. The come-from-behind rally additionally pushed the market capitalization to almost $17 billion. In the meantime, LINK was up 30% within the final seven days, knowledge from Coingecko reveals.

Market observers famous that LINK’s good points to succeed in $26.87 have allowed the token to recover from the resistance degree of $22.87, which some analysts prompt the token could possibly be shifting in direction of a extremely bullish situation.

The cup and deal with sample technique confirmed there’s a excessive chance that Chainlink would attain its goal of $37, which an analyst explains,

“The revenue goal for this sample is calculated by measuring the depth of the cup and projecting the identical distance upward from the breakout level.”

WLFI Acquires Extra Tokens

One of many causes seen by crypto analysts that drive Chainlink’s worth in an upward path is the Trump-associated WLFI which purchased a big variety of tokens.

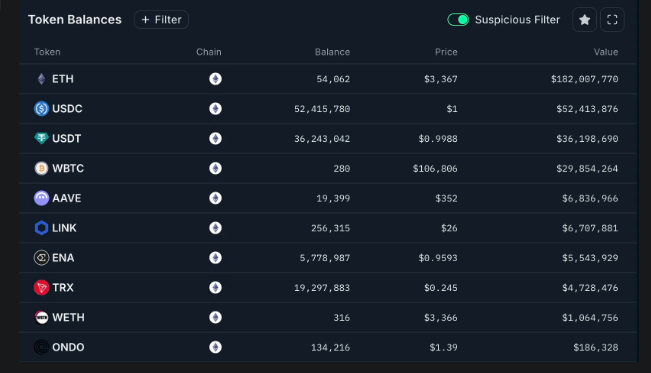

In accordance with Nansen, about $4.6 million value of LINK tokens have been acquired by WLFI, bolstering their Chainlink holdings to greater than $6.6 million value of tokens.

Some analysts identified the opportunity of the US Securities and Trade Fee (SEC) approving a Chainlink ETF if an utility is submitted, noting that Trump’s crypto coverage might positively have an effect on these tokens.

Furthermore, knowledge confirmed that WLFI holds $179 million value of Ethereum tokens along with different property like USD Coin, Tether, Wrapped Bitcoin, AAVE, Ethena, and Tron. It’s estimated that WLFI has a portfolio that exceeds $322 million in worth.

Now that we’ve got governance shifting alongside rather well, this 12 months I’m going to focus deeply on three large themes for Cardano:

1) Bitcoin DeFi on Cardano (Market is 4 instances the dimensions of Ethereum and Solana mixed)

2) 24/7 work on scalability, together with Leios

3) Making Cardano a…— Charles Hoskinson (@IOHK_Charles) January 18, 2025

Associated Studying

Doable Cardano Partnership

One other issue that contributed to Chainlink’s worth surge is the rumor that Cardano can have a partnership cope with the token.

A minimum of the Cardano founder, Charles Hoskinson, hinted {that a} potential collaboration is underway, saying they want to construct extra partnerships this 12 months.

In accordance with Hoskinson, one among his targets this 12 months is to make Cardano “a peninsula, not an island.”

“Integrations, integrations, integrations. Already bought a gathering with Chainlink on the books,” the Cardano founder mentioned in a put up.

Featured picture from CoinFlip.tech, chart from TradingView