UK payroll software program studies PAYE data robotically after every payroll, retains monitor of fixing labour legal guidelines, manages worker pension deductions, distributes end-of-year P60s and P45s, and is HMRC-compliant. However, the perfect payroll software program layers on performance, akin to automation, worker self-service, and superior payroll cadences like managing Development Trade Scheme (CIS) returns.

I’ve researched seven high UK payroll options and ranked them from greatest to worst in line with an goal scoring rubric.

Prime payroll software program for UK companies comparability

Plans and pricing are updated as of 17/02/2025.

* Pricing excludes VAT.

** Beginning worth is for Xero Develop, the most affordable plan that features payroll.

Sage Payroll: Finest general

My ranking: 4.25 out of 5

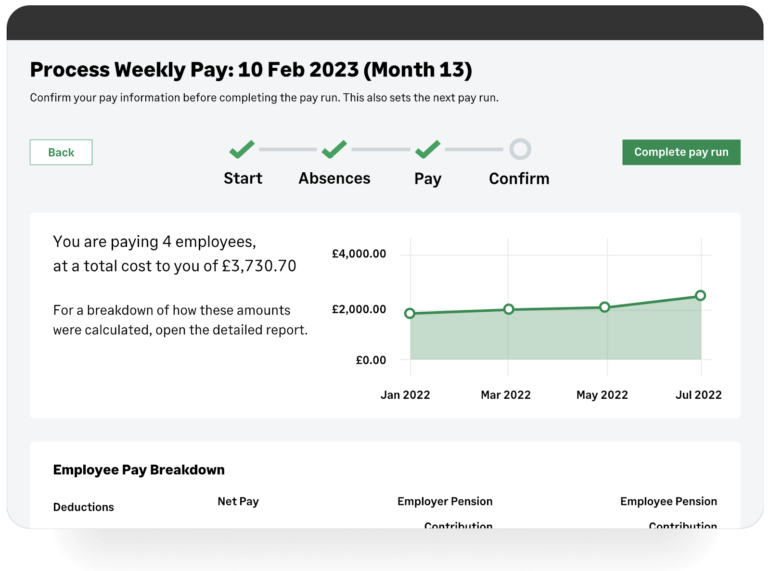

Sage Payroll is Sage’s starter payroll platform appropriate for small and medium-sized companies (SMBs). You may have entry to important payroll options, together with computerized Actual Time Data (RTI) submissions to the HMRC for every payroll plus pension enrolments. Sage Payroll additionally consists of primary HR options in each plan, like doc, go away, and absence administration, stopping you from integrating with a third-party human sources data system (HRIS) for this performance.

You can even mix Sage Payroll with different Sage merchandise for extra HR and accounting capabilities. This lets you handle folks and funds in a single centralised system for extra streamlined processes.

Pricing

With a rating of 4.13 out of 5 for pricing, Sage Payroll charges one of many highest in my roundup because of its clear pricing, 30-day free trial, and least expensive beginning worth. It does get dearer as you progress by its product tiers and achieve entry to HR options like org charts and scheduling. However in the event you’re involved with affordability, I’d look to BrightPay as an alternative for instant price financial savings.

Plans:*

- Payroll Necessities: £10/mo. + 20% VAT

- Payroll Normal: £20/mo. + 20% VAT

- Payroll Premium: £30/mo. + 20% VAT

* All plans embrace as much as 5 workers. For six workers and extra, you’ll have to pay an extra £2, £4, and £6 per 30 days on the Necessities, Normal, or Premium plans, respectively.

Be aware: Sage Payroll is presently working a three-month free promotion for brand spanking new prospects. Take a look at its web site for the most recent.

Key options

- Entry to HR and payroll assist

- Worker self-service

- Primary scheduling capabilities within the Premium plan

- Customized automations for approvals in Normal plan and up

Sage Payroll execs and cons

| Professionals | Cons |

|---|---|

|

|

Why I selected Sage Payroll

Sage Payroll is a good stepping-stone for brand spanking new companies that should steadiness compliant payroll processes with primary HR options to take care of a small workforce. It’s the solely platform in my lineup to supply each in all its product tiers whereas sustaining a clear pricing construction.

However top-of-the-line causes to go along with Sage Payroll is its over 40 years of expertise with UK corporations and its enterprise-level number of merchandise to suit any enterprise cadence. This implies you’ll be able to keep inside the Sage household of merchandise as your enterprise evolves, lowering knowledge migration complications and new product studying curves.

For instance, when you exceed Sage Payroll’s 150-employee cap, you’ll be able to improve to Sage 50 and entry superior payroll capabilities, akin to departmental views of the organisation. This extra granular take a look at enterprise prices lets you adapt shortly to monetary headwinds and even help in strategic workforce planning.

Rent and pay folks internationally? Take a look at the 5 Finest World Payroll Providers.

BrightPay: Finest for affordability

My ranking: 4.03 out of 5 (if relevant)

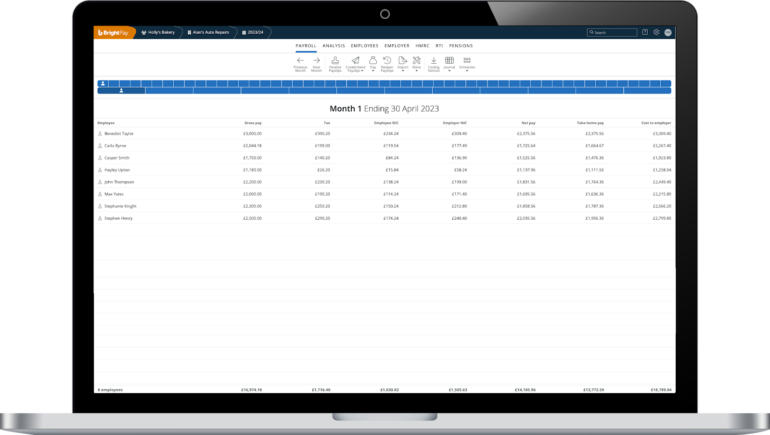

BrightPay is Brilliant’s payroll platform answer that just lately launched a cloud model of its desktop software. BrightPay is the one answer in my roundup to supply this, making it a extra versatile choice in the event you favour a extra conventional software program expertise.

As a result of BrightPay’s cloud software is so new, it nonetheless reserves a number of capabilities for its desktop model, akin to some statutory payroll studies, doc uploads, and even CIS assist. Within the case of the latter, Brilliant lets you use the desktop model freed from cost to facilitate CIS returns, whereas the others stay on the product’s 2025 roadmap. Curiously, entry to options like employer and worker portals remains to be solely accessible in BrightPay’s desktop model with the BrightPay Join add-on that gives automated knowledge backup to the cloud.

Pricing

BrightPay affords all of its options to its prospects in every plan. Its worth relies upon first on whether or not you desire a desktop or cloud model after which on what number of workers you will have.

BrightPay desktop plans

- As much as 3 workers: £84/12 months + VAT

- As much as 10 workers: £149/12 months + VAT

- As much as 25 workers: £239/12 months + VAT

- Limitless workers: £339/12 months + VAT

BrightPay cloud instance prices*

- 3 workers: £8.25/mo. + VAT or £84/12 months + VAT

- 10 workers: £22.95/mo. + VAT or £235.20/12 months + VAT

- 25 workers: £40.95/mo. + VAT or £415.20/12 months + VAT

- 50 workers: £68.55/mo. + VAT or £691.20/12 months + VAT

- 100 workers: £103.55/mo. + VAT or £1,051.20/12 months + VAT

- 250+ workers: Name for a quote.

You can even add BrightPay Join, BrightPay’s automated knowledge cloud backup service, to the desktop model for an extra month-to-month price. Plans are primarily based on the variety of workers you will have, with some instance prices beneath:

- 1 worker: £0.65/mo.

- 5 workers: £2.73/mo.

- 10 workers: £5.08/mo.

- 25 workers: £11.38/mo.

- 50 workers: £20.63/mo.

- 100 workers: £36.13/mo.

- 250 workers: £75.13/mo.

- 500 workers: £130.13/mo.

- 1000 workers: £210.13/mo.

* The value per 30 days will increase as your headcount will increase. The costs listed are examples. You can even try BrightPay’s price calculator for extra correct estimates for your enterprise.

Key options

- Means to have a number of pay runs on the identical pay frequency on the cloud model

- Customisable worker calendar

- Computerized pension re-enrolment alerts

- Limitless attachment orders for each worker

- Per-employee expense and advantages monitoring

BrightPay execs and cons

| Professionals | Cons |

|---|---|

|

|

Why I selected BrightPay

BrightPay is probably the most inexpensive platform in my lineup, incomes a whopping 4.56 out of 5 rating for pricing. It is because BrightPay’s pricing is clear, doesn’t require a long-term contract (for its cloud model), affords yearly reductions, and gives a 60-day free trial — one of many longest trial durations I’ve ever seen. This offers BrightPay a aggressive edge since you will have loads of time to demo the product earlier than committing.

BrightPay lacks the accounting options of Xero and QuickBooks and the delicate HR capabilities of ADP iHCM and Rippling. However in the event you solely want payroll assist, BrightPay helps all statutory payroll necessities at a fraction of the price of rivals. For instance, with 100 workers, you’ll pay solely £103.55 per 30 days for BrightPay in comparison with £200 per 30 days for Sage Payroll Necessities — a financial savings of 48%.

Interested in different low cost payroll choices? Study extra by exploring the hyperlinks beneath.

Xero: Finest for startups

My ranking: 3.95 out of 5 (if relevant)

Xero is a small enterprise accounting software program that provides HMRC-compliant payroll in its increased subscription plans. Regardless of this, Xero’s accounting capabilities assist you to entry extra sophisticated payroll assist, akin to CIS returns, expense administration, mileage, and challenge monitoring.

Xero additionally integrates with tons of of HR purposes, together with different payroll platforms like BrightPay, Onfolk, Personio, and Oyster, to simply fill any performance gaps.

Pricing

Xero has 4 subscription tiers to select from: Ignite, Develop, Complete, and Final. Nevertheless, its least expensive tier, Ignite, doesn’t embrace payroll, which means the least you’ll pay to entry payroll is £33 per 30 days for its Develop plan.

Xero tied with Sage Payroll for pricing, incomes a 4.13 out of 5. It is because Xero expands its accounting and payroll options with each subscription tier, whereas Sage Payroll focuses on levelling up its HR capabilities.

Plans:

- Develop: £33/mo. + VAT (as much as 1 particular person)

- Complete: £47/mo. + VAT (as much as 5 folks)

- Final: £59/mo. + VAT (as much as 10 folks)*

* Every further particular person after 10 is one other £1 month-to-month for as much as 200 folks.

Be aware: Xero is presently working a six-month free promotion for brand spanking new prospects. Take a look at its web site for the most recent.

Key options

- Computerized pension assessments, reminders, and enrolments

- Xero Me worker self-service payroll app

- Predictive analytics with Analytics Plus within the Complete plan and up

- Worker reimbursement administration with receipt cellular seize

Xero execs and cons

| Professionals | Cons |

|---|---|

|

|

Why I selected Xero

Xero is especially well-suited for startups because it combines accounting, payroll, and worker expertise options into one product. As you monitor your organization’s revenue and loss, Xero robotically facilitates pay-as-you-earn (PAYE) HMRC necessities and reconciles payroll prices along with your normal ledger.

Apart from its project-tracking capabilities, akin to its in-app time-tracker, Xero’s employee-specific Xero Me cellular software gives easy accessibility for workers to view and handle payslips, leaves, and bills. For startups with an typically distributed workforce, this is usually a main plus for workers not tied to a desk since they will full necessary duties with out a desktop pc.

Study extra about Xero

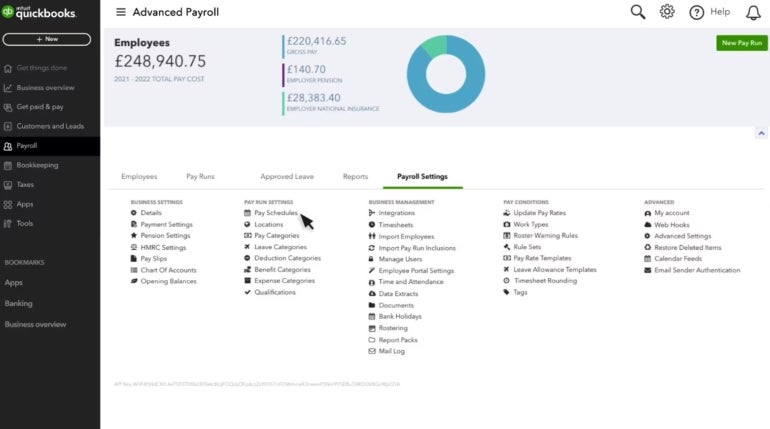

QuickBooks Payroll: Finest for payroll and accounting

My ranking: 3.92 out of 5 (if relevant)

QuickBooks On-line is a well known accounting answer that’s a part of Intuit’s small enterprise product portfolio. Like Xero, QuickBooks On-line helps payroll however solely as an non-obligatory add-on with QuickBooks Payroll. QuickBooks Payroll is an effective alternative in the event you’re already utilizing QuickBooks On-line for accounting functions however want to start out paying workers.

QuickBooks Payroll affords further HR options by QuickBooks Time, together with time-off administration, scheduling, and geolocation to stop time fraud. Though an extra price, this can be a main plus in the event you pay a majority of your workforce at an hourly price.

Pricing

QuickBooks Payroll has two plans, Core and Superior. The Core plan calculates and distributes paychecks, remits RTI to the HMRC, helps weekly and month-to-month pay schedules, and calculates statutory parental and sick leaves. The Superior plan consists of every part in Core, plus timesheet administration, computerized pay runs, and extra payroll frequency choices.

Intuit doesn’t reveal the beginning worth for its QuickBooks Payroll Core or Superior plans. You additionally must buy QuickBooks On-line first earlier than selecting a payroll plan. QuickBooks On-line plans begin at £16 per 30 days plus 20% VAT. You even have two low cost choices to select from: 90% off the plan’s base worth for six months or a one-month free trial.

Key options

- Computerized pension assessments and enrolment

- Statutory cost administration

- Computerized pay runs for administrators and salaried workers on the Superior plan

- Rotas, timesheets, and expense administration on the Superior plan

QuickBooks Payroll execs and cons

| Professionals | Cons |

|---|---|

|

|

Why I selected QuickBooks Payroll

QuickBooks Payroll’s reference to QuickBooks On-line makes it a strong instrument for working all of your small enterprise monetary wants in a single place. Though functionally similar to Xero, QuickBooks Payroll is the higher choice in the event you’re searching for extra superior controls, akin to monitoring inventory and computerized payroll in its increased plans.

What’s extra, QuickBooks Payroll affords extra in depth HR options that will help you handle your enterprise’s cash extra successfully. Rota administration, for instance, comes normal in QuickBooks Payroll’s Superior subscription for extra exact worker scheduling that minimises Excel spreadsheet errors. You even have further reporting choices, akin to splitting payroll prices by class and division, for extra granular insights into labour prices and income streams.

Study extra about QuickBooks Payroll

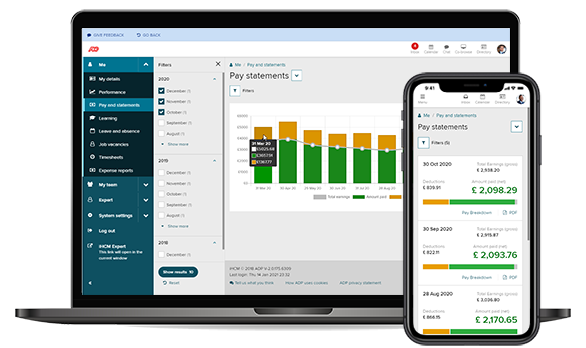

ADP iHCM: Finest for workforce administration

My ranking: 3.86 out of 5 (if relevant)

ADP affords an array of payroll and HR merchandise to suit a wide range of enterprise sizes and wishes. Its iHCM product features a wholesome mixture of important HR instruments that almost all standalone payroll options lack, akin to recruiting, efficiency administration, and studying administration.

Apart from its HR options, one other benefit of ADP iHCM is its scalability. The platform helps as much as 1,000 workers, affords an open API to increase the platform’s performance, and might even centralise payroll processing for greater than 140 international locations. It is a nice choice in case your operations lengthen into mainland Europe, even when these world staff are contractors.

Pricing

ADP doesn’t disclose its costs on-line; you should contact its gross sales group for a quote. But it surely does supply three totally different iHCM plans that I outlined beneath:

- Important Version: Primary payroll, personnel, timesheets, and doc administration.

- Normal Version: Every thing in Important, plus go away and absence administration, onboarding, bills, and entry to its AI instrument.

- Superior Version: Every thing in Normal, plus superior analytics, efficiency administration, recruitment, and studying administration.

ADP iHCM additionally affords a good variety of add-ons to select from, together with:

- ADP RealTime: Time and labour administration

- ADP HR All over the place: Employment authorized recommendation

- ADP Payroll Disbursement Service: Cash motion providers

- ADP LocalPay: Managed payroll providers for UK workers in Eire or the Channel Islands

- ADP BackCheck: On-line employment screening providers

- APIs for software integration

Nevertheless, because of ADP’s lack of pricing transparency, reductions, and free trial, it scored solely a mere 1.63 out of 5 for pricing.

Key options

- Unified system for payroll and advantages administration

- Computerized P60s and P45s technology and submitting

- Worker portals for managing self-service duties, like accessing payslips

- Strategic enterprise studies on payroll, recruitment, and workers demographics

ADP iHCM execs and cons

| Professionals | Cons |

|---|---|

|

|

Why I selected ADP iHCM

ADP iHCM is the one platform in my high 5 with options that contact upon each stage of the worker life cycle. I used to be notably impressed with its non-obligatory Expertise Cloud module, which has options to assist coaching, upskilling, and retaining workers. Should you want a platform with extra complicated payroll schemes alongside options to handle your workforce and put together your enterprise for the long run, ADP iHCM is my best choice.

Nevertheless, I ought to observe that ADP’s myriad of merchandise, add-ons, and providers may be fairly complicated and overwhelming for small companies with easy pay cadences. If that’s you, I’d contemplate BrightPay, which nonetheless permits for a number of pay frequencies.

That mentioned, with a complete rating of 3.86, beginning with ADP iHCM could also be simpler to stick with long-term in the event you anticipate your enterprise wants to alter quickly — particularly in the event you leverage its managed payroll providers.

Study extra about ADP

Honourable mentions

The next platforms didn’t fairly make my high 5, however they nonetheless supplied some nice options which may higher match the wants of your organisation.

Staffology Payroll by IRIS: Finest for small companies

My ranking: 3.72 out of 5

When to decide on Staffology Payroll by IRIS: You probably have fewer than 50 workers and don’t want something however payroll assist, Staffology Payroll is HMRC-compliant, makes use of a easy interface, and may be cheaper than Sage Payroll to start out. Even higher, you’ll be able to bundle Staffology Payroll with Staffology HR to handle small enterprise HR capabilities, like firm handbooks, paperwork, org charts, worker engagement, and rotas.

Why it didn’t make the checklist: Working payroll in Staffology Payroll remains to be very guide, particularly in comparison with techniques like QuickBooks Payroll and Rippling. Staffology Payroll additionally requires you to combine with both Staffology HR or a third-party HRIS for primary worker self-service, together with viewing payslips.

Rippling: Finest for reporting and analytics

When to decide on Rippling: Rippling is an all-in-one HR platform with superior IT, payroll, advantages, attendance, studying, recruitment, and efficiency administration options. Its plans supply superior reporting choices, together with customisable chart visualisations, permitting you to view payroll knowledge alongside metrics like workers demographics for extra in-depth insights.

Why it didn’t make the checklist: Rippling doesn’t reveal its beginning costs, and its payroll performance is an add-on module moderately than included in each plan. Its sheer variety of capabilities may also be an excessive amount of for a small enterprise the place customising workflow automation and apps is much less necessary than error-free payroll and managing enterprise revenue and loss.

UK enterprise payroll software program FAQs

What’s the greatest software program for payroll within the UK?

Sage Payroll is among the greatest payroll software program techniques within the UK. Its low beginning worth of £10 a month to pay 5 workers makes it nice for small companies, and Sage’s extra strong payroll merchandise (Sage 50 and Sage Folks) assist even larger organisations with tons of to hundreds of workers.

Different high UK payroll suppliers embrace BrightPay, Xero, and ADP. In fact, the perfect UK payroll supplier for you is dependent upon what your finances can accommodate, what options you want, and what number of workers you’ll want to pay.

Should you’re attempting to decide on a payroll supplier, contemplate signing up for a free trial (if one is obtainable), viewing a demo, or requesting a product tour. First-hand expertise may also help you determine if a preferred, well-reviewed payroll program is the perfect match for you.

How a lot does payroll software program price within the UK?

Relying on the payroll software program, you’ll both pay a flat month-to-month price or a price for every particular person paid. Sage Payroll, for instance, makes use of each pricing schemes, costing £10 per 30 days for the primary 5 workers after which an extra £2 per worker per 30 days for six or extra workers. Usually, the extra workers you’ll want to pay, the dearer the payroll platform.

However, in the event you’re new to payroll and wish to minimise payroll prices, I like to recommend making the most of HMRC’s Primary PAYE Instruments, which is free to companies with fewer than 10 workers. Be aware that it’s a desktop, not a cloud software.

Can I do my very own payroll within the UK?

Sure, as a UK enterprise proprietor and employer, you are able to do your personal in-house payroll utilizing payroll software program. Make sure that to decide on solely HMRC-approved payroll to make sure your enterprise stays compliant with tax legislation.

Methodology

I picked my decisions with you in thoughts.

First, I selected seven UK payroll options to run by an goal rubric primarily based on present choices and the evaluations of consumers such as you. I then collaborated with a group of in-house analysis analysts led by Irene Casucian to gather data on every platform’s payroll options, providers, consumer evaluations, and technical capabilities. Beneath is a breakdown of the standards I used to guage every platform:

- Payroll options: 30%

- Payroll providers: 25%

- Platform and interface: 20%

- Pricing: 15%

- Help: 10%

Because the market modifications, I reevaluate my decisions so that you at all times obtain the perfect perception on your buying determination.

Replace Notes

Feb. 25, 2025: Jessica Dennis reviewed seven UK payroll options utilizing a brand new scoring rubric. In consequence, Rippling moved to an honourable point out whereas ADP iHCM and Staffology Payroll by IRIS changed FreeAgent and Moneysoft. Jessica additionally rewrote many of the article, offering recent evaluation and skilled insights.