A latest report by digital belongings analysis agency 10x Analysis highlights that the US Federal Reserve’s (Fed) stance on rate of interest cuts stays essentially the most vital hurdle that might dampen the present Bitcoin (BTC) rally.

Bitcoin’s Trump-Fuelled Rally At Danger Forward Of FOMC Assembly

Since pro-crypto Republican candidate Donald Trump secured victory within the November presidential election, Bitcoin has climbed a powerful 47%, rising from roughly $67,500 on November 4 to round $99,700 as of January 6.

Associated Studying

Whereas additional positive factors are anticipated in the course of the so-called “Trump rally” main as much as the January 20 inauguration, the momentum may stall forward of the Federal Open Market Committee (FOMC) assembly later in January, says 10x Analysis’s Markus Thielen.

Thielen predicts a “constructive begin” to January for BTC, adopted by a slight dip earlier than the Shopper Value Index (CPI) inflation knowledge launch on January 15. A good CPI report might reignite optimism, probably fueling one other rally earlier than Trump’s inauguration. Nevertheless, Thielen cautions that bullish momentum could wane forward of the FOMC assembly on January 29.

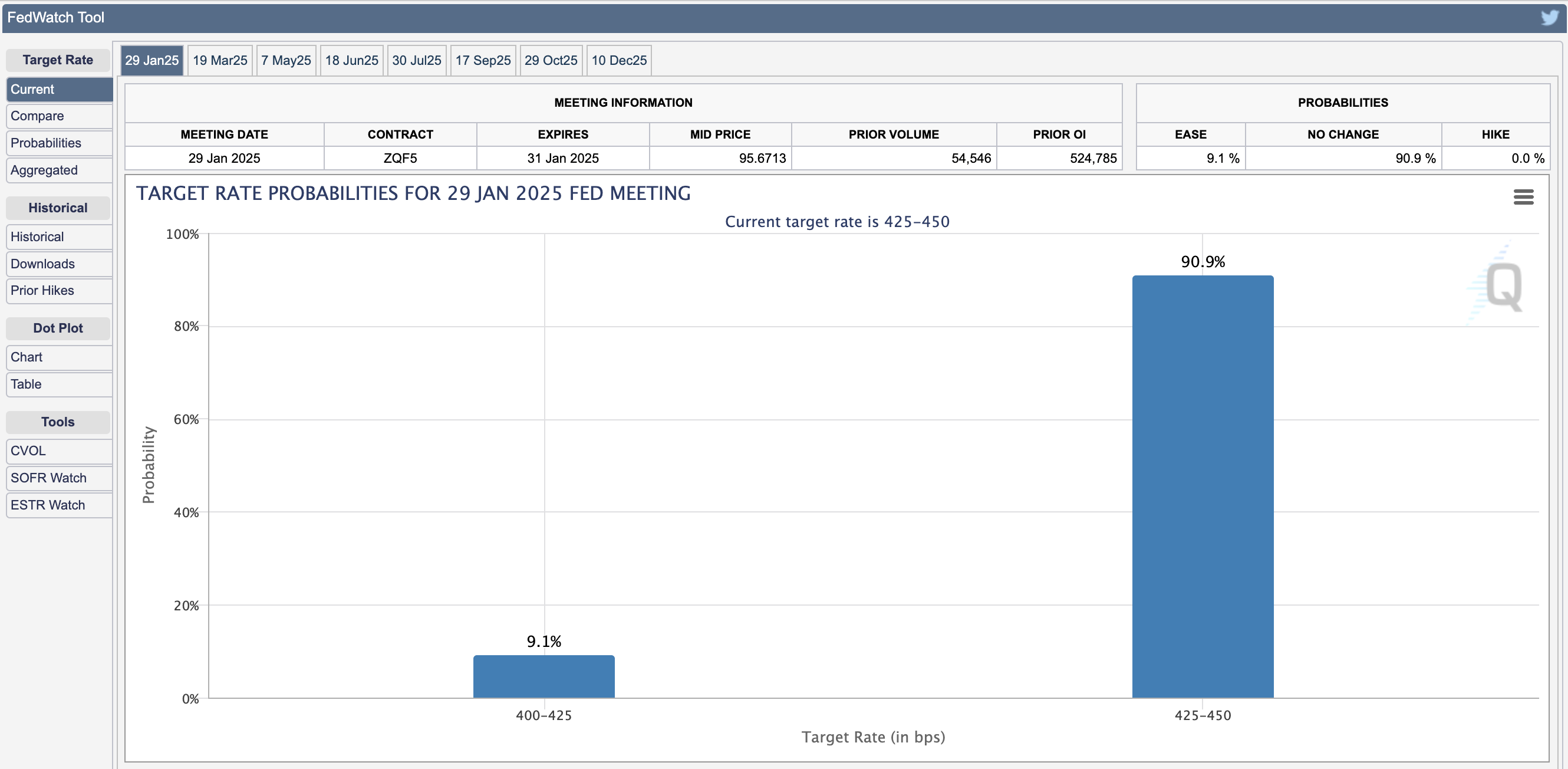

Newest knowledge from CME Group’s FedWatch software exhibits that rates of interest are prone to stay unchanged following the upcoming FOMC assembly. The software at present predicts a 90.9% likelihood of rates of interest remaining 425 and 450 foundation factors (BPS).

Bitcoin’s decline of roughly 15% to $92,900 following the December 18 FOMC assembly underscores the Fed’s vital affect. This drop got here after the Fed signaled solely two charge cuts for 2025 as an alternative of 5, reinforcing Thielen’s view that the Fed’s choices are the “major threat” to BTC’s present bullish trajectory. Thielen said:

We anticipate decrease inflation this yr, although it could take a while for the Federal Reserve to acknowledge and reply to this shift formally.

Thielen additionally cited institutional participation as a key issue influencing Bitcoin’s short-term worth motion, with metrics like stablecoin minting charges and crypto exchange-traded fund (ETF) inflows serving as indicators of institutional curiosity.

Institutional Curiosity In Bitcoin Continues To Rise

Though US spot Bitcoin ETFs confronted vital outflows on the finish of December, contemporary inflows have sparked optimism about rising institutional curiosity within the premier cryptocurrency. Information from SoSoValue notes that spot Bitcoin ETFs noticed $908 million in inflows on January 3.

Associated Studying

As well as, a number of main BTC mining companies similar to MARA and Hut 8 are bolstering their BTC reserves. Know-how companies similar to Canada-based video-sharing platform Rumble additionally lately unveiled a $20 million BTC treasury technique.

A separate report by cryptocurrency change Bitfinex predicts Bitcoin might surge to $200,000 by mid-2025, regardless of minor worth pullbacks. At press time, BTC trades at $101,555, up 3.7% within the final 24 hours.

Featured picture from Unsplash, charts from 10x Analysis, CME FedWatch and Tradingview.com