Ondo Finance is rising as a key participant in real-world asset tokenization, positioning itself as one of many altcoin contenders more likely to shine on this bull cycle. Regardless of its sturdy fundamentals, the beginning of 2025 has been difficult for ONDO, with the token experiencing an enormous selloff that led to a 33% drop in worth since January 4. This bearish value motion has raised questions amongst some buyers, however optimism is starting to construct.

Associated Studying

Prime crypto analyst Ali Martinez not too long ago shared compelling knowledge that will point out a turnaround for ONDO. In line with Martinez, ONDO’s funding price has dropped to -60%, a uncommon phenomenon that indicators exchanges are paying merchants to go lengthy on the token. Such an setting usually displays a extremely bearish sentiment within the brief time period, which may result in sharp reversals as market circumstances normalize.

Ondo Finance may current an intriguing alternative for buyers trying to capitalize on real-world asset tokenization’s rising position within the crypto area. As metrics counsel a possible rebound, all eyes are on ONDO to see if it will probably get well and carry out as anticipated on this bull cycle.

Grasping Bears Holding The Worth

Ondo Finance has cemented its place as a standout challenge within the real-world asset (RWA) sector, attracting vital investor consideration in the course of the November 2024 post-election rally. Throughout this era, $ONDO surged by over 260% in simply weeks, showcasing its capability to generate huge returns in favorable market circumstances. Regardless of current value declines, Ondo stays a extremely engaging altcoin attributable to its sturdy fundamentals and management within the RWA area.

Prime analyst Ali Martinez not too long ago shared intriguing knowledge on X that sheds mild on the present state of ONDO. In line with Martinez, the token’s funding price has reached -60%. This implies exchanges are successfully paying merchants to take lengthy positions on ONDO, creating a singular alternative.

Such excessive funding charges sometimes point out heightened promoting stress, but the value hasn’t collapsed below the load of bearish sentiment. This dynamic usually factors to underlying energy and the potential for a pointy reversal.

Associated Studying

This example may sign overconfidence amongst short-sellers who’re aggressively betting in opposition to ONDO. If shopping for stress resumes and overwhelms the shorts, it may result in a squeeze, propelling the value larger. For buyers searching for alternatives within the altcoin market, Ondo Finance’s present setup gives a compelling mixture of threat and reward.

Navigating Volatility Amid Bearish Sentiment

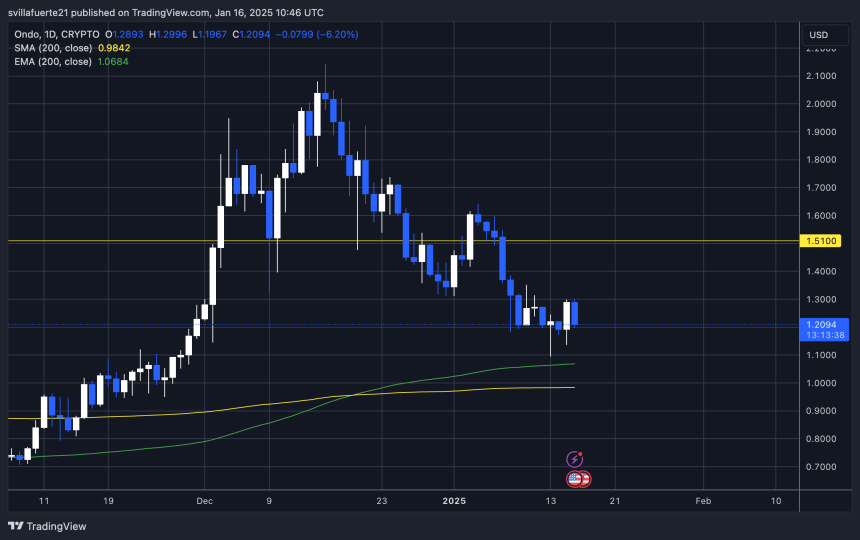

Ondo Finance (ONDO) is at the moment buying and selling at $1.20, reflecting a risky value trajectory over current days. The token has skilled sharp actions, dropping as little as $1.09 earlier than bouncing to a neighborhood excessive of $1.30. Regardless of these fluctuations, bears seem to take care of management, overshadowing the broader market restoration.

For bulls to regain momentum and set up a reversal, reclaiming the $1.35 mark is essential. This stage serves as a short-term resistance level that might sign renewed shopping for curiosity if surpassed. Past that, the $1.50 stage stands as the subsequent vital goal, doubtlessly marking a transition right into a bullish pattern if achieved and held as help.

Conversely, a failure to take care of the $1.20 stage may exacerbate bearish sentiment, placing further stress on the value. A sustained breakdown beneath this stage may open the door for additional declines, testing decrease demand zones and discouraging investor confidence.

Associated Studying

Whereas ONDO’s fundamentals and market potential stay sturdy, its short-term value motion suggests a cautious strategy. Bulls have to act decisively to reclaim key ranges and shift the narrative towards restoration, whereas bears proceed to leverage market uncertainty to maintain the token below stress.

Featured picture from Dall-E, chart from TradingView